Prepaid credit cards like the Koho Mastercard (www.Koho.ca) are growing in popularity across Canada. In this article, we’ll review the card to help you decide whether it’s right for you.

According to a 2023 study by the Canadian Prepaid Providers Organization (CPPO), digital solutions have helped close the gap for those who previously struggled to obtain credit. The report stated:

“Prepaid has surged in popularity and satisfaction as Canadians embrace digital payment methods for new use cases, including buy now, pay later (BNPL), earned wage access for gig and contract workers, third-party delivery services, digital-first accounts for transacting and saving and digital wallets for gaming and sports betting.”

Moreover, “Canadians are embracing prepaid for online purchases because they believe it is more secure. Prepaid cards also demonstrate lower levels of concern regarding data security when traveling internationally, with a twenty-point difference compared to credit cards and an eighteen-point difference compared to debit cards.”

Thus, if you have bad credit or prefer the safety and security of prepaid credit cards, could KOHO Financial be the right solution for you?

☝ IMPORTANT 2025 TIP:

➔ Overwhelmed by the outstanding balance on your loans? You could qualify for 50% debt relief from Consolidated Credit Canada. Reach out today.

About the Company

- URL: https://www.koho.ca/

- Phone: 1-855-564-6999

- Email: support@koho.ca

- Company HQ: Toronto, ON.

- Google Play Reviews: 4.5/5 stars (68,900 reviews)

- TrustPilot Reviews: 1.4/5 stars (373 reviews)

- Apple Store Reviews: 4.8/5 stars (80,400 reviews)

- BBB Reviews: 1.24/5 stars (51 reviews)

- Money.ca Review: 5/5 stars

- Money With Mark: 5/5 stars

KOHO Pros and Cons:

For a brief outline of how KOHO stacks up, please see our list below:

Pros:

- Guaranteed approval

- Helps rebuild credit (You can also consider other debt relief options from Consolidated Credit Canada.)

- As much as 2% cash back

- Up to 4% interest on savings balance

- Virtual and physical cards

- No fee with direct deposit or $1,000 deposits

- Named 1 of Nerdwallet’s 3 Best Prepaid Credit Cards in Canada for 2024

Cons:

- Spotty customer service

- Mixed reviews from users

What is KOHO Financial?

KOHO is a digital-first financial firm that offers cash-back spending accounts, KOHO credit cards, secured borrowing products, and its credit-builder program.

The fintech company is known for eliminating hidden fees and credit checks for its borrowing products. Its credit card partner is Mastercard and prominent investors like Drive Capital, Portag3, TTV Capital, HOOPP, Round13, and the BDC have partnered with KOHO.

You can also access KOHO’s customer service team seven days a week through the mobile app and website, or call 1-855-564-6999 to speak with an agent.

How Can KOHO Help Me?

With our Inflation Calculator CPI breakdown highlighting how pricing pressures remain a burden for many Canadians, practicing prudent spending habits is more important than ever. For example, your credit score plays a key role in loan approval, terms, and financing costs. And the higher your score, the lower the out-of-pocket costs. For your reference, Canadian credit scores range from 300 to 900, and brackets are defined as follows:

- 300 – 579: Poor

- 580 – 659: Fair

- 660 – 719: Good

- 720 – 779: Very Good

- 780+: Excellent

So, with a KOHO prepaid credit card creating a bridge from poor to better credit, making on-time recurring payments can boost your credit score and help you obtain cheaper financing in the future. If you have existing debt, you can also seek debt relief from Consolidated Credit Canada.

In a nutshell: applying for a mortgage or auto loan can seem daunting when you have bad credit. And even if you’re approved, you’ll likely confront unfavourable terms and interest rates. Therefore, by building up your credit history with KOHO, you’ll benefit down the line when you go to purchase big-ticket items.

What Is a KOHO Credit Card and How Does It Work?

KOHO Financial offers a prepaid credit card where you can shop in-store and online and earn up to 6% cash back. Instead of borrowing directly from the company or third-party lenders, you deposit funds onto your card and use the proceeds to make everyday purchases. The transactions are characterized as credit withdrawals, and when you pay back the funds, your credit score can benefit from the on-time repayments.

Essentially, you’re borrowing your own funds to show potential lenders that you can responsibly manage your balance and repay the amount you owe. Over time, this should increase your attractiveness in the eyes of lenders, and put you on a path to a better financial future.

Are There Other KOHO Credit Card Benefits?

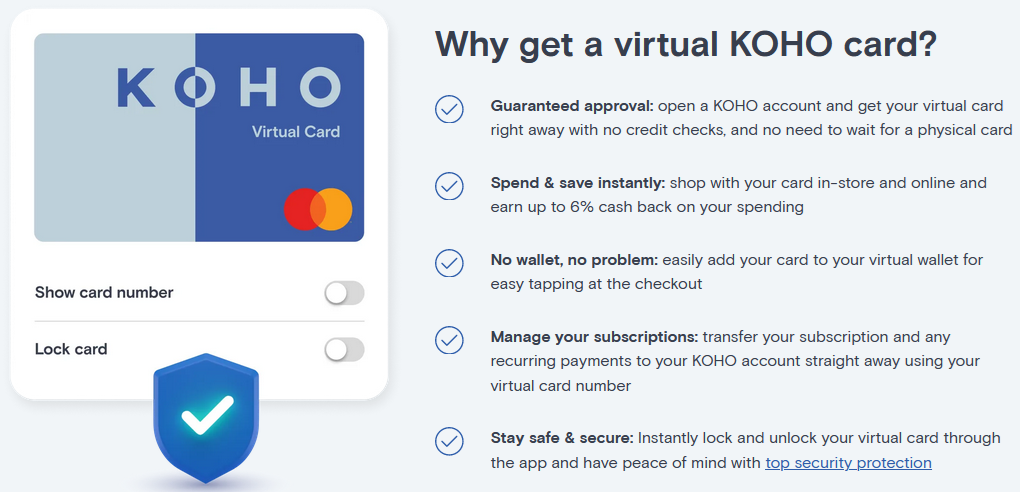

The best part about a KOHO credit card is that approval is guaranteed, regardless of your credit score. So, if you have extremely bad credit, KOHO is a great way to repair your reputation.

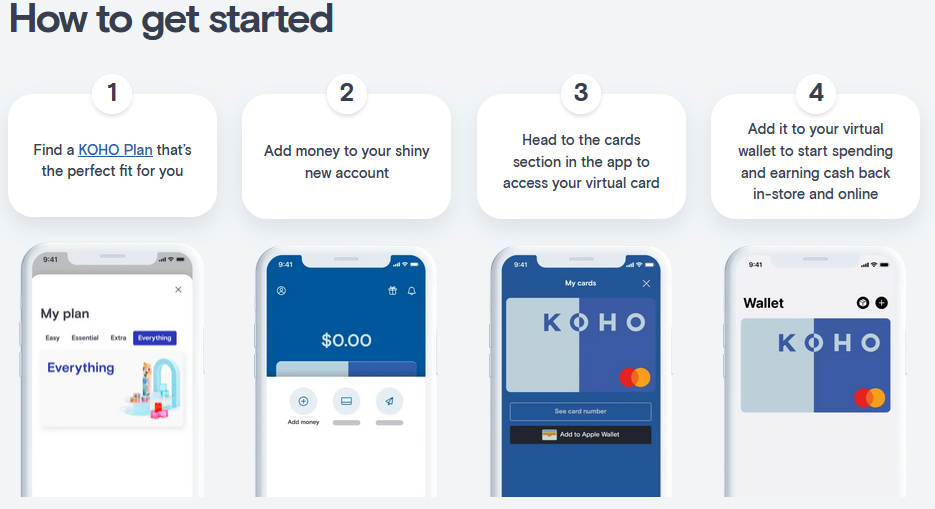

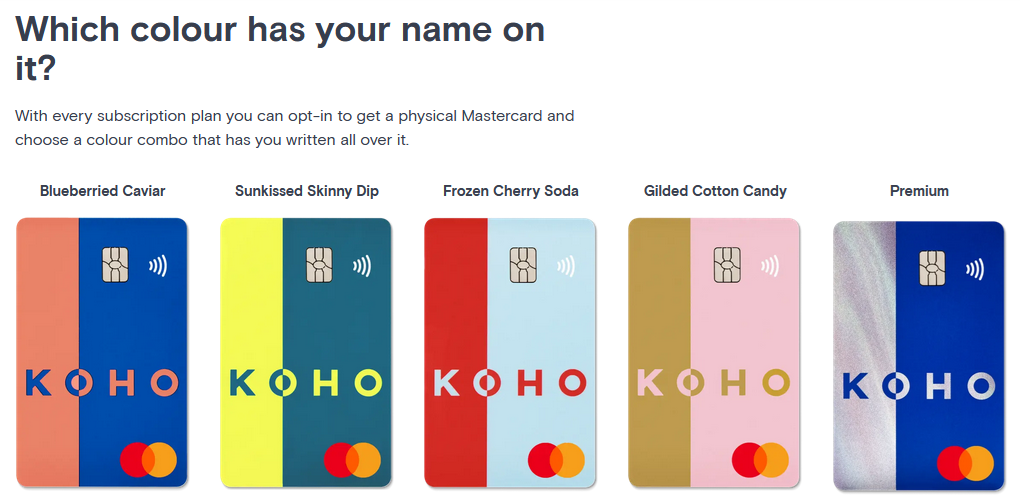

In addition, there is no credit check, and applying won’t impact your credit score. You can also obtain a virtual card that can be loaded to platforms like Apple or Google Pay, alongside a physical card if you prefer manual transactions.

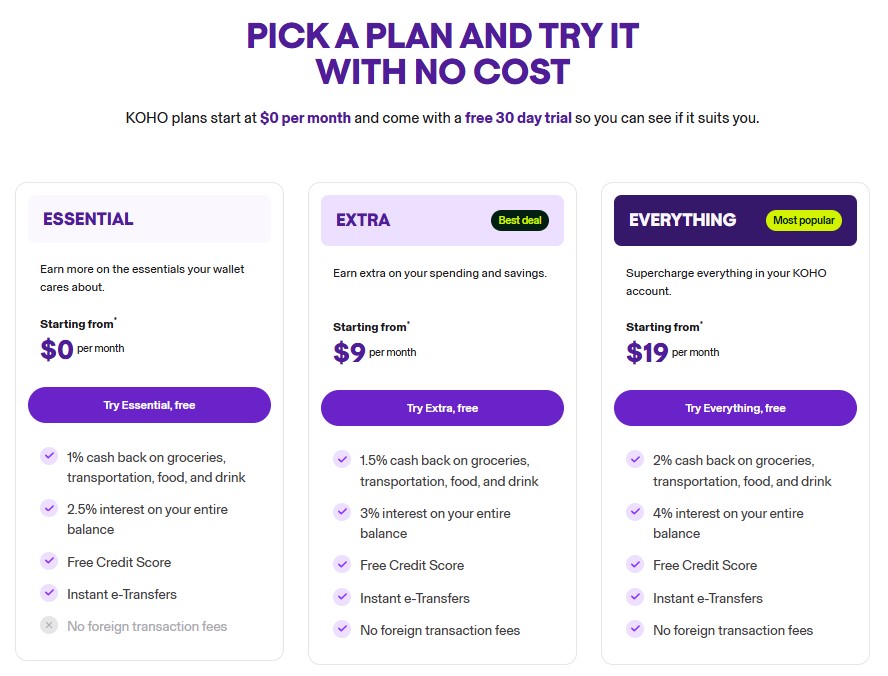

On top of that, you get 1% cash back on groceries, transportation, and eating & drinking, plus (up to) 4% interest on your savings balance. For security, you can instantly lock and unlock your virtual card through the app if you lose your physical card or suspect unauthorized activity.

Finally, you must have a KOHO Essential Plan to obtain a KOHO credit card. And the former costs $4 per month or $48 per year. However, there is no fee if you set up direct deposits or load $1,000 into your account per month. As a result, the pros greatly outweigh the cons, and it’s rare to find a potentially no-fee spending account with this many perks.

How Does the Financial Community Rate KOHO?

While KOHO users have mixed reviews of the company, Nerdwallet rated KOHO one of its “3 Best Prepaid Credit Cards in Canada for 2024.” Likewise, the KOHO app has a 4.8-star rating out of 5 at the Apple app store with over 80,400 reviews. One satisfied customer wrote:

- I will never be without my Koho card. I had all three of my bank accounts emptied out 3 weeks ago and all I had usable was my Koho card. I was super happy it still had money on it and once my money was returned I was able to transfer out of my bank account to Koho, it saved me major headaches, I had to wait 10 days for a new debit card by mail. Besides who has cash these days without a debit card you are basically hooped. Thank goodness for my KOHO CARD.

In contrast, several complaints mention poor customer service. Since KOHO Financial is a fintech company, its digital-first model may result in longer wait times versus traditional banks. Yet, by operating digitally and shunning physical locations, the cost reductions allow KOHO to offer you better products with higher savings and cash-back rates. As such, you should determine which services you value the most to determine if KOHO is the right fit.

Are We Fans of KOHO?

Outside of a few customer service hiccups, there is a lot to like about KOHO’s prepaid credit card. It’s a useful tool for rebuilding credit, you earn cash back, obtain higher interest on your savings, and the monthly fee is waived by meeting a few simple requirements.

When you compare checking accounts from traditional banks, the Government of Canada notes how “Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services.”

However, whether it’s RBC, TD, BMO, Scotiabank, or CIBC, the lowest-cost option is $3.95 per month, there are transaction maximums, and you don’t get anywhere near 4% interest on your balance. As such, a KOHO Essential account offers more value than comparable low-cost options, and simply direct depositing your paycheck allows you to obtain all the benefits for free.

Furthermore, with guaranteed approval and the KOHO credit card helping to rebuild your credit, we think KOHO Financial is a terrific option for Canadians comfortable with mobile and online banking.

If you want to sign up or learn more, visit: www.koho.ca

☝ IMPORTANT 2025 TIPS:

➔ Overwhelmed by the outstanding balance on your loans? You could qualify for 50% debt relief from Consolidated Credit Canada. Reach out today.