The Consumer Price Index edged up 0.9% in January on a monthly basis, following a 0.1% decline seen in December, reported Statistics Canada. This marks the largest percentage rise since January 2017.

“In January 2022, Canadian inflation surpassed 5% for the first time since September 1991, rising 5.1% on a year-over-year basis and up from a 4.8% gain in December 2021. In comparison, the headline Consumer Price Index (CPI) increased 1.0% on a year-over-year basis in January 2021.

Excluding gasoline, the CPI rose 4.3% year over year in January 2022—the fastest pace since the introduction of the index in 1999. COVID-19 pandemic-related challenges continue to weigh on supply chains, and consumer energy prices remain elevated. Taken together, Canadians continued to feel the impact of rising prices for goods and services, especially for housing, food and gasoline,” remarked Statistics Canada in its report.

In addition, Statistics Canada also discussed inflation in its January report.

“Inflation is often compared with changes to average wages. In January 2022, the CPI rose 5.1% on a year-over-year basis. Wage data from the Labour Force Survey found wages rose 2.4% during the same period, meaning that, on average, prices rose faster than wages and Canadians experienced a decline in purchasing power.”

(Sources: Statistics Canada)

Shelter

In January, Canadians continued to pay more for shelter as the shelter index rose 6.2% since this time last year – the fastest percentage increase seen since February 1990.

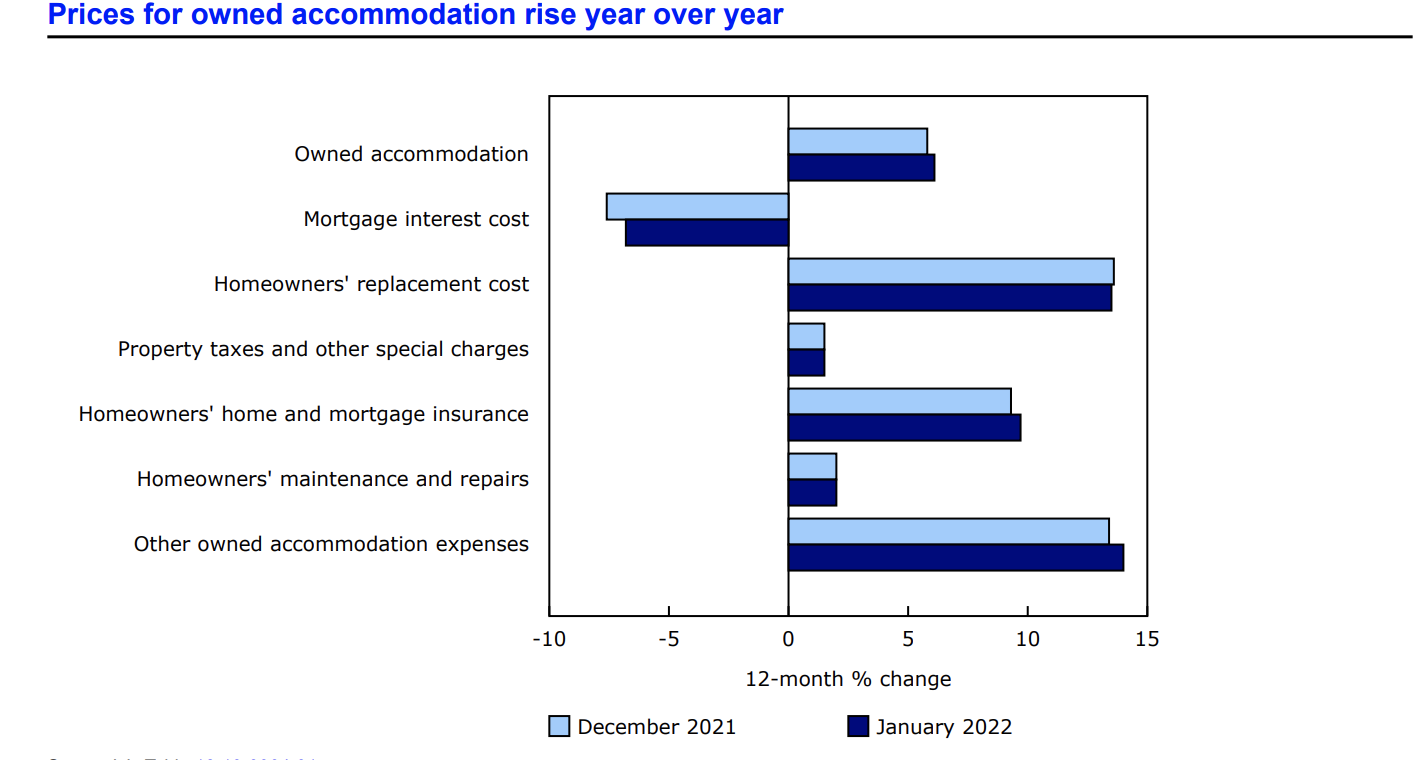

“Higher prices for new homes contribute to higher costs associated with the upkeep of a property, or the homeowners’ replacement cost. Higher home prices also tend to raise other owned accommodation expenses. In contrast, lower interest rates bring borrowing costs down—measured in the CPI through the mortgage interest cost index, which includes both new and resale home prices.

The owned accommodation index, which measures the ongoing costs of homeownership, increased 6.1% year over year in January. On a yearly basis, homeowners’ replacement cost (+13.5%) and other owned accommodation expenses (+14.0%), which includes commissions on the sale of real estate, put upward pressure on shelter prices amid rapid price growth in the housing market throughout the pandemic. Renters also saw a rise in prices, as the rented accommodation index increased 3.2% year over year, contributing to the higher shelter prices Canadians faced in January,” explained Stats Can.

(Sources: Statistics Canada)

Gasoline

Over the last 12-month period, the price of gasoline increased 31.7%.

“Gasoline prices increased amid concerns over global oil supplies in response to international political events. Year over year, gasoline prices rose to a lesser extent in January 2022 (+31.7%) compared with December 2021 (+33.3%). This is because higher prices in January 2021, when gasoline prices rose 6.1% month over month, were used as the basis for the year-over-year comparison, leading to a slowdown in year-over-year growth in January 2022.

Statistics Canada released a statement regarding COVID-19 and the Consumer Price Index:

“COVID-19 and the Consumer Price Index Goods and services in the Consumer Price Index (CPI) that were not available to consumers in January due to COVID-19 restrictions received special treatments, effectively removing their impact on the monthly CPI. The following sub-indexes were imputed from the monthly change in the all-items index: some components of both spectator entertainment and use of recreational facilities and services in some areas. The details of the special treatments from April 2020 to March 2021 are provided in technical supplements available through the Prices Analytical Series. Details and other treatment information for April 2021 and onwards are available upon request.”

Source cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/220216/dq220216a-eng.pdf?st=LzgL5-fX