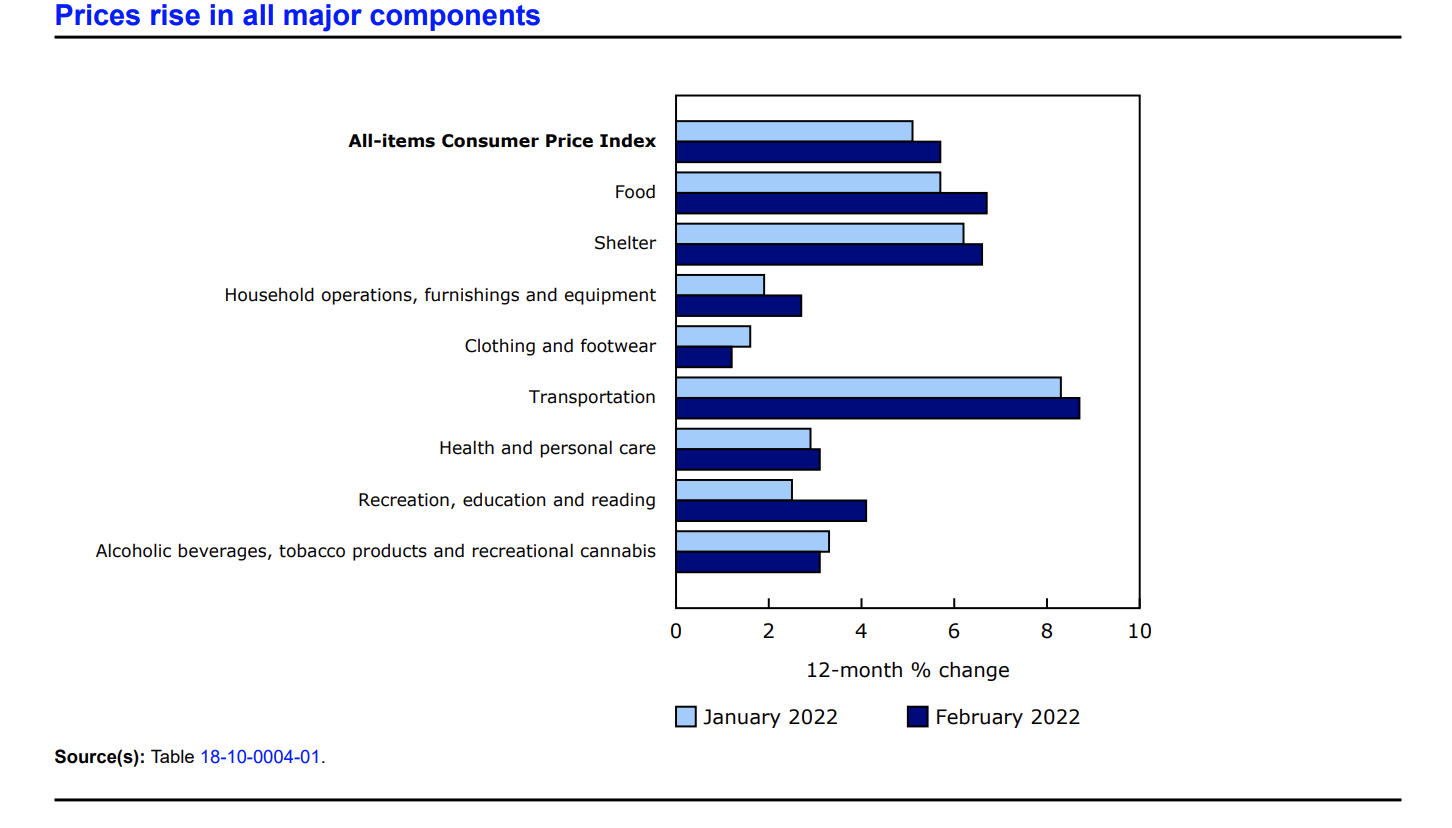

The Consumer Price Index increased 1% in February on a monthly basis, reported Statistics Canada. This marks the largest monthly percentage rise seen since February 2013.

“Price increases were broad-based in February, pinching the pocketbooks of Canadians. Consumers paid higher prices for gasoline and groceries in February 2022 compared with the same month a year earlier. Shelter costs continued to trend higher, rising at the fastest year-over-year pace since August 1983.

Excluding gasoline, the Consumer Price Index (CPI) rose 4.7% year over year in February, surpassing the gain in January (+4.3%) when the index increased at the fastest pace since its introduction in 1999,” noted Statistics Canada in its report.

On a year-over-year basis in February, consumer prices rose an astonishing 5.7%.

“This was the largest gain since August 1991 (+6.0%). February marked the second consecutive month where headline inflation exceeded 5%,” explained the agency.

(Sources: Statistics Canada)

Gasoline Prices

In February, the price of gasoline soared 32.3% since this time last year.

“Monthly gasoline prices increased 6.9% amid geopolitical conflict in Eastern Europe and the Middle East, as uncertainty surrounding global oil supply put upward pressure on prices.

Similarly, prices for fuel oil and other fuels increased 8.5% month over month following higher international energy prices,” the agency explained in its monthly report.

(Sources: Statistics Canada)

Food Index

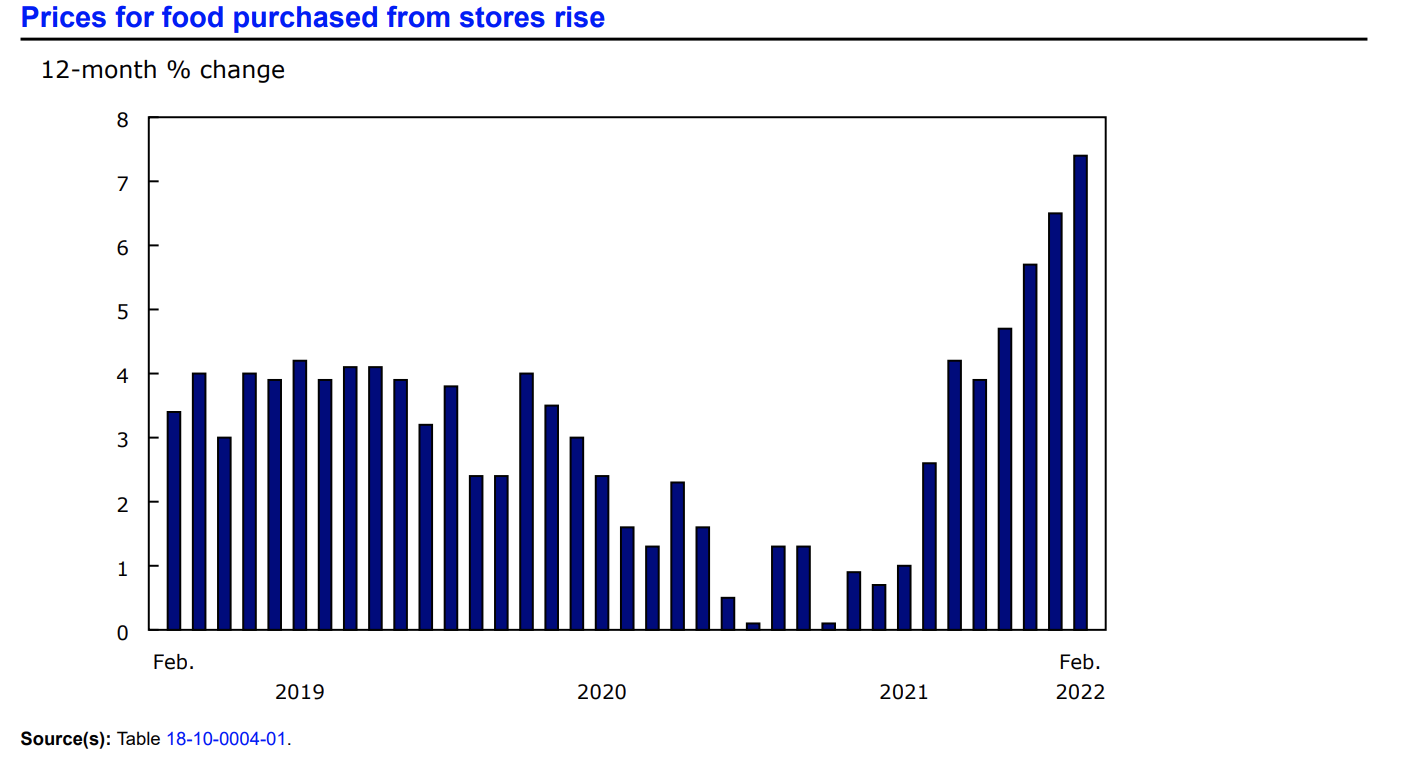

On a year-over-year basis, the food index rose 6.7%. The price of foodstuffs purchased from stores increased by 7.4% since this time last year.

“This is the largest yearly increase since May 2009. Higher input prices and heightened transportation costs continued to contribute inflationary pressure in February,” remarked the agency.

Furthermore, in its monthly report Statistics Canada issued a special statement regarding the increase in food prices across Canada.

“Price change for staple foods, like dairy products, has an impact on inflation, which affects some Canadians more than others, especially those for whom food costs represent a larger proportion of disposable income.

In Canada, dairy, poultry and eggs are supply-managed and the Canadian system is supported by three main pillars to ensure income stability for domestic farmers: production control, import control and pricing mechanisms. Production control refers to limiting production through quotas, and therefore limiting supply of a product to ensure price stability. Import control refers to tariffs placed on foreign goods, making these goods comparatively expensive for Canadians. Pricing mechanisms refer to guaranteed minimum prices for farmers selling supply-managed products, called “farm gate prices,” when farmers sell to processors. Each of the three pillars has an effect on the prices Canadians ultimately pay for dairy, poultry and eggs at grocery stores.

After reviewing farm gate milk prices as well as various other costs used to administer the supply management system, the Canadian Dairy Commission (CDC) implemented several changes on February 1, 2022. The farm gate milk price increased $0.06 per litre (+8.4%), the largest increase to date, in order to partially offset the increased costs of production associated with COVID-19 (particularly animal feed, energy and fertilizer costs). Additionally, the support price for butter, the price at which the CDC buys and sells butter within the framework of its various programs, rose from $8.7149 to $9.7923 per kg, a 12.4% increase.

Following the changes by the CDC, many processors and retailers passed on dairy product price increases to consumers. In the Consumer Price Index (CPI), dairy products account for 1.45% of the CPI basket weight. In February, prices for dairy products rose 3.7% month over month. While fresh milk prices (+5.8%) rose at the fastest month-over-month pace since April 1994, price increases were seen across all dairy products in February, most notably in the indexes for cheese (+3.0%) and other dairy products (+4.9%) and, to a lesser extent, in butter (+0.8%) and ice cream and related products (+0.8%).”

(Sources: Statistics Canada)

Shelter Index

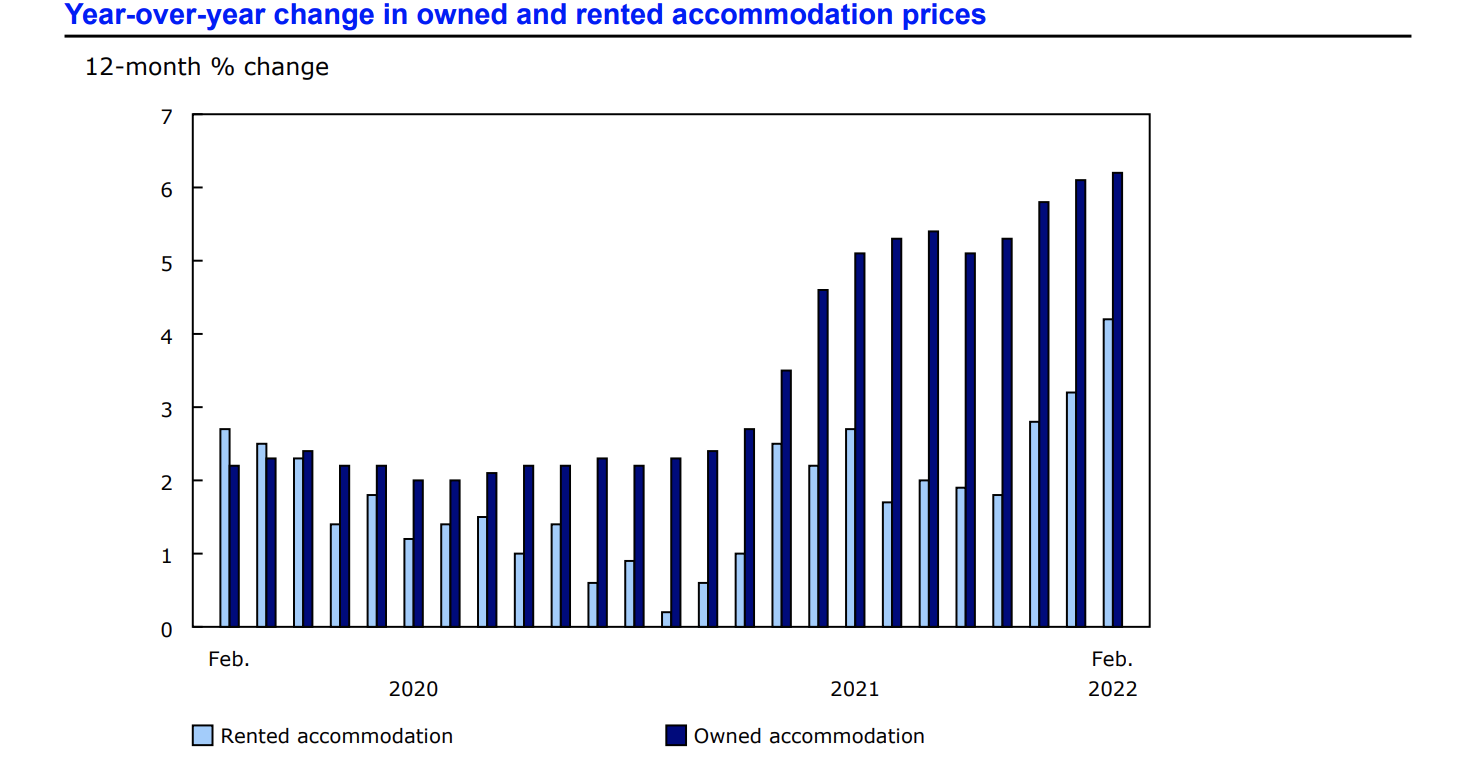

In February, the index for shelter increased 6.6% over the past 12-months period – the largest percentage increase seen since August 1983. In its monthly report, Statistics Canada stated that “higher costs for both owned accommodation (+6.2%) and rented accommodation (+4.2%) contributed to the increase.”

Composite shelter indexes that likewise saw percentage increases included the homeowners’ replacement cost index (which is correlated to the price of houses) by 13.2%, and the owned accommodation expenses index (which includes real estate commissions) by 14.3%.

Despite the increase in shelter costs, there was a drop in the mortgage interest cost index over the last 12-month period.

“In contrast, mortgage interest cost (-6.0%) moderated the shelter index on a year-over-year basis,” explained Statistics Canada in its report.

Statistics Canada released an additional statement pertaining to the effect of COVID-19 on the Consumer Price Index.

“The COVID-19 pandemic has had an undeniable impact on the prices of consumer goods and services, and on the way Canadians spend their money. Capturing shifts in purchasing patterns is critical to helping government leaders and policy-makers make evidence-based decisions. As Canada continues to chart a path to economic recovery, Statistics Canada is updating its methods to ensure its core statistical programs, including the Consumer Price Index (CPI), are accurate, timely and of the highest quality.”

Source cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/220316/dq220316a-eng.pdf?st=00alImv3