The Consumer Price Index (CPI) increased 1.1% on a year-over-year basis in February, reported Statistics Canada. The agency stated that the rise from 1% in January was primarily due to the increase in gasoline prices. Excluding the price of gasoline, the CPI increased by 1%. In February, the CPI edged up 0.1% on a seasonally adjusted monthly basis.

(Source: Statistics Canada)

Gasoline Index

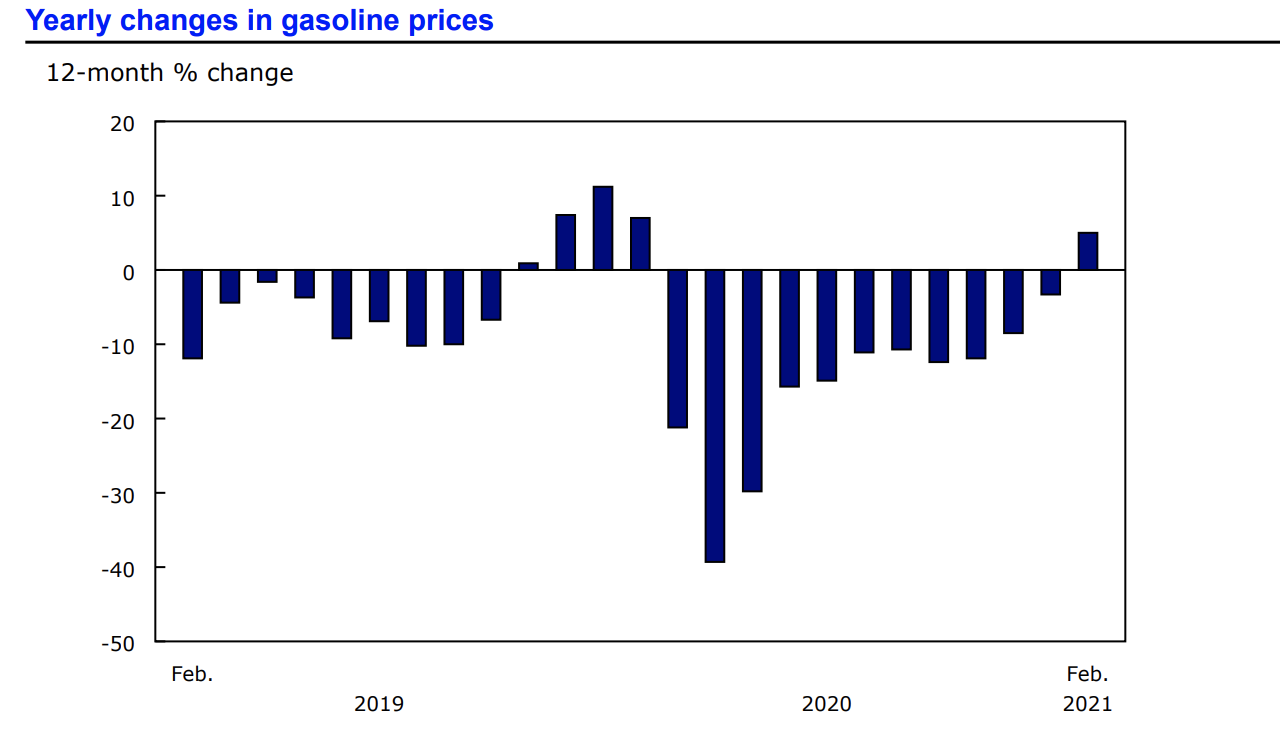

In February, the price of gasoline edged up 6.5%, compared to the 6.1% in January.

“The price increase comes amid a gradual recovery in global demand for gasoline, crude oil supply cuts in major oil-producing countries, and weather-related shutdowns in the southern United States. On a year-over-year basis, gasoline prices were 5.0% higher, the first yearly price increase since February 2020,” reported Statistics Canada.

Food Index

Within the food index, the price for specifically fresh vegetables rose 5.9% in February. This increase, in turn, fueled the rise in prices of food purchased from stores, which rose 1.3% over the last 12-month period. Likewise, the price of food purchased from restaurants also increased in February, rising 2.9% over the last 12-month period.

(Source: Statistics Canada)

Homeowners’ Replacement Cost Index

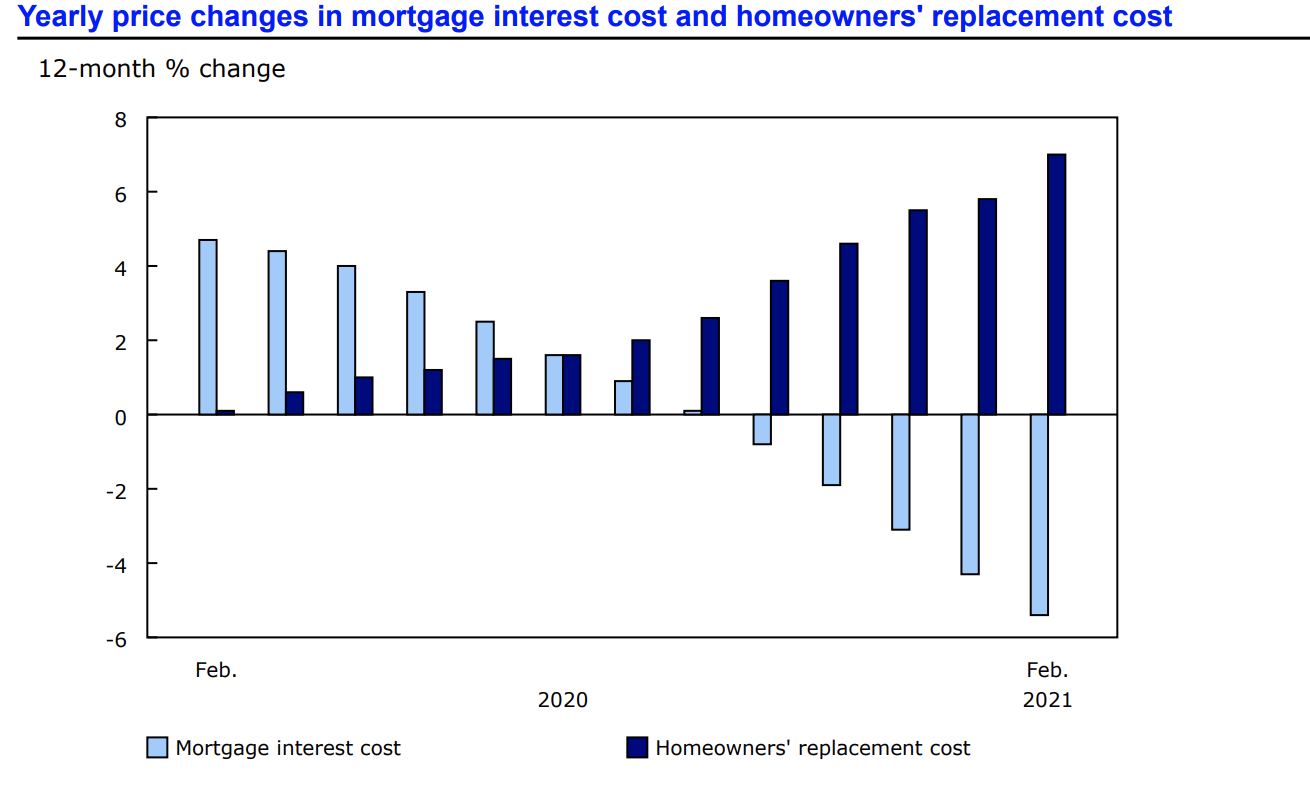

In February, the homeowners’ replacement cost index, which correlates to new home prices, increased 7% since this time last year.

“The homeowners’ replacement cost index, which is linked to the price of new homes, rose 7.0% year over year in February, as higher building costs, low-interest rates, and strong demand for homes with more space continued to push prices for new housing higher. This is the largest yearly gain recorded since February 2007. In contrast, the Mortgage Interest Cost Index fell 5.4% year over year in February, following a 4.3% decrease in January, as more Canadians renewed or initiated mortgages at historically low interest rates,” explained Stats Can in its report.

Statistics Canada released a statement pertaining to the COVID-19 pandemic and CPI.

“Statistics Canada continues to monitor the impacts of the novel coronavirus (also known as COVID-19) on Canada’s Consumer Price Index CPI. Goods and services in the CPI that were not available to consumers in February because of COVID-19 restrictions received special treatments, effectively removing their impact on the monthly CPI. The following sub-indexes were imputed from the monthly change in the all-items index: travel tours, components of spectator entertainment, recreational services, personal care services in some areas, and some components of use of recreational facilities and services in some areas. The price indexes for beer served in licensed establishments, wine served in licensed establishments and liquor served in licensed establishments were imputed in several regions, using the indexes to which consumers likely redirected their expenditures: beer purchased from stores, wine purchased from stores and liquor purchased from stores. Consistent with previous months affected by the COVID-19 pandemic, prices for suspended flights are excluded from the February CPI calculation because passengers were ultimately unable to consume them. As a result, selected sub-components of the air transportation index were imputed from the parent index (air transportation). Enhancement: Resale housing prices incorporated into the Mortgage Interest Cost Index With the release of the February 2021 CPI data on March 17, 2021, the Mortgage Interest Cost Index (MICI) has been enhanced by incorporating into the house sub-index the Resale Housing Price Index (a component of the Residential Property Price Index). The MICI represents 3.57% of the 2017 CPI basket and is part of the shelter component of the CPI. Detailed documentation is available in the “Technical Supplement for the February 2021 Consumer Price Index,” within the Prices Analytical Series (62F0014M) publication. It provides further details on the imputations used to compile the February 2021 CPI and the incorporation of resale housing prices in the MICI.”

Source cited: https://www150.statcan.gc.ca/n1/daily-quotidien/210317/dq210317a-eng.htm