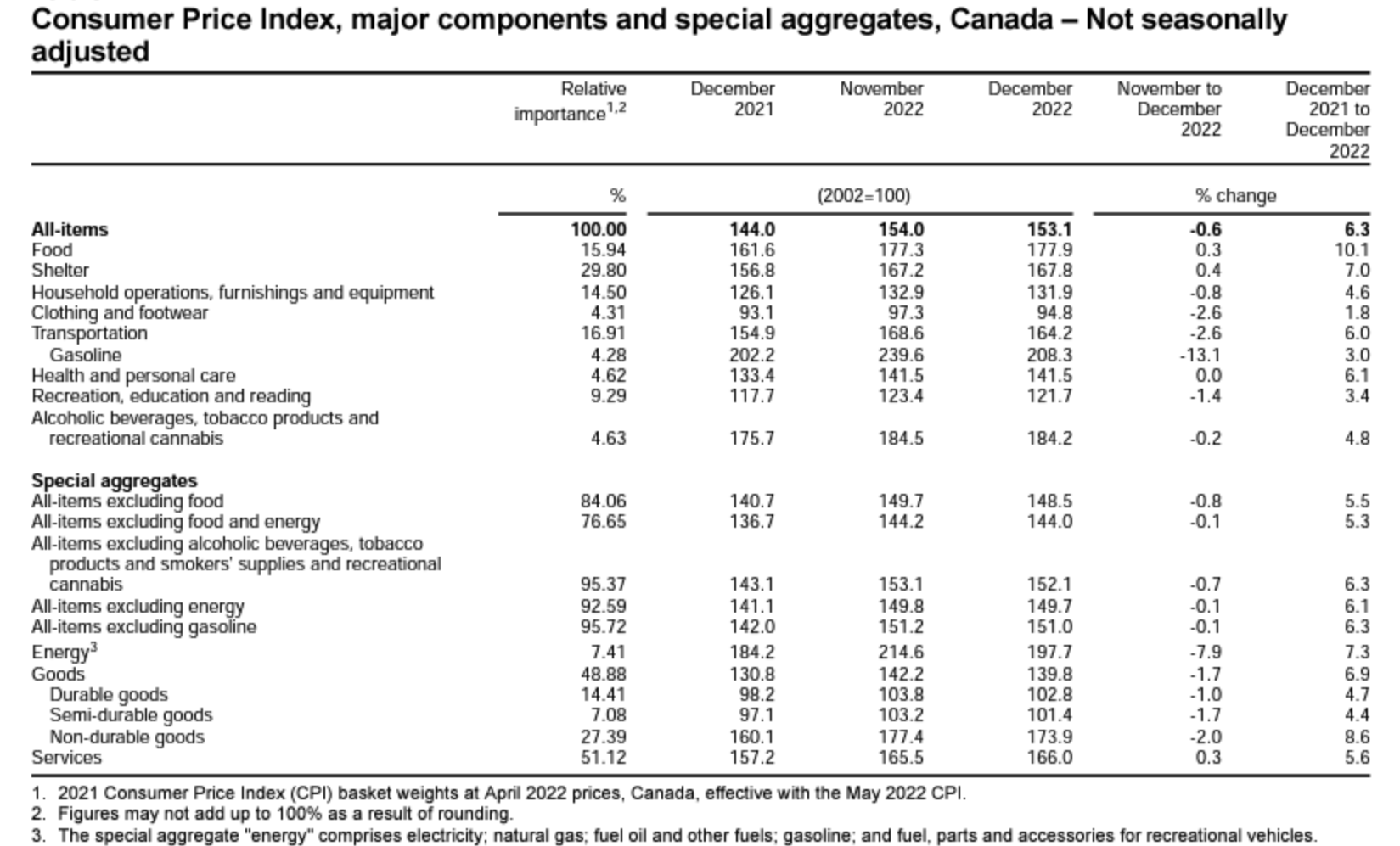

The Consumer Price Index (CPI) decreased by 0.6% on a monthly basis in December 2022, per today’s CPI report issued by Statistics Canada. On a year-over-year (Y-O-Y) basis, the CPI rose by 6.3%. This marks a decrease from the gain (+0.6%) seen in November, and constitutes the smallest Y-O-Y CPI increase since February of last year.

The slowdown in inflation was largely caused by a reduction in gasoline prices, while home prices, fuel oil, and certain durable goods also saw price decreases compared to December 2021.

Lower gasoline and fuel prices, however, were largely offset by augmented mortgage interest costs, as well as many retail personal goods such as shoes, clothing, and equipment.

This month’s CPI data indicates that inflation has cooled down significantly over the past month. This may be considered a sign that the Bank of Canada’s hawkish interest rate policy has been successful in reining in generationally-high inflation.

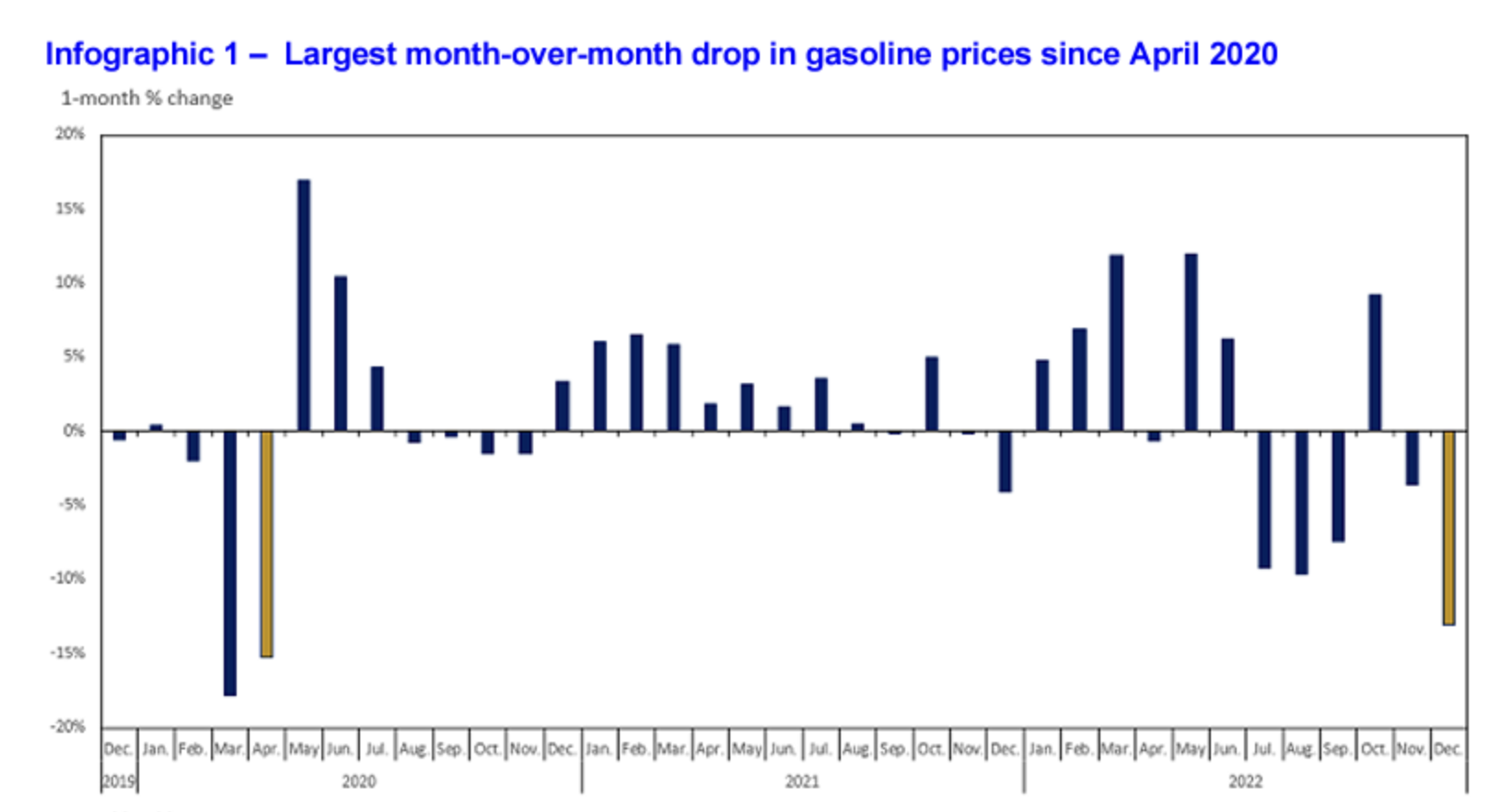

The Price of Gasoline

Canadian consumers paid 13.1% less for gasoline in the month of December compared to the month prior. This marks the sharpest one-month reduction in gasoline prices since April 2020 and a significant decline in gas prices from those enumerated in November’s CPI report, when the price at the pump increased 13.7% Y-O-Y.

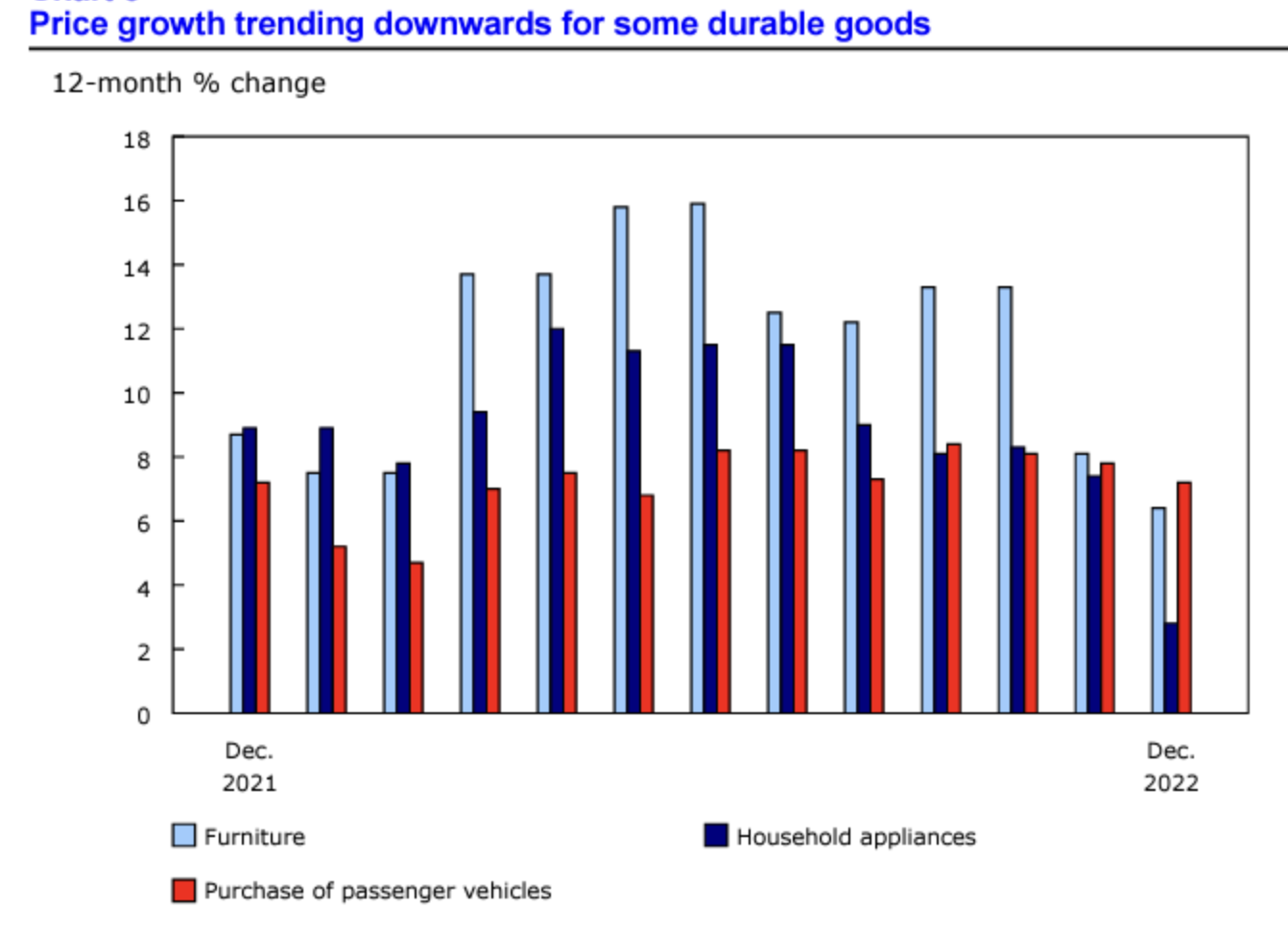

Durable Goods and Food

Canadian consumers have a good reason for optimism as December 2022 marked a significant slowdown in price increases for some durable goods, including furniture, passenger vehicles, and, most markedly, household appliances. Food costs from stores decelerated by (+11.0%) in December, which is down from (+11.4%) in November. December also saw consumer food prices such as coffee and tea (+13.2%), non-alcoholic beverages (+16.6%), and bakery products (+13.5%) all decelerate compared to the month prior.

Notably, Canadians paid significantly more for personal care supplies (+9.9%) Y-O-Y, which is the largest price increase in this category since February 1983, nearly 40 years ago.

Rising fresh vegetable costs also accelerated in December (+13.6%) compared to (+11.2%) the month prior. According to Statistics Canada, agricultural products rose in costs due, in large part, to adverse weather patterns in farming regions.

Shelter and Mortgages

Perhaps one of the most important line items in December 2022’s CPI report is homeowners’ replacement costs. On a Y-O-Y basis, these costs were augmented (+4.7%) while other accommodation expenses upticked (+2.5%). Ultimately, these items put downward pressure on this month’s CPI and are largely indicative of Canada’s nationwide housing market cool.

On the other hand, mortgage interest costs rose in December which applied upward pressure on the CPI. Given Canada’s rising interest rate environment, December’s mortgage interest costs rose by (+18%) Y-O-Y, up sharply from (+14.5%) in November.

“Year over year, prices rose at a slower pace in December compared with November in all provinces,“ explained Stats Can in its monthly report. “[This was] largely the result of lower prices for furnace fuel oil, which is commonly used for home heating in Atlantic Canada.”

Interested in learning about diversifying your investment portfolio with historically inflation-resistant assets? Check out our exclusive guide to buying gold in Canada in 2023. In it, we explain how you can get the best deal on TFSA and RRSP-eligible bullion and coins while avoiding the common scams and pitfalls that first-time buyers can sometimes run into.

Source Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/230117/dq230117a-eng.htm