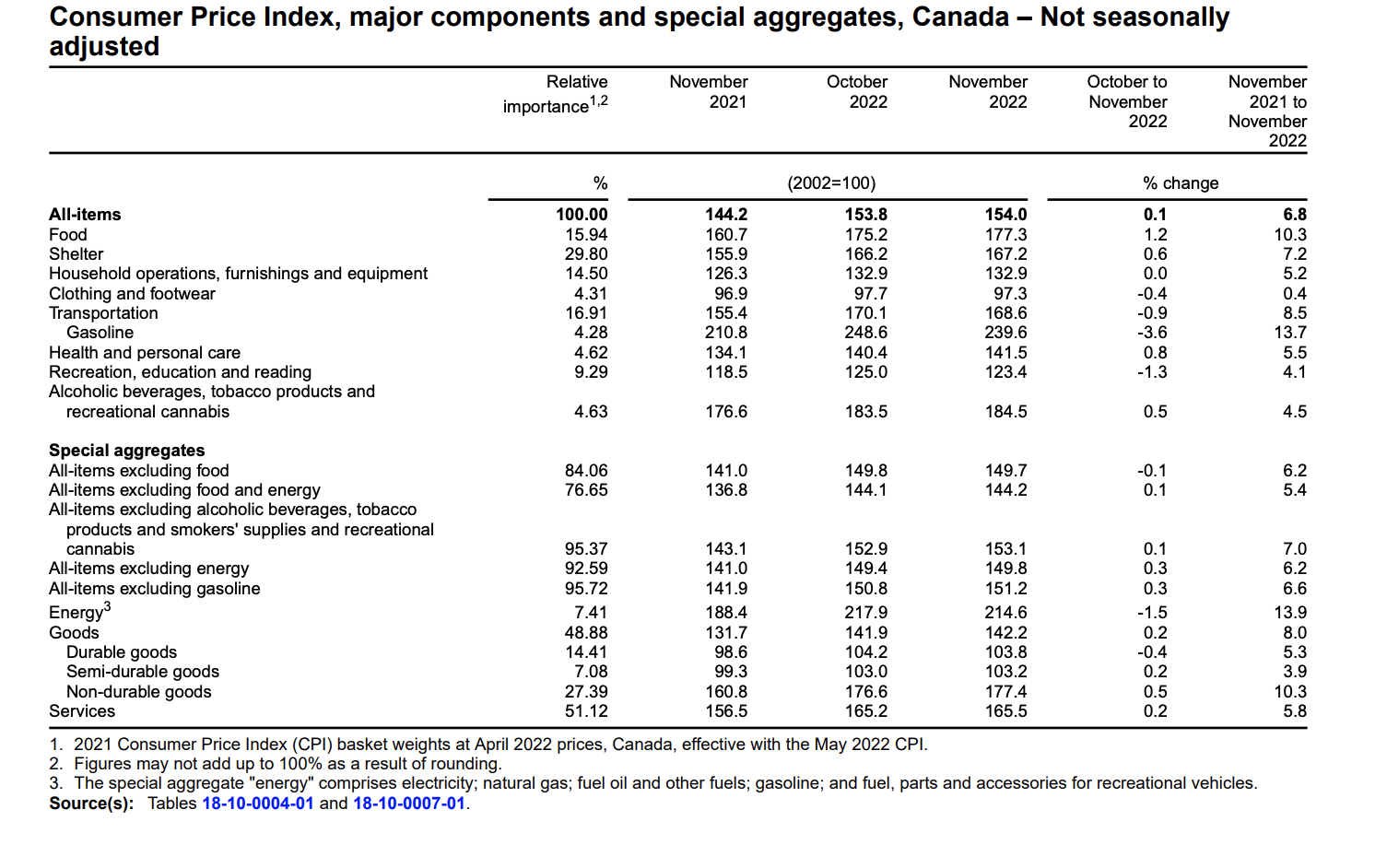

The Consumer Price Index (CPI) increased by 0.1% on a monthly basis in November, reported Statistics Canada. On a year-over-year basis, the CPI rose by 6.8%. This marks a decrease from the 6.9% gain seen in October.

The principal reason for the cooling in inflation seen in November was a drop in the price of gasoline. However, Canadian consumers paid more for foodstuffs at grocery stores over the month.

In addition, shelter prices likewise rose with both an increase in rent prices and mortgage interest costs in November.

Based on the data, inflation in Canada has decelerated slightly for the month. Yet, over the course of the year, the Bank of Canada increased interest rates an astounding seven times in an attempt to tame decades-high inflation.

(Source: Statistics Canada)

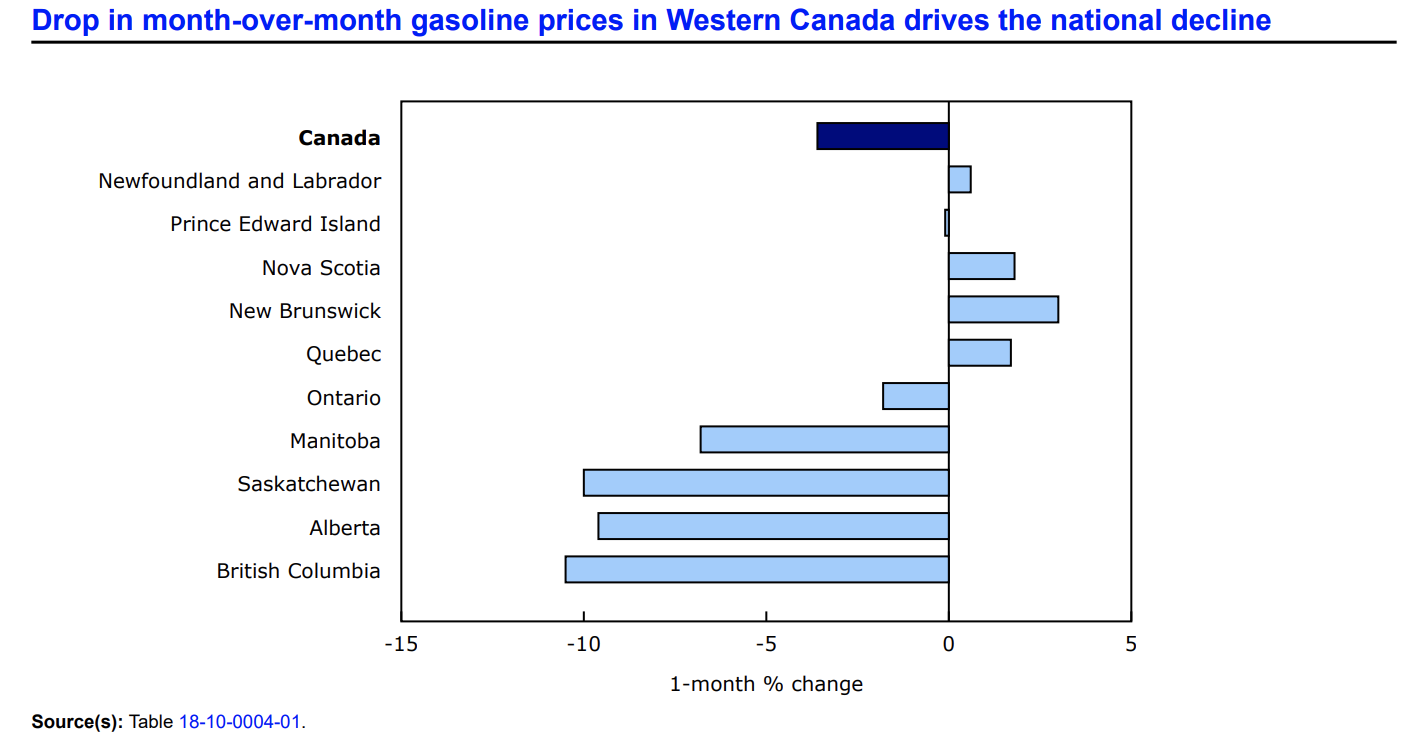

The Price of Gasoline

In November, Canadian consumers had a bit of respite at the gas pumps, as the price of gasoline dropped by 3.6%. The drop in gasoline prices was primarily because of refineries reopening in regions of the western United States.

Over the last 12-month period, the price of gasoline increased by 13.7% – a decline from the 17.8% rise seen in October.

(Source: Statistics Canada)

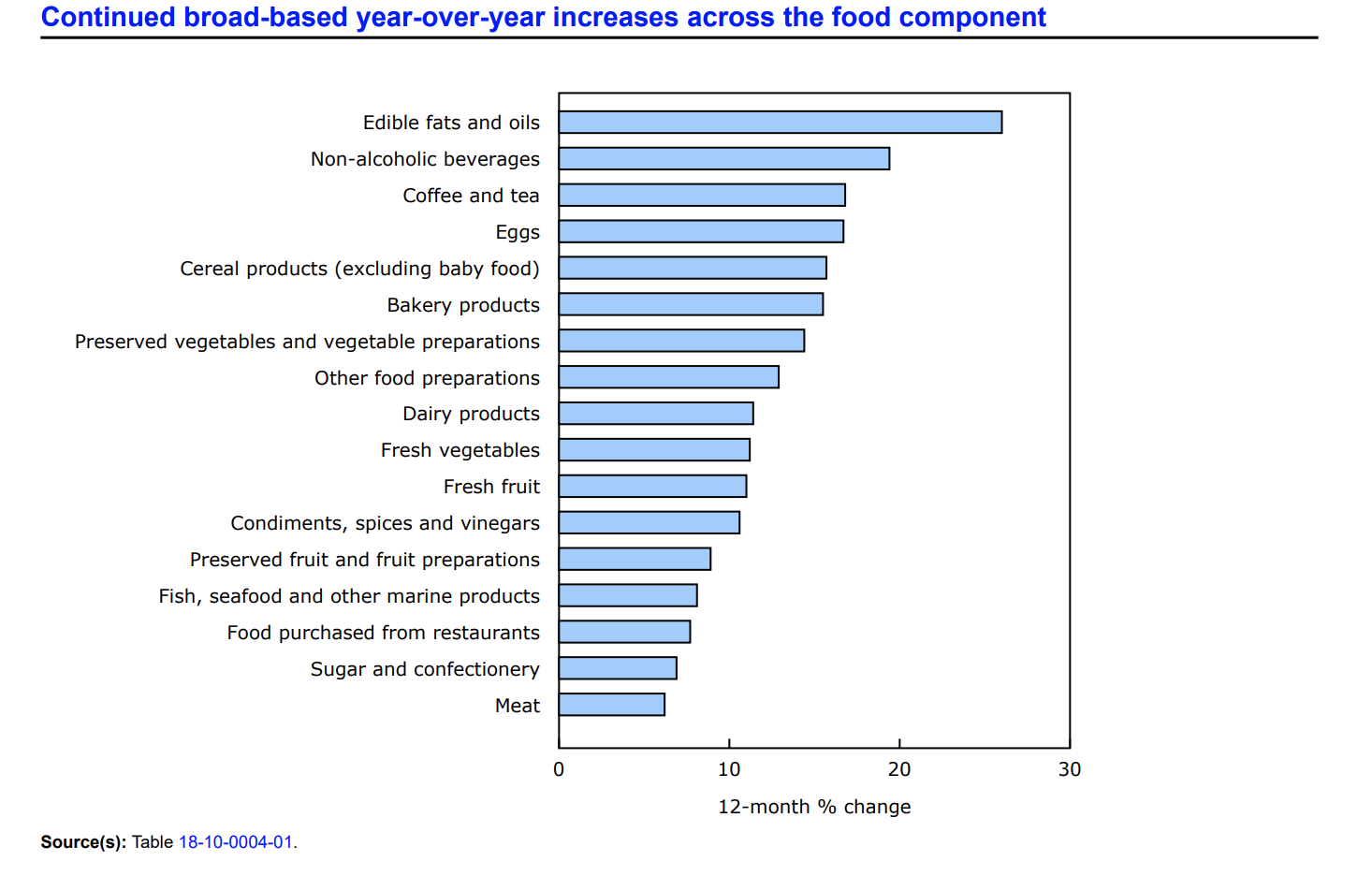

Food

Canadian consumers continued to pay more for foodstuffs purchased at grocery stores. Year-over-year, the index for food increased by 10.3% in November.

“Food inflation remained broad-based, with prices for groceries rising at a faster rate than the all-items CPI every month since December 2021,” explained Stats Can in its monthly report.

Canadian consumers paid more for food items such as edible fats and oils (+26.0%), non-alcoholic beverages (+19.4%), coffee and tea (+16.8%), eggs (+16.7%), cereal products (+15.7%), bakery products (+15.5%), and fresh fruit (+11.0%).

(Source: Statistics Canada)

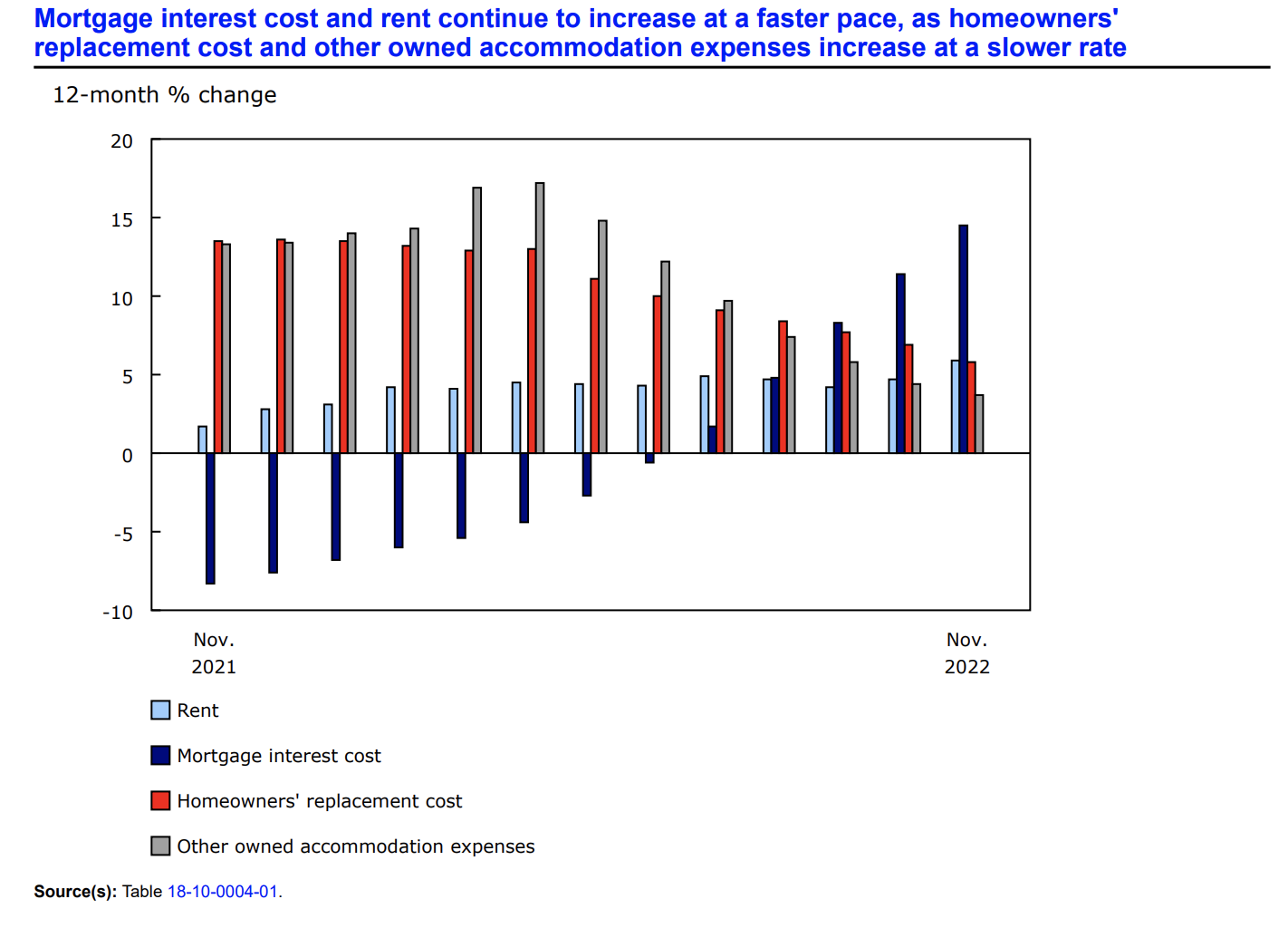

Shelter

In November, the cost of shelter in Canada increased at a faster pace on a year-over-year basis. Since this time last year, the index for shelter rose 7.2%. This was primarily due to the increase in the composite indexes of rent and mortgage interest cost, respectively.

Composite shelter indexes that saw percentage increases were the mortgage interest cost index, which rose 14.5% since this time last year, and the index for rent, which grew by 5.9% year-over-year in November.

It should be noted that Stats Can stated that there hasn’t been such a significant monthly increase in the mortgage interest cost index since February 1983.

Conversely, composite shelter indexes that slowed on a year-over-year basis included the homeowners’ replacement cost index by 5.8% and the index for other owned accommodation expenses by 3.7%. This year-over-year slowdown is indicative of the continued cooling of Canada’s real estate market.

Statistics Canada explained that there has been a decline in both respective indexes since May of this year.

(Source: Statistics Canada)

Want to learn more about how inflation is impacting the economy? Have a look at our table highlighting information regarding the Consumer Price Index (CPI) and inflation rates in Canada for 2022, try our inflation calculator, and subscribe to our newsletter.

Source Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/221221/dq221221a-eng.htm?HPA=1