The Consumer Price Index (CPI) grew by 0.7% on a monthly basis, reported Statistics Canada. On a year-over-year basis, the CPI increased 8.1% – marking the largest annual change since January 1983.

“The rate of consumer inflation continued to rise, reaching 8.1% year over year in June, following a 7.7% gain in May. The increase was the largest yearly change since January 1983. The acceleration in June was mainly due to higher prices for gasoline, however, price increases remained broad-based with seven of eight major components rising by 3% or more.

Excluding gasoline, the CPI rose 6.5% year over year in June, following a 6.3% increase in May.

On average, prices rose faster than hourly wages, which increased 5.2% in the 12 months to June, based on data from the Labour Force Survey,” explained Statistics Canada in the monthly report.

Gas Prices

In June, the price of gasoline soared 54.6% since this time last year. Soaring gas prices were the largest contributor to the rise in inflation.

“Prices at the pump rose 6.2% month over month in June, following a 12.0% increase in May. Gas prices largely followed crude oil prices, which peaked in the first week of June with higher global demand amid the easing of COVID-19 public health restrictions in China, the largest importer of crude oil. Crude oil prices eased in the remaining weeks of June amid slowing demand worldwide related to concerns of a global economic slowdown,” remarked the agency.

(Source: Statistics Canada)

Shelter

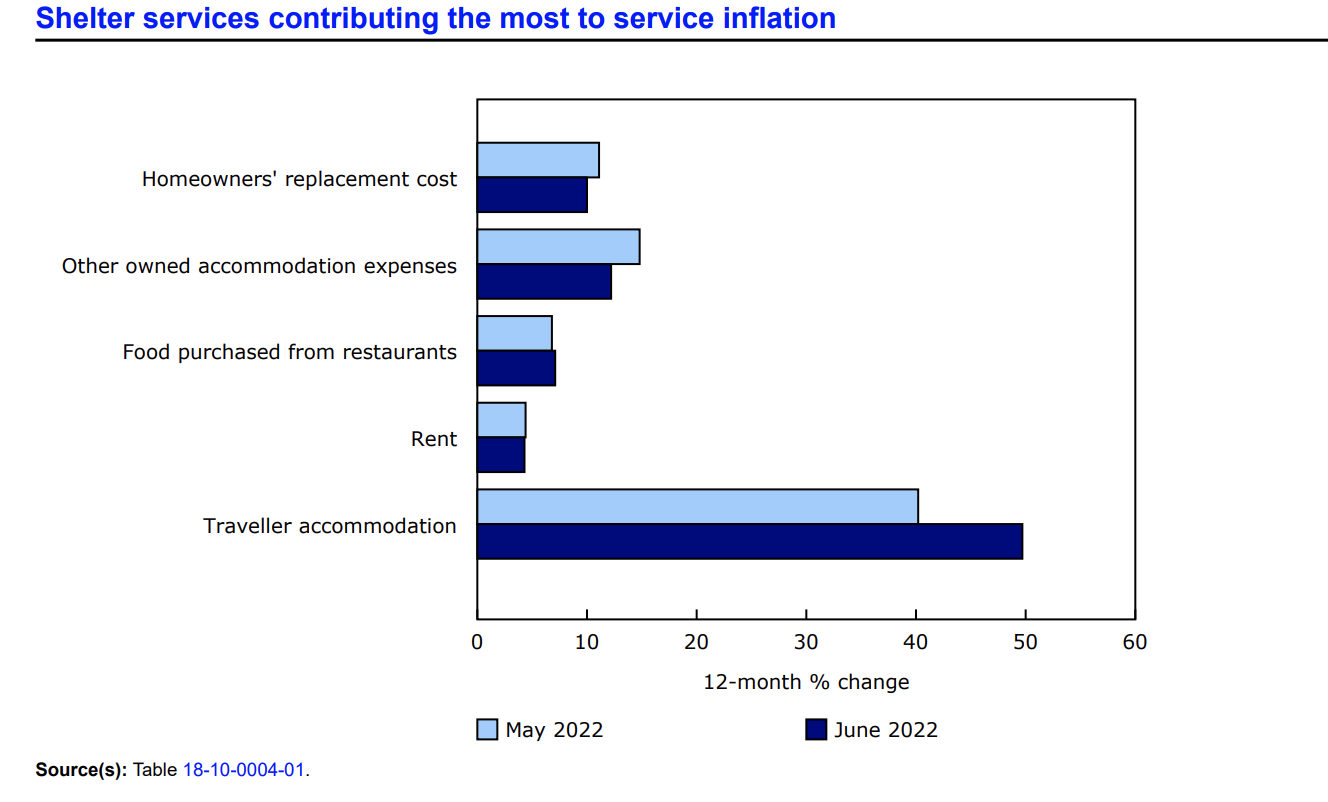

“Other owned accommodation expenses rose less year over year in June (+12.2%) than in May (+14.8%), driven by the first month-over-month decrease since August 2019. This reflects lower real estate commissions as housing prices ease from early 2022 highs. The homeowners replacement cost index also increased at a slower pace year over year in June (+10.0%) compared with May (+11.1%), further moderating the increase in the shelter index.

The mortgage interest cost index continued to decrease at a slower pace on a year-over-year basis, down 0.6% in June following a 2.7% decline in May, putting upward pressure on the all-items CPI. This was driven by the largest month-over-month increase (+1.4%) since September 1982, amid higher bond yields and a higher interest rate environment.,” explained the agency.

Travel-Related Services

Over the past month, there has been much discussion about the surge in demand for travel by Canadian consumers.

“The easing of public health measures and the increase in tourism which followed has led to higher demand for travel-related services. Travellers across the country faced higher prices for accommodation (+49.7%) compared with June 2021, with prices rising the most for consumers in Ontario (+68.0%). The return of sporting events, festivals and other large in-person gatherings has resulted in higher demand for accommodation, particularly in major urban centres.

Prices for air transportation rose 6.4% month over month in June, following a 0.8% decline in May. Air travel has continued to increase amid loosening COVID-19 public health restrictions, with pent-up demand heading into the summer travel season putting upward pressure on prices,” said Statistics Canada in its report.

(Source: Statistics Canada)

Passenger Vehicles

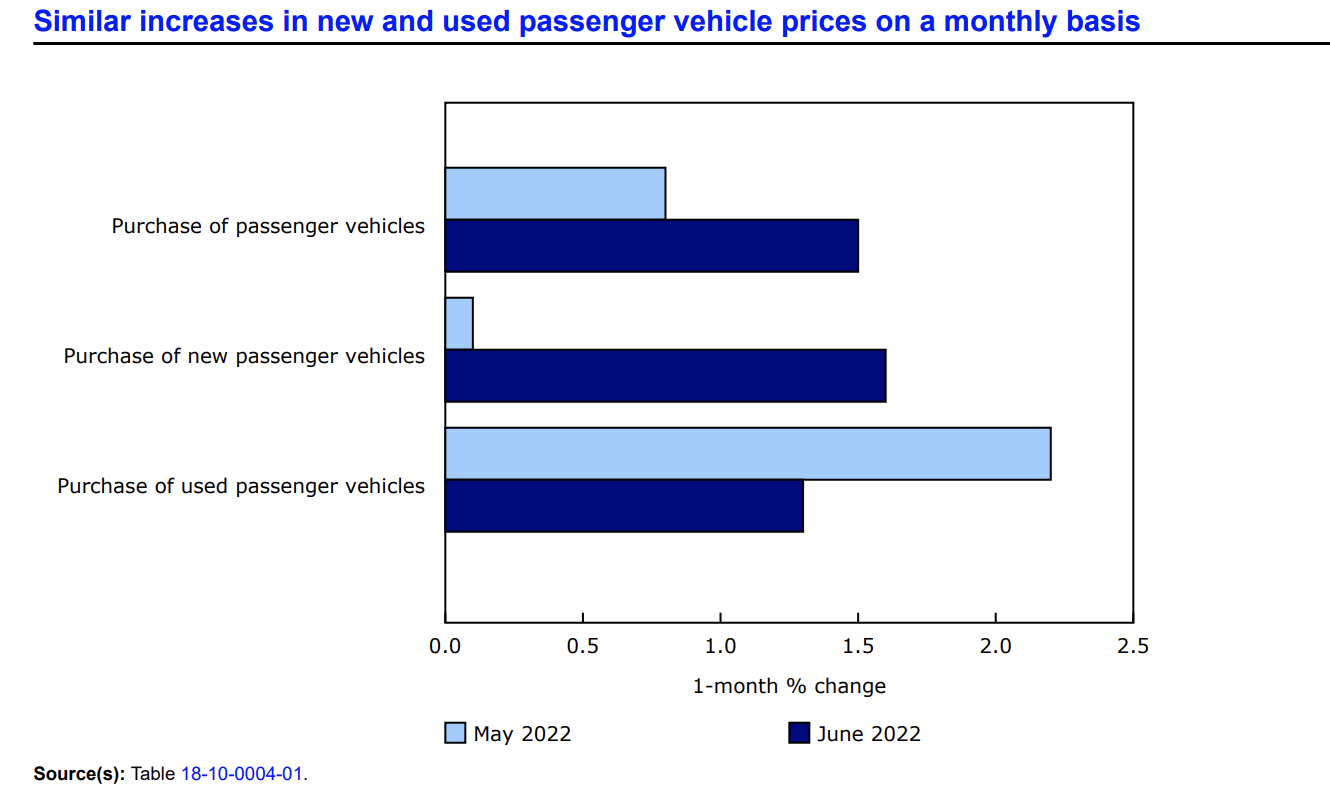

In June, the price of passenger vehicles has increased by 8.2% since this time last year.

“Demand for passenger vehicles continues to outpace supply as a result of the ongoing semi-conductor shortage, putting upward pressure on prices. On a monthly basis, prices for passenger vehicles rose 1.5% in June, as prices for new vehicles (+1.6%) and used vehicles (+1.3%) increased. Month over month, prices for new vehicles rose at a faster pace than the 0.1% increase in May, due, in part, to the higher availability of new model-year vehicles,” explained Stas Can.

Source cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/220720/dq220720a-eng.pdf?st=4XKzJvPr