The Consumer Price Index (CPI) edged up 0.1% on a monthly basis, reported Statistics Canada. On a year-over-year basis, the CPI rose 7.6% in July. This marks a decline from the 8.1% increase seen the previous month.

The principal reason for the percentage decline seen in July was the decrease in the price of gasoline. Despite the drop in prices that Canadian consumers paid at the pump, other indexes saw percentage increases on a year-over-year basis – particularly foodstuffs purchased at grocery stores and travel services.

For Canadian consumers, this means they will pay more for in-person services such as airline tickets, hotel accommodations, and dining out at restaurants.

Excluding the gasoline index, in July prices increased 6.6% over the last 12-month period.

Regarding inflation, based on the data for July provided by Statistics Canada, consumer inflation continued to surpass the average hourly wage, but at a slower pace than seen in June. Since this time last year, the average hourly wages of Canadian workers rose 5.2%.

Yet, despite the fact that inflation has decelerated, the Bank of Canada announced that much still needs to be done to curtail it.

(Source: Statistics Canada)

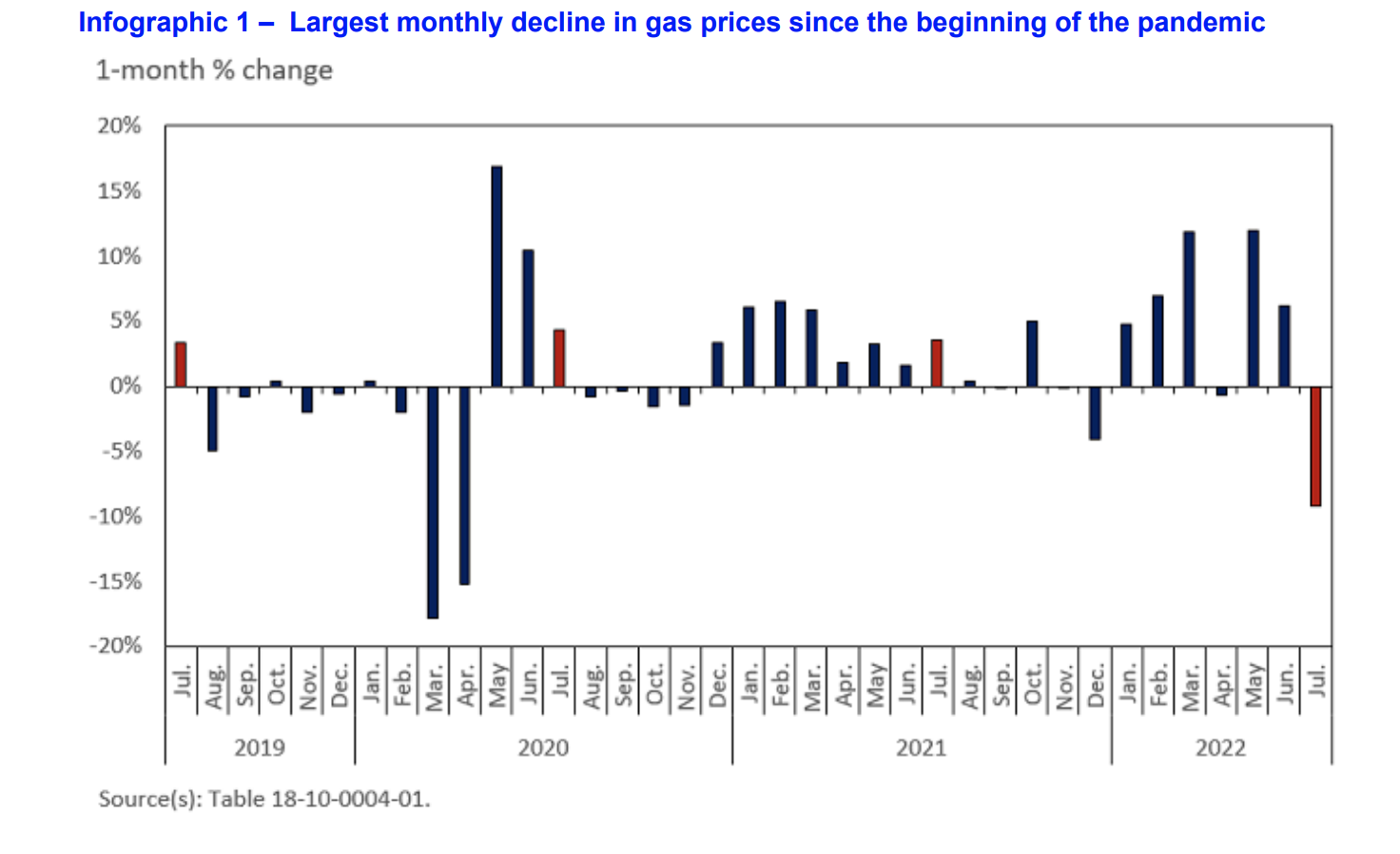

Gas Prices

In July, the price of gasoline soared by 35.6% over the last 12-month period. Yet, gas prices increased at a slower pace year-over-year compared to a 54.6% rise seen in June.

Canadians experienced a bit of relief at the gas pumps paying 9.2% less than in June. It should be noted that this marked the most substantial decrease in gas prices in over two years, specifically April 2020.

Uncertainty pertaining to a looming global recession, coupled with a decreased market for gasoline in both China and the United States were the main contributing variables to the drop in gas prices in July.

(Source: Statistics Canada)

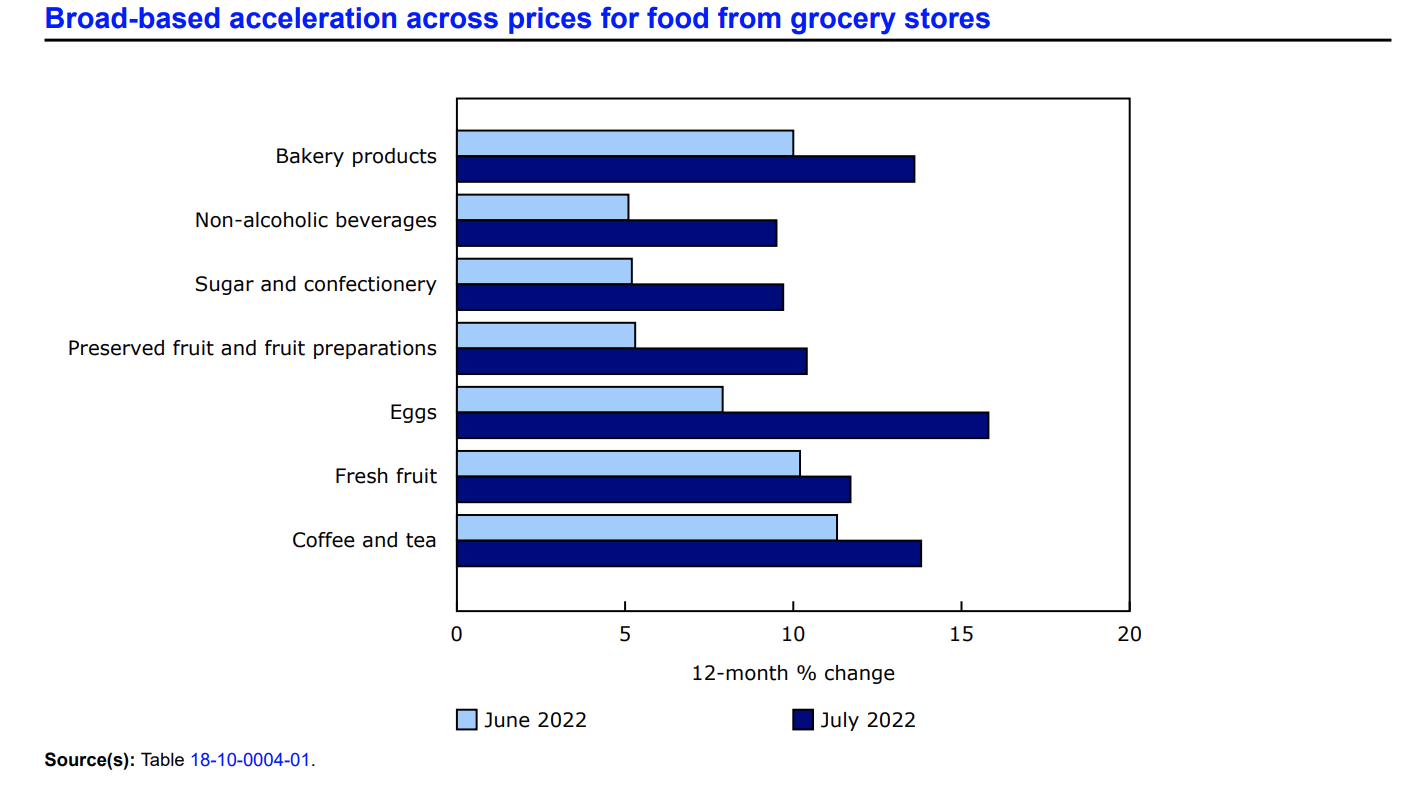

Food

Conversely, Canadian consumers paid more for groceries since this time last year. In July, the price of foodstuffs from grocery stores rose 9.9% over the last 12-month span, compared to the 9.4% increase seen in June.

Grocery items that were the main contributors to the increase in food prices included fresh fruit (+11.7%), coffee and tea (+13.8%), non-alcoholic beverages (+9.5%), preserved fruit and fruit preparations (+10.4%), sugar and confectionery (+9.7%), and eggs (+15.8%).

This continuing increase in food prices has furthered concerns that many Canadians are now unable to meet basic daily living expenses. In fact, two out of five people in Canada now report being significantly impacted by the soaring price of food at grocery stores.

Travel Services

Canadian consumers paid more for travel-related services such as airline flights, hotel accommodation, and dining out at restaurants in July.

“Prices for various services associated with travel and in-person gatherings continued to increase during the busy travel season, the first summer since the loosening of COVID-19 public health restrictions across Canada,” explained Statistics Canada in its monthly report.

In July, on a year-over-year basis, Canadian consumers paid 25.5% more for airline tickets and 24.8% more for travel tours. Furthermore, the price of hotel accommodations likewise increased 47.7%, as did the cost of dining out at restaurants by 7.3% since this time last year.

(Source: Statistics Canada)

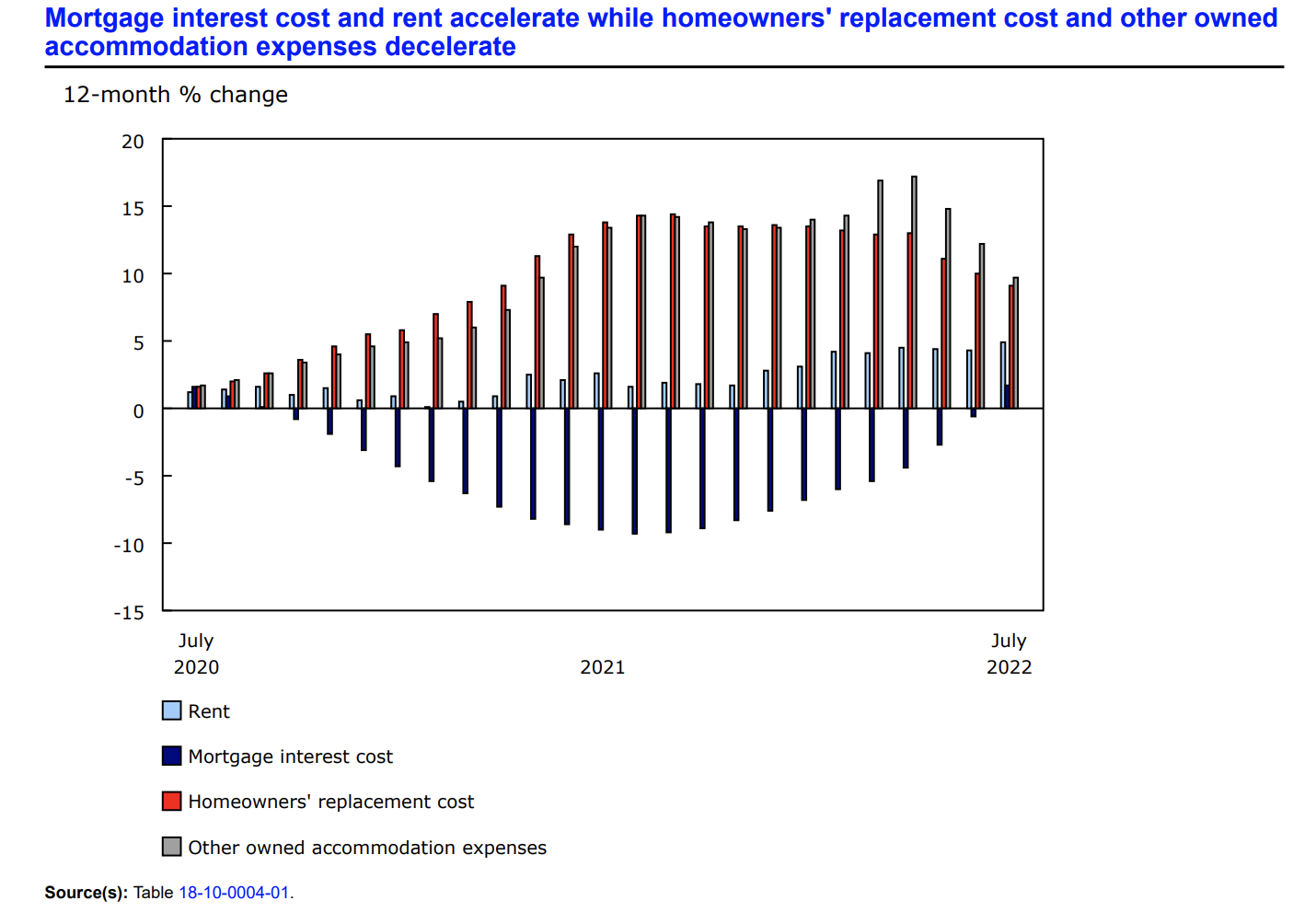

Shelter

In July, the price of shelter rose in Canada in correlation to the recent increase in interest rates.

Composite indexes that contributed to year-over-year price increases in July included rent (+4.9%) and mortgage interest cost (+1.7%).

Conversely, in correlation to the recent cooling housing market witnessed across the country, composite indexes that declined on a year-over-year basis were homeowners’ replacement cost (+9.1%) which is correlated to the price of new homes, and other owned accommodation expenses (+9.7%).

Want to learn more about how inflation is impacting the economy? Have a look at our table highlighting information regarding the Consumer Price Index (CPI) and inflation rates in Canada for 2022, try our inflation calculator, and subscribe to our newsletter.

Source Cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/220816/dq220816a-eng.pdf?st=UALZ5Rvo