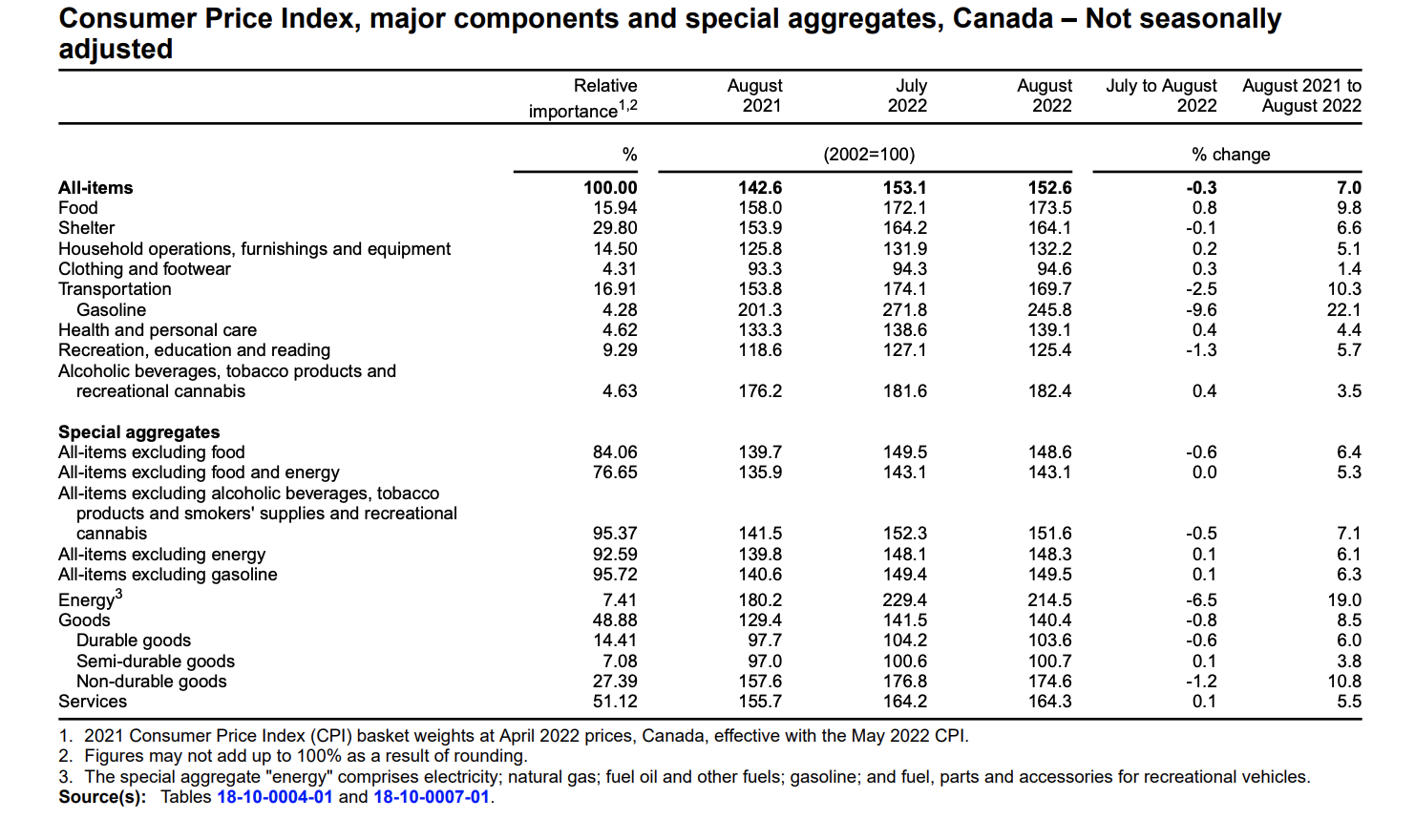

The Consumer Price Index (CPI) dropped by 0.3% on a monthly basis in August, reported Statistics Canada. The agency noted that this marked the most significant monthly percentage drop since the onset of the COVID-19 pandemic. On a year-over-year basis, the CPI increased 7% in August.

The primary reason for the percentage drop seen in August was a decline in transportation prices and shelter prices. However, Canadian consumers were forced to pay more for foodstuffs purchased from grocery stores.

In fact, Statistics Canada noted that this was the most significant price increase for foodstuffs bought at stores seen in over four decades, specifically, since August 1981.

With regards to inflation, based on the data provided by Statistics Canada for August, consumer inflation continued to surpass the average hourly wage, but at a slower pace than seen in July. Over the last 12-month period, the average hourly wages of Canadian employees rose 5.4%.

Although inflation appears to be easing, it remains to be seen what actions will be taken by the Bank of Canada.

(Source: Statistics Canada)

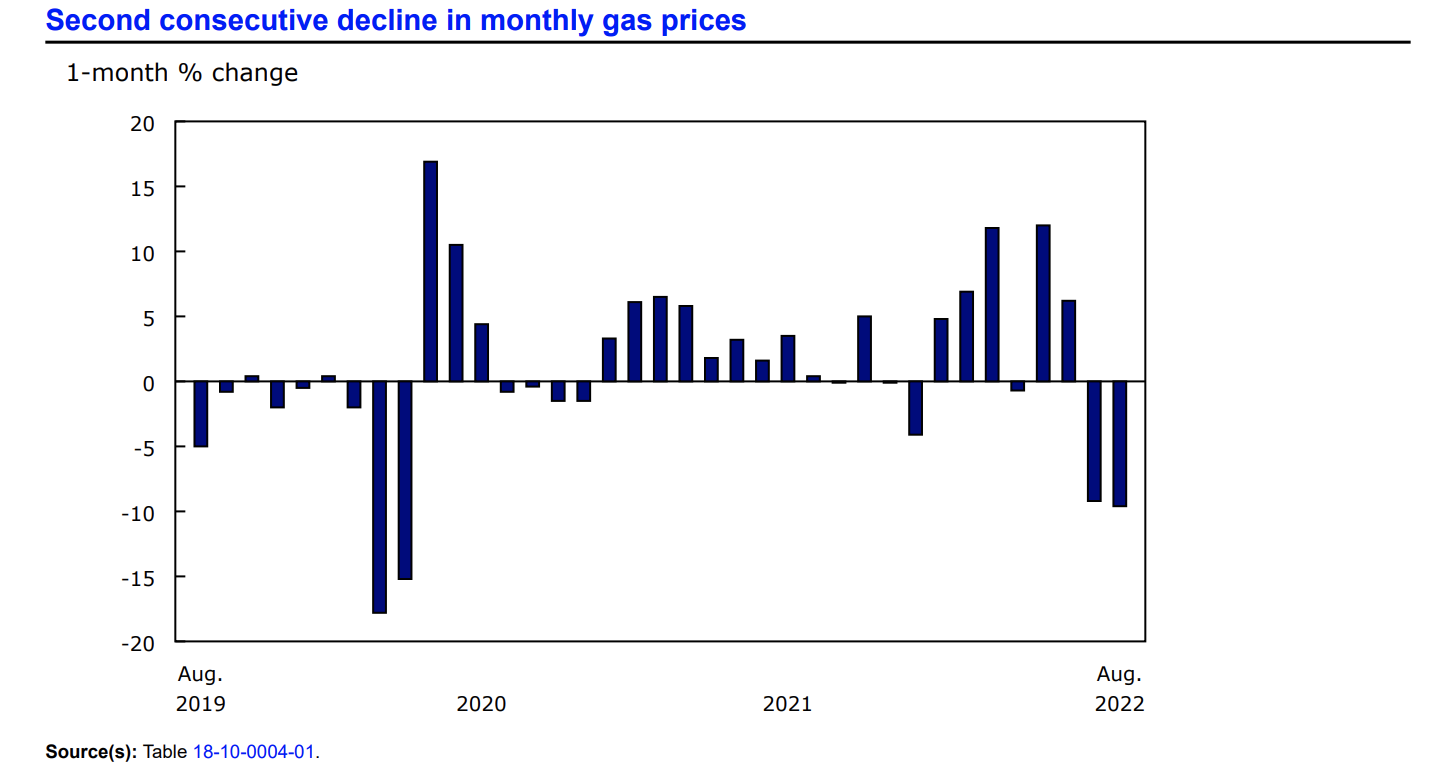

The Price of Gasoline

In August, Canadian consumers paid 22.1% more for gasoline year-over-year, compared to the 35.6% year-over-year increase seen in July. Canadians enjoyed more relief at the pumps, paying 9.6% less for gas over the month. This marks the most significant monthly decrease in the price of gas since April 2020.

According to the data, Canadians in Saskatchewan and Alberta saw the most significant decline in gas prices. The principal factor for the overall drop in the price of gas seen in August was an increase in production by oil-producing nations.

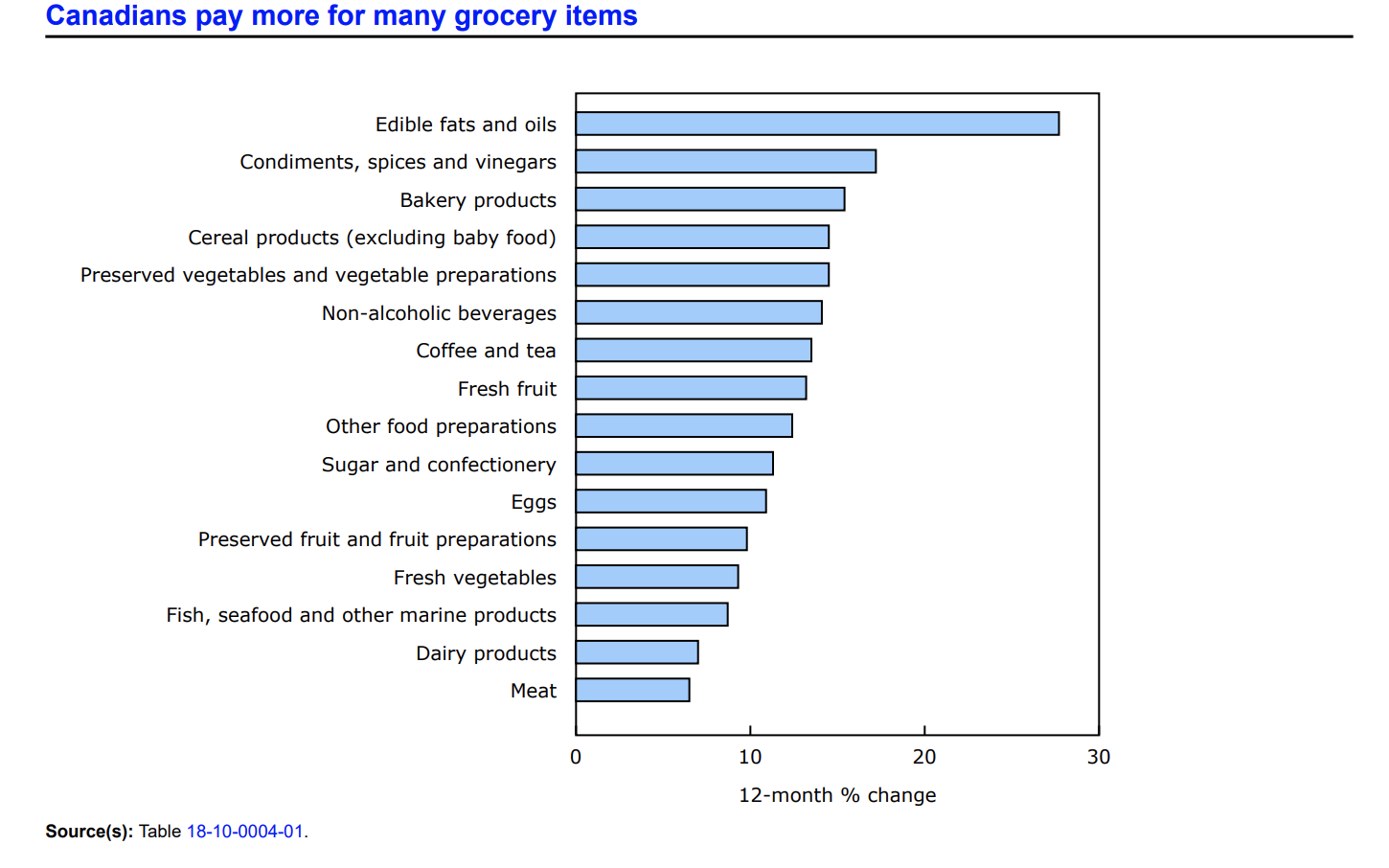

Food

Conversely, Canadian consumers paid more for foodstuffs purchased from grocery stores. Likewise, food purchased from restaurants increased by 7.4% on a year-over-year basis, which was also one of the primary upward contributors to the increase in CPI for August.

On a year-over-year basis grocery items with the highest price increases included fresh fruit (+13.2%), non-alcoholic beverages (+14.1%), bakery products (+15.4%), fish and seafood (+8.7%), dairy products (+7.0%), meat (+6.5%), sugar and confectionery (+11.3%), and condiments, spices, and vinegars (+17.2%).

Overall, the supply of food has been affected by numerous variables including the recent extreme weather around the globe, supply chain disruptions, and the geopolitical situation between Russia and Ukraine.

(Source: Statistics Canada)

Shelter

In August, the cost of shelter in Canada increased at a slower pace on a year-over-year basis. Since this time last year, the index for shelter rose 6.6%.

In correlation to the continued cooling of Canada’s real estate market, composite shelter indexes that slowed on a year-over-year basis were homeowners’ replacement cost index (+8.4%), and commissions on the sale of real estate (+7.4%).

(Source: Statistics Canada)

Durable Goods

In August, Canadian consumers paid less year-over-year for durable goods (6%), compared to the 7% year-over-year witnessed in July. The price of household appliances increased at a slower pace of 9% in August, compared to the 11.5% increase seen the previous month.

Specific items that saw slowed prices since this time last year included cooking appliances (+7.9%), laundry and dishwashing appliances (+9.3%), and refrigerators and freezers (+12.0%).

Want to learn more about how inflation is impacting the economy? Have a look at our table highlighting information regarding the Consumer Price Index (CPI) and inflation rates in Canada for 2022, try our inflation calculator, and subscribe to our newsletter.

Source Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/220920/dq220920a-eng.htm?HPA=1