Windmill Microlending (www.windmillmicrolending.org) provides loans, mentorship, and consulting services to help newcomers hit the ground running. But, is it a trustworthy resource? In this review, we’ll break down this service to help you decide if it’s right for you…

About the Company

- URL: https://www.windmillmicrolending.org/

- Phone: 1-855-423-2262

- Email: info@teamwindmill.org

- Company HQ: Calgary, AB, Montreal, QC and Toronto, ON.

- Google Reviews: 5/5 stars (935 reviews)

- Facebook Reviews: 4.7/5 stars (15 reviews)

The company does seem to have a lot of positive reviews on sites like Google Reviews and Facebook Reviews, which is a good sign.

Windmill Microlending Pros and Cons:

For a checklist on how Windmill Microlending stacks up, please see our pros and cons below:

Pros:

- You can borrow up to $15,000

- Interest rates are capped at 6.7%

- There are no loan processing fees

- Loans can be used for several purposes, like childcare costs, certifications, and training

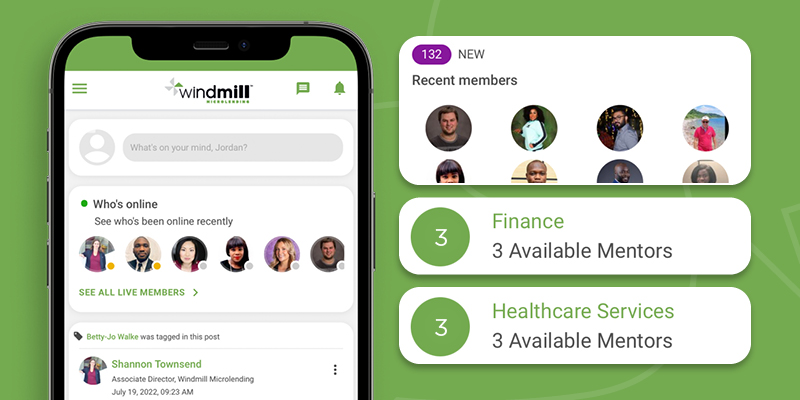

- You also receive one-on-one coaching, mentorship, and financial planning tools

- Highly rated by borrowers

Cons:

- You must have some form of permanent status and meet other requirements

- The list of required documents is extensive

What Is Windmill Microlending

Windmill Microlending is a Canadian nonprofit organization offering loans and career advice to immigrants and refugees. Its mission is to reduce poverty, inequality, and help offset labour shortages.

Financial assistance can be used to cover expenditures like childcare costs, living expenses, accreditation, training, certification, and career development courses. In addition, clients obtain one-on-one coaching, mentorship, and financial planning tools.

The nonprofit receives funding through private donations (60%) and the Canadian Government (40%), and its loans are designed for newcomers with little or no credit history, and those deemed high-risk by financial institutions.

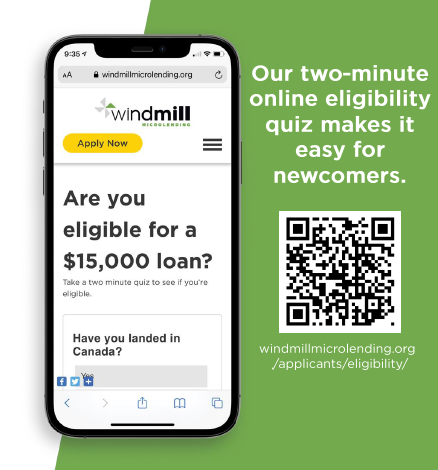

Who Can Apply For a Windmill Microlending Loan?

To obtain financing from Windmill Microlending, you must meet the following requirements:

- Be an immigrant that’s a Permanent Resident, Protected Person, Convention Refugee, Provincial Nominee, or a Canadian Citizen

- Have a post-secondary degree that you obtained internationally and/or at least one year of post-secondary work experience before moving to Canada

- Not have an undischarged bankruptcy or a consumer proposal that’s been active during the last six months.

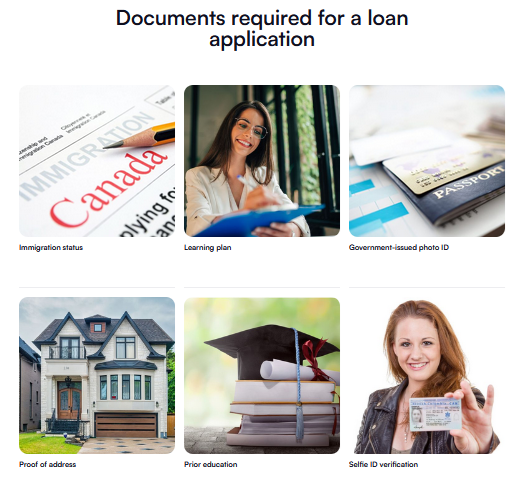

What Documents Do I Need When Applying?

Before submitting an application, make sure you have the following documents ready to ensure compliance With Windmill Microlending’s vetting process:

- Government-issued photo ID confirming your identity

- Photograph of yourself holding your government-issued photo ID to further verify your identity

- Documents verifying your address

- Documents verifying your immigration status

- Training/education documents verifying your credentials

- Evidence of education acceptance, like an admission, registration, or enrollment letter

- Banking information to process deposits

- Resume (recommended)

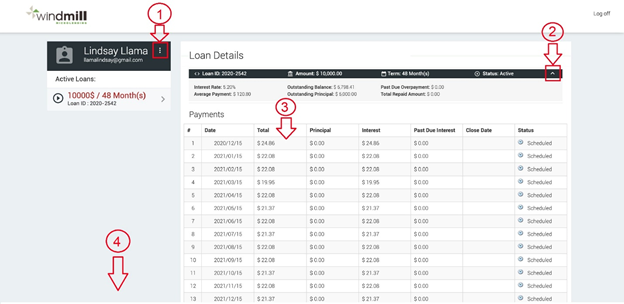

What Are the Loan Terms?

If you meet the eligibility criteria, you can borrow up to $15,000 with a fixed interest rate of 6.7% and there are no loan processing fees. The company notes, “As a registered not-for-profit, Windmill does not make any money from the loans. Future clients will benefit from the interest paid by today’s clients.”

In other words, Windmill Microlending charges interest to cover bank fees, overhead charges, and to replenish the loan fund. The strategy ensures the nonprofit has the recurring cash flow to meet the demand for future loans.

Please note that Windmill Microlending is registered with Equifax and conducts hard credit pulls before extending credit. Consequently, obtaining a loan will impact your credit score.

Why Is Windmill Microlending So Popular?

With record immigration realized in 2021 and 2022, the Canadian Government welcomed the most newcomers since 1913. A 2023 report stated:

“The Government of Canada planned to welcome 431,645 new permanent residents in 2022. Canada has reached that target, surpassing our previous record from 2021. This represents the largest number of people ever welcomed in a year, in Canadian history. Prior to setting a new record for admissions in 2021, the last time Canada welcomed such a large number of newcomers was in 1913.”

Moreover, the policy was aimed at “addressing the acute labour market shortages we are facing today and building a strong economy into the future; one thing remains certain: immigration is a key part of the solution.”

So, with Windmill Microlending playing a meaningful role in supporting, coaching, and financing new entrants, the nonprofit’s mission aligns with the federal government.

Furthermore, Canada added 471,550 new permanent residents in 2023, which is 33,950 more than the 437,600 in 2022. As such, demand for Windmill Microlending loans has risen, and the company should be on your radar if you’re a skilled newcomer looking to get your Canadian career on track.

How Do Borrowers Rate Windmill Microlending?

Windmill Microlending has exceptional Google reviews, as several newcomers lauded the foundations’ coaching and customer service. Some of the testimonials stated:

- Life-changing experience. Sanaya was amazingly helpful and really helped me take so much stress off. The whole team at Windmill is absolutely amazing and wants to help you with genuine intentions. I will never forget their helpful nature.

- I highly recommend Windmill to new immigrants that looking for career transitioning and education. Career guidance such as coaching and short-term training in the Canadian financial system were excellent.

- Awesome non-profit organization and the employees are really helpful, kind, and aware of your needs (special thanks to Sanaya and Andrea). They are dedicated to helping professional immigrants reach their goals in practicing their careers in Canada, giving amazing and practical solutions and support financially,

- The website and people behind this organization are straightforward and everything is easy to understand. Mr.Lau is outstanding! He is very welcoming, easy to talk to, and helped with my current situation. He provided me with detailed information about the loan and processes. It made me feel that people care about my success in achieving my RN here in Canada.

As you can see, Windmill Microlending has built a solid reputation for not only extending credit, but also instilling knowledge and mentoring newcomers to help them achieve success. As a result, the nonprofit helps with much more than just financial assistance.

Do We Recommend Windmill Microlending?

When assessing the merits of financial companies, nothing speaks louder than customer reviews. And with testimonials overwhelmingly positive, Windmill Microlending has done a lot to earn newcomers’ trust.

Therefore, if you’re feeling overwhelmed and unsure of where to turn, the company can instill confidence and guide you in the right direction. Furthermore, successful repayment of your loan is invaluable, because it will improve your credit score.

For example, our Borrowell Credit Report Review highlights how free tools are available to help rebuild your credit. However, newcomers may find it difficult to obtain a loan due to job insecurity and a lack of credit history. In contrast, Windmill Microlending accounts for these issues and advises clients on the right loan amounts and terms for their unique situations. Consequently, it’s a worthwhile resource for immigrants seeking a better life.

If you want to sign up or learn more, visit: https://www.windmillmicrolending.org/