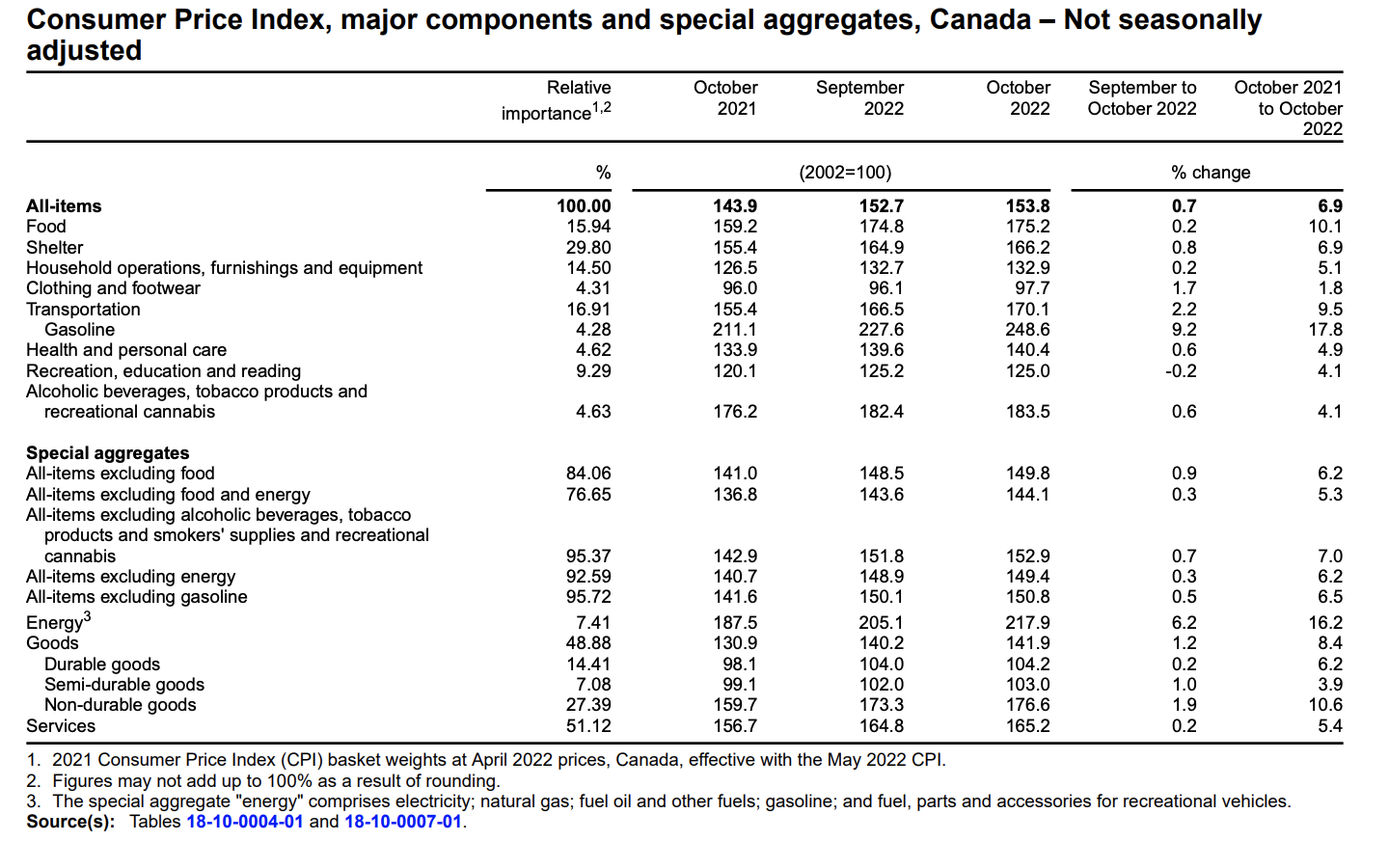

The Consumer Price Index (CPI) edged up 0.7% on a monthly basis, reported Statistics Canada. On a year-over-year basis, the CPI rose 6.9% in October. This is the identical year-over-year percentage increase seen the previous month.

The principal contributors to the increase in costs were gasoline prices and the index for mortgage interest cost. Yet, conversely, Canadian consumers paid less for natural gas and foodstuffs such as meat, vegetables, and fruit.

Pertaining to the average hourly wage in Canada, in October based on the data provided by Statistics Canada, the average hourly wage of Canadian workers increased by 5.6% over the last 12-month period.

Although consumer inflation continued to surpass the average hourly wage, it was at a lesser degree than seen in September.

Given that the country’s annual inflation rate remains unchanged, it is anticipated that the Bank of Canada will further increase interest rates at the beginning of December.

(Source: Statistics Canada)

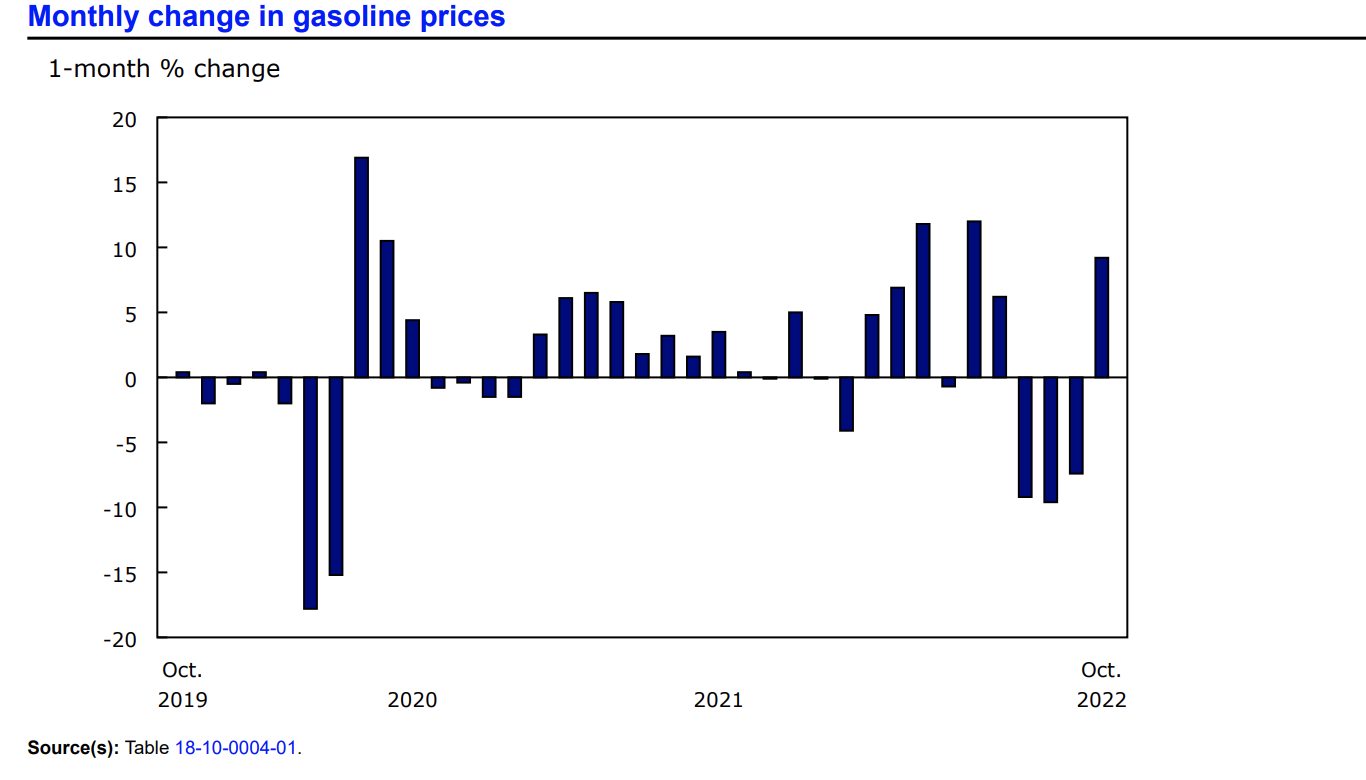

The Price of Gasoline

In October, Canadian consumers paid more at gas pumps. Over the month, the price of gasoline rose 9.2%, after dropping 7.4% in September.

“The announcement of future oil production cuts by the Organization of the Petroleum Exporting Countries Plus and a weaker Canadian dollar contributed to higher gasoline prices for Canadian consumers,” explained Stats Can in its monthly report.

Year-over-year, the price of gasoline increased by 17.8% in October, compared to the 13.2% seen year-over-year in September.

(Source: Statistics Canada)

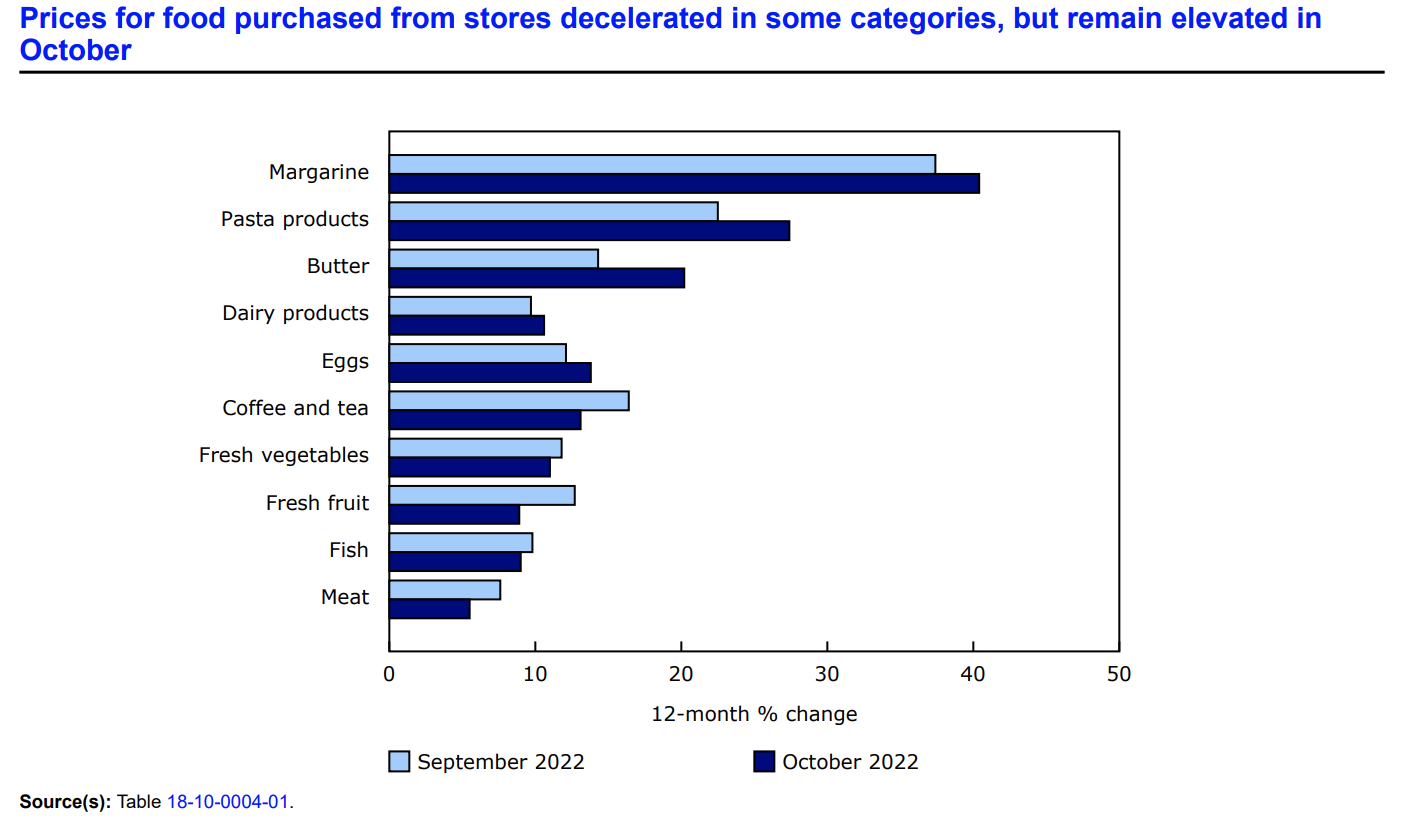

Food

In October, Canadian consumers paid slightly less for foodstuffs from grocery stores. The index for food increased 10.1% over the last 12-month span.

Grocery items that contributed to the overall decrease in food prices included fresh vegetables, fresh fruit, and meat. Conversely, food items from grocery stores that saw price increases included margarine, pasta products (+44.8%), lettuce (+30.2%), soup (+18.4%), and rice and rice-based mixes (+14.7%).

Shelter

In October, the cost of shelter in Canada increased on a year-over-year basis. Composite indexes that rose at a slower pace was the homeowners’ replacement cost index (correlated to new home prices), which increased 6.9%, compared to the 7.7% rise seen in September.

Other composite indexes that also saw percentage increases included mortgage interest costs by 11.4%, property taxes by 3.6%, and rent prices by 4.7% year-over-year in October. British Columbia was the province that saw the most significant increase in property taxes, while Manitoba was the only province that witnessed a decline in property taxes.

(Source: Statistics Canada)

Want to learn more about how inflation is impacting the economy? Have a look at our table highlighting information regarding the Consumer Price Index (CPI) and inflation rates in Canada for 2022, try our inflation calculator, and subscribe to our newsletter.

Source Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/221116/dq221116a-eng.htm