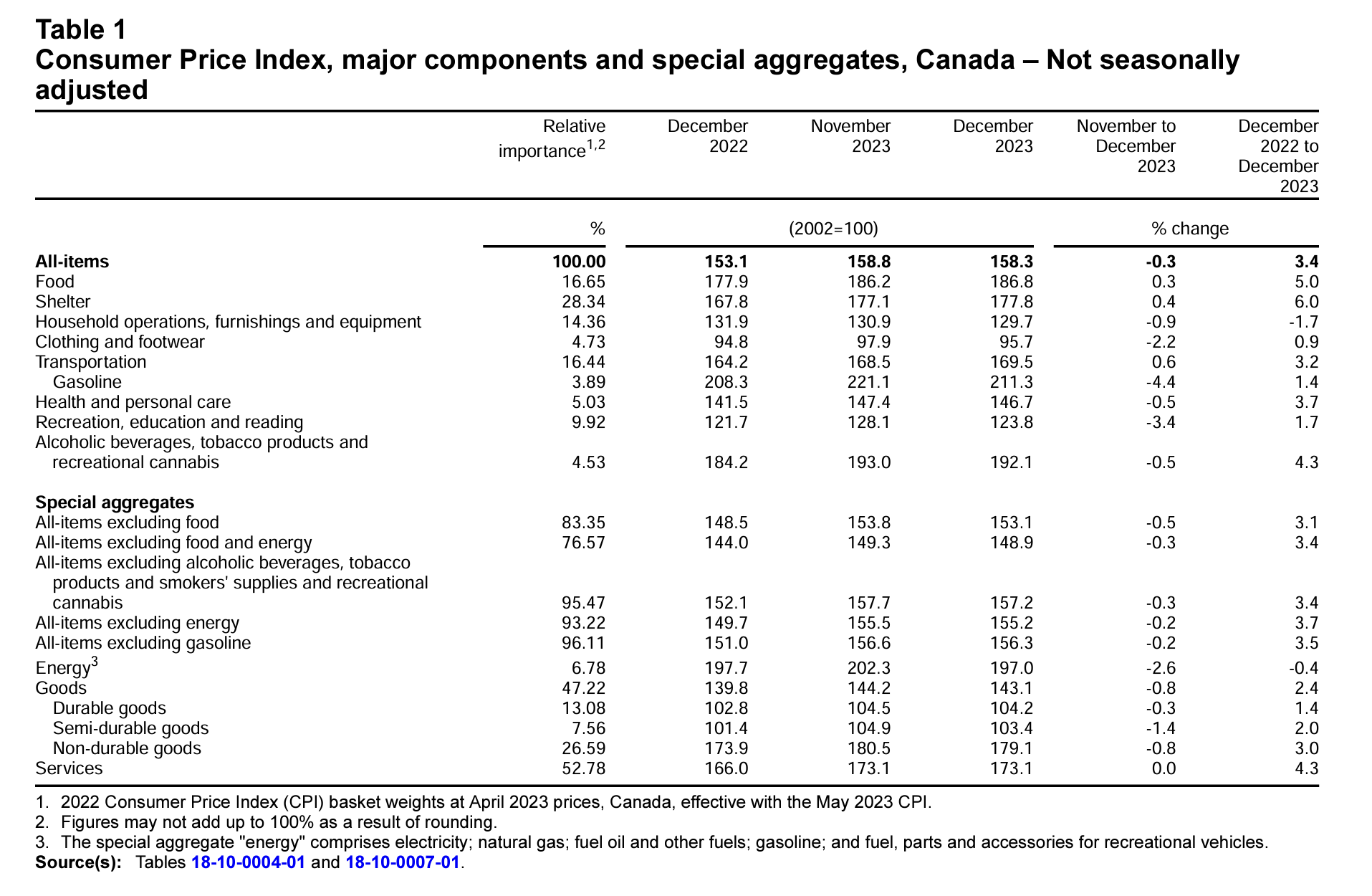

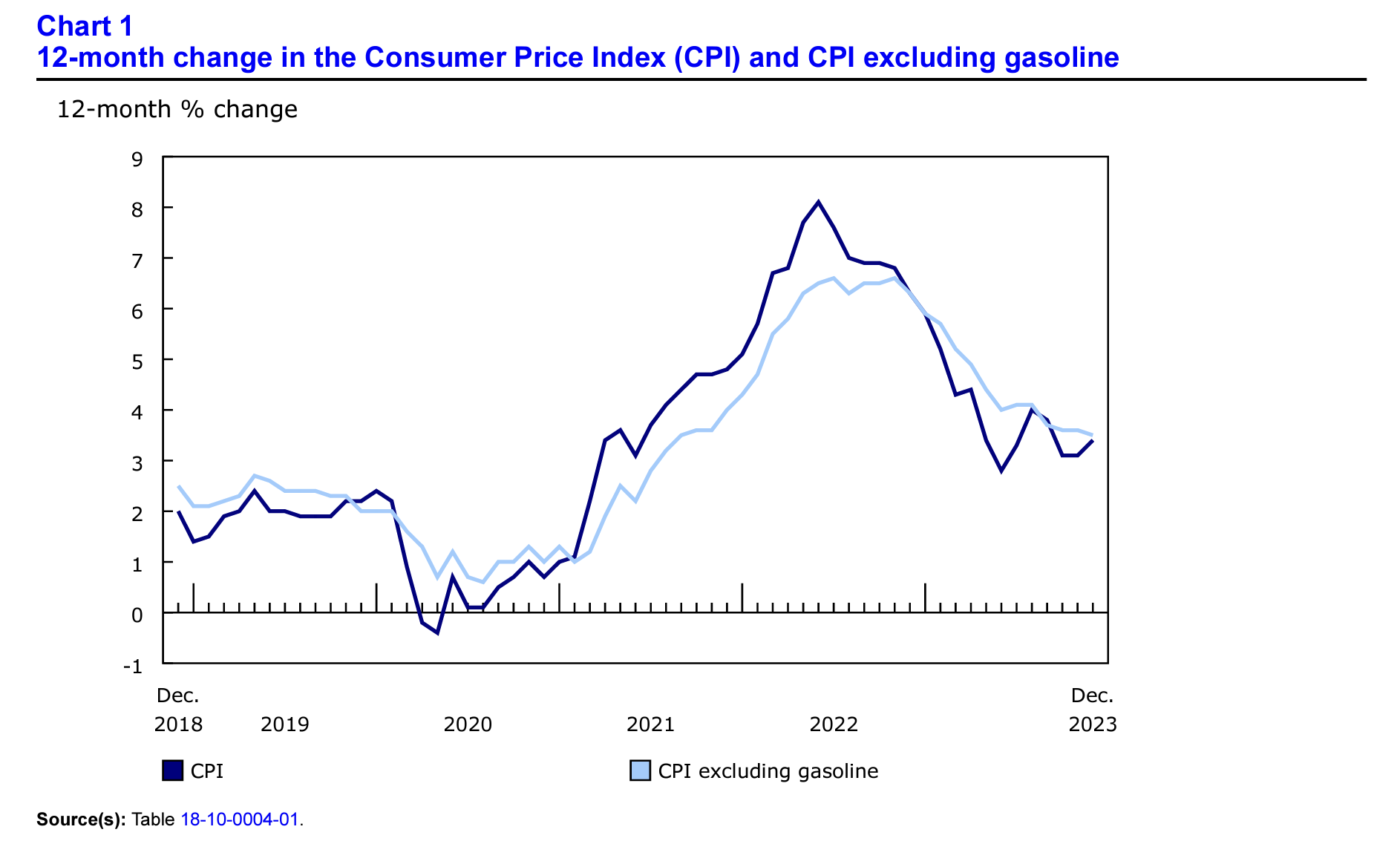

Canada’s consumer price index (CPI) rose by a sizable margin in December 2023, rising by 3.4% year over year (Y-o-Y) per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on January 16, 2024. This exceeds the level of price acceleration seen in both November 2023 and October 2023’s 3.1% CPI readings.

The rise in this month’s CPI reading was widely anticipated by economists, with the Financial Post citing rising gasoline prices in December as the primary catalyst for the month’s inflation surge. This, despite official Bank of Canada forecasts that had expected inflation to fall below 3.0% before the end of 2023—wishful thinking that, unfortunately, never came to fruition.

Despite December’s disappointing inflation news, experts still forecast that the Bank of Canada will cut interest rates sometime in 2024 and reverse the hawkish monetary policy campaign that they maintained throughout last year. A precondition for interest rate cuts in Canada would be several consecutive months of downward momentum in inflation. Therefore, today’s inflation reading may have delayed any incoming interest rate cuts.

Inflation in December 2023 was largely driven by Y-o-Y increases in the gasoline index (+1.4%), following a large decline in gas prices in the 12-month period noted the month prior (-7.7%). Additional upward price pressure was also felt in airline fares, fuel oils, passenger vehicles, and—surprise, surprise—rents and housing costs. However, downward price pressure was seen in the report due to lowered costs for travel tours. Below, we’ll take a closer look at Canada’s December 2023 CPI report to see how and where prices are changing in Canada.

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Rises in December

In December, the “CPI-trim” measurement of “core” price movements increased by 3.7% in December, following a rise of 3.5% in November, breaking a longstanding downward trend since 2022. The CPI-trim metric tracks the core CPI reading in Canada, minus the outlying extremes on the tail ends of the price distribution.

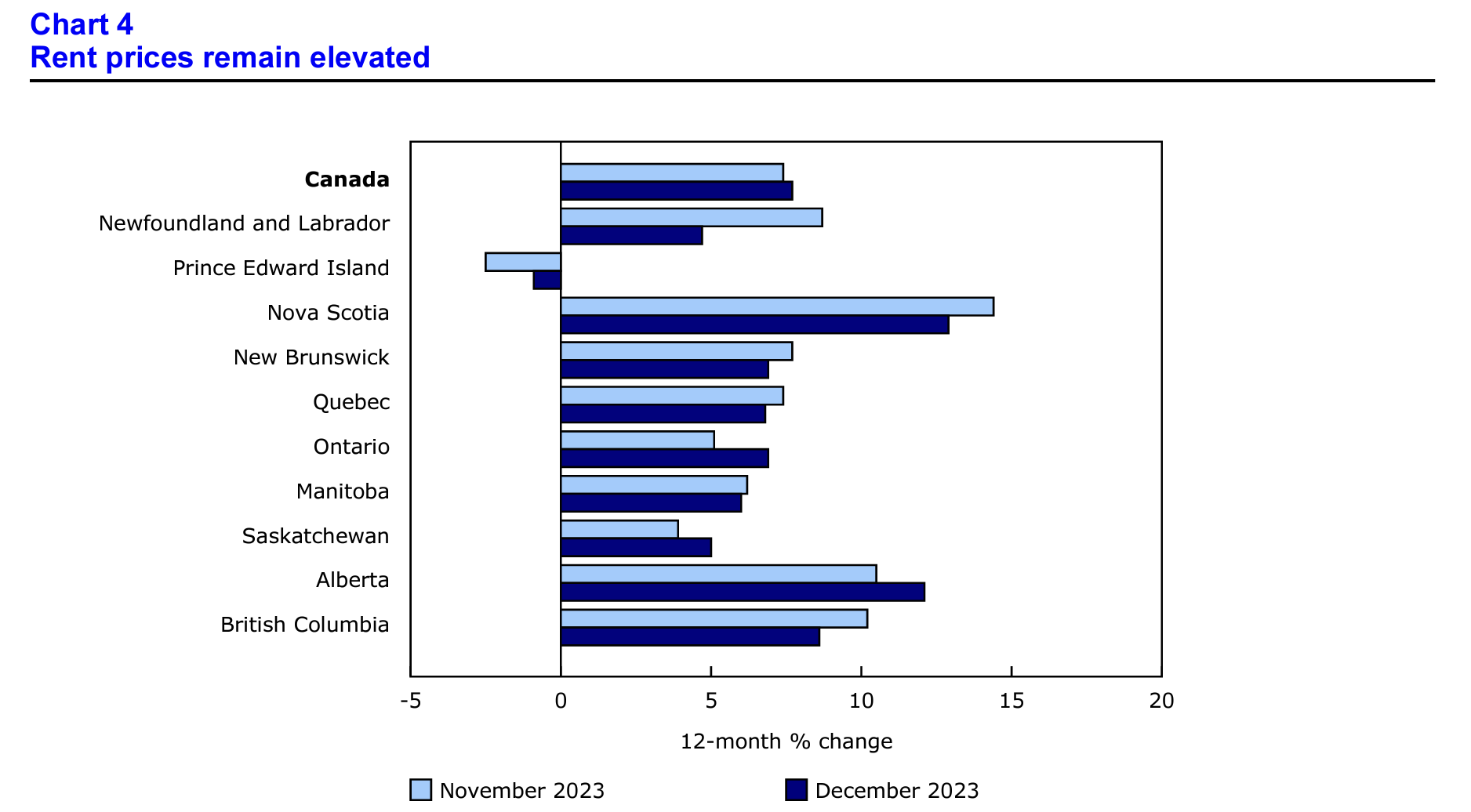

Rents and Housing Costs Remain Red Hot in December 2023

November saw rent prices for housing remain elevated in all provinces except for Prince Edward Island, which saw rental cost decreases in November as well. Ontario contributed most to the country-wide index’s increase this month, with this heavily weighted province seeing rent increases of 6.8% Y-o-Y in December. A rising interest rate environment is largely responsible for rising housing costs, which adds cost barriers to homeownership and increased demand for rentals.

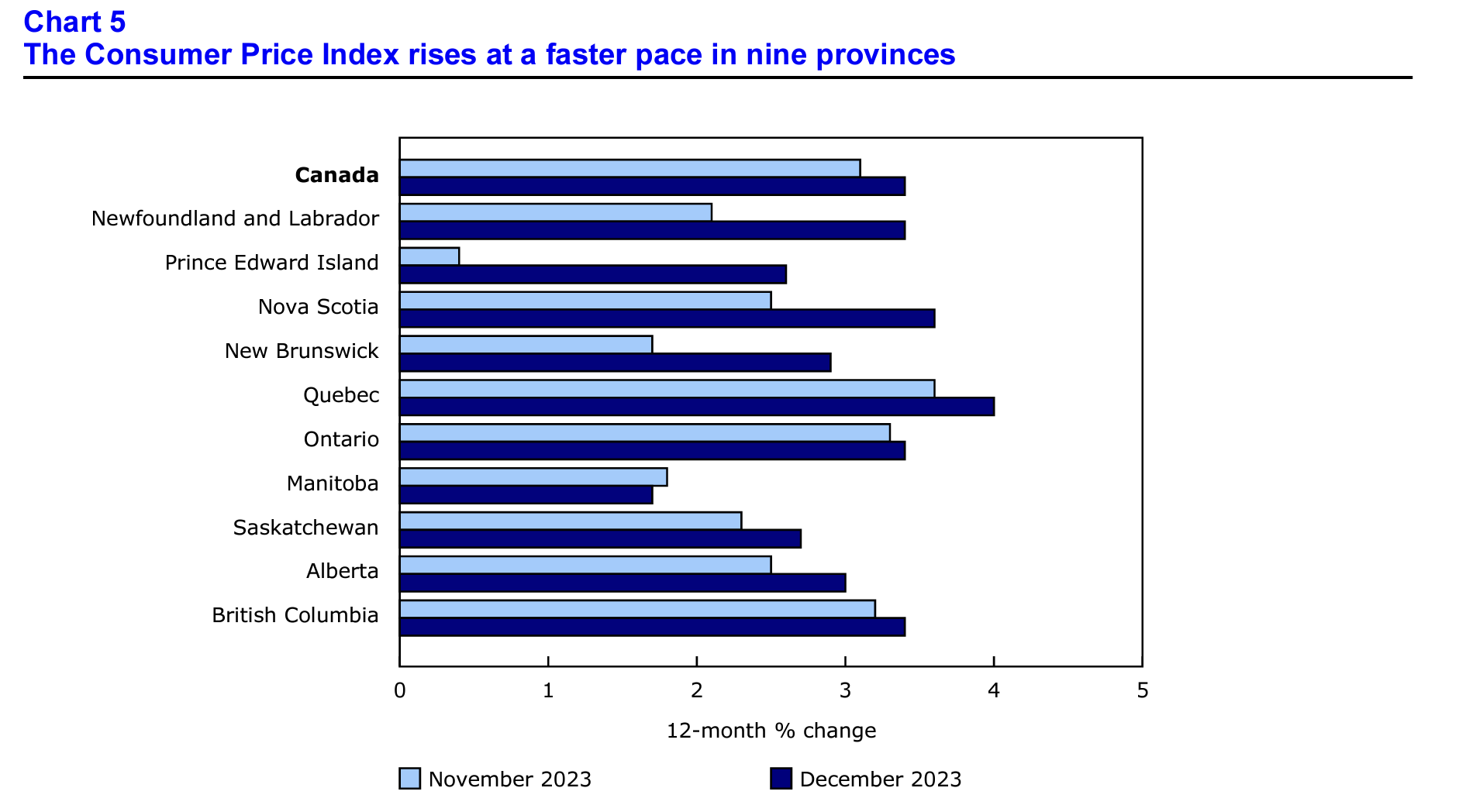

Price Acceleration Seen in 9 of 10 Provinces in December’s CPI Report

Year over year, prices rose at a faster pace in December compared to this previous month in all provinces except for Manitoba. Prices for fuel oils fell by a much lesser extent in December (-13%) compared to November (-23.6%), which led to economy-wide price acceleration. Fuel oils are more commonly used to heat homes in Atlantic Canada, which explains why this region saw steeper price acceleration than other parts of Canada.

Inflation Shuts the Door on Early 2024 Rate Cuts

Stubborn inflation isn’t going away any time soon. Despite a target inflation rate of 3.0 percent or lower set by Canadian central banks for H2 2023, we never saw a single month hit that mark—in fact, prices have accelerated over the past few months. Unfortunately, runaway deficit spending and poor macroeconomic management have made inflation a long-term reality for many Canadians who simply want to put food on the table this new year.

While the pain of high inflation seems to be here for the long haul, there are, fortunately, proactive measures you can take to safeguard your wealth before bad turns to worse.

Precious metals such as gold and silver have historically held their value more reliably than stocks during inflationary periods. Physical assets and commodities such as real estate and precious metals may provide a strategic hedge against adverse market conditions such as inflation, recessions, and more. Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the deleterious effects of inflation.

Want to get started with investing in metals such as gold and silver? Browse our free guide to gold buying in Canada in 2024 to learn how to add physical metals to your investment accounts.

Report Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/231219/dq231219a-eng.htm