Your credit score is a critical factor that determines whether you qualify for a mortgage, auto loan, line of credit, or other lending vehicles. And if unfortunate circumstances hurt your score and made it difficult to obtain financing, there are solutions.

In this guide, we’ll cover the 10 ways to improve your credit score in Canada.

What Is a Credit Score?

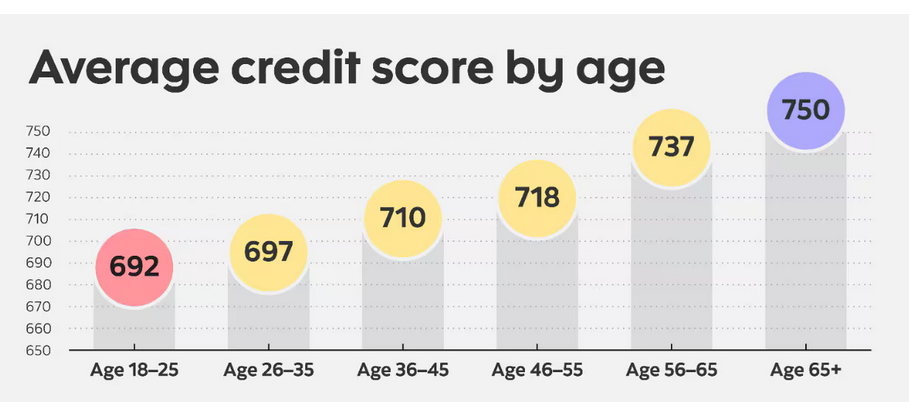

A credit score is a standardized metric lenders use to determine whether to approve or deny financing. By using a universal number, it allows lenders to make quick assessments of the risk levels of applicants. As a result, improving your credit score and maintaining a higher figure are essential to obtaining more affordable products and better terms. According to Equifax, Canadian credit scores range from 300 to 900 and individuals are placed in the following brackets:

- Poor: 300-559

- Fair: 560-659

- Good: 660-724

- Very Good: 725 to 759

- Excellent: 760+

As you can see, a credit score of 660 or higher puts you in brackets that lenders deem attractive. Consequently, pursuing prudent credit habits can make a big difference in how you’re perceived by financial institutions.

How Is a Credit Score Calculated?

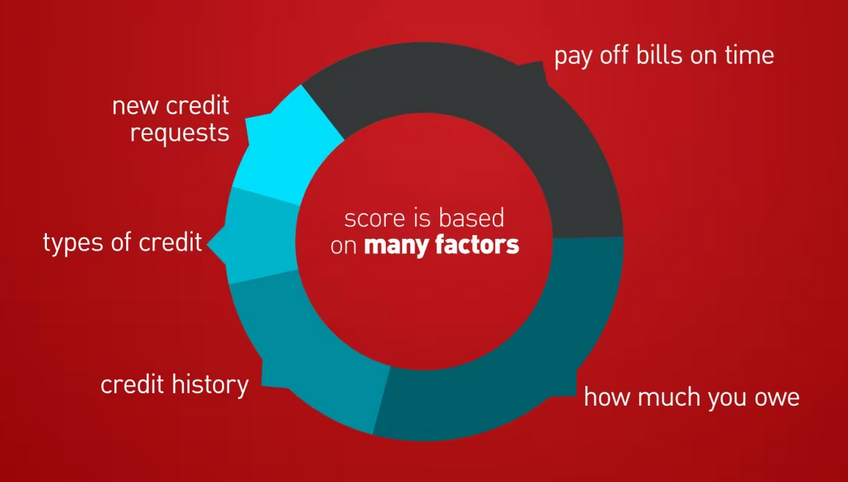

To determine the correct bracket for each Canadian, lenders analyze the following metrics to generate your credit score:

- Payment History (35% Weight)

- Credit Utilization (30% Weight)

- Credit History (15% Weight)

- Credit Mix (10% Weight)

- Credit Inquiries (10% Weight)

Thus, payment history and credit utilization hold the most weight in the calculation, and optimizing these variables is the quickest path to a better credit score.

How Long Does It Take to Improve My Credit Score in Canada?

The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report.” As a result, you should see improvement within that time frame if you practice better credit habits.

However, please note that your credit score won’t go from 400 to 700 overnight. It takes time to see material changes, and you should view the process as a long-term commitment.

How Do I Improve My Credit Score?

Now that you’re empowered with the range of scores and how they’re calculated, it’s time to put this knowledge into practice.

Tip #1: Make On-Time Payments

If you want to know how to improve your credit score in Canada, look no further than establishing a reliable repayment history. Whether it’s your mortgage, credit card, utility bills, car payment, or line of credit, paying off your balance each month or at least meeting the minimum payment is essential. Doing so demonstrates responsible credit habits and increases your attractiveness in the eyes of lenders.

Tip #2: Limit Your Borrowings to 30% or Less

When you swipe your credit card or withdraw from a line of credit, keep the debits at 30% or below your credit balance. When you exceed this threshold, lenders assume you’ve confronted financial stress and have to rely more heavily on credit to meet your obligations. In turn, this negatively affects your credit score.

To solve the problem, cap your borrowings at 30% and use a different credit card or line of credit when you need more.

Tip #3: Establish a Long Credit History

The sooner you develop a credit history, the better. And this means it’s wise to keep old accounts open rather than closing them. The reason is the longer you’ve had products in good standing, the more it helps your perceived creditworthiness.

Tip #4: Diversify Your Credit Accounts

Whether it’s revolving (credit cards and lines of credit), installment (loans), mortgages, or open (cell phone plans, utility bills, etc.), the more items on your credit profile, the better it looks to financial institutions.

Even The Government of Canada chose to “amend the Canadian Mortgage Charter and call on landlords, banks, credit bureaus, and fintech companies to make sure that rental history is taken into account in your credit score.”

As such, on-time rent payments are useful to improve your credit score without a credit card.

Tip #5: Limit Credit Inquiries

Each time a lender conducts a hard credit pull, it hurts your credit score, so you shouldn’t apply for too many products in a short period. Remember, the more institutions that view your credit profile, the more it looks like you’re in financial distress.

Tip #6: Check For Errors On Your Credit Report

Inaccurate information can be present on your credit profile, which makes you seem less creditworthy and hurts your credit score. If you notice administrative errors, accounts that don’t belong to you, or fraud, The Government of Canada recommends contacting Equifax, TransUnion, and the Canadian Anti-fraud Centre.

Tip #7: Find a Co-Signer

If you struggle to obtain financing due to a poor credit score, a co-signer is a great way to mitigate the issue. By having a friend or loved one act as a guarantor, you can obtain products that may be out of reach. In turn, this allows you to make on-time repayments and rebuild your reputation.

Tip #8: Secured Credit Cards

Secured credit cards are different than traditional credit cards because instead of borrowing from the issuer or third-party lender, you deposit your own funds and borrow from the balance.

The strategy allows you to withdraw your own money, and then when you repay the funds, the transactions are characterized as debt repayments, which improves your credit score.

For more information, please see our Neo Credit Cards Review and our KOHO Credit Cards Review. As a reminder, Nerdwallet named KOHO’s secured card as one of the “3 Best Prepaid Credit Cards in Canada for 2024.”

Tip #9: Use Cash Advance Apps

Nyble is a fintech app that offers cash advances of $30 to $150 to Canadians and there are no credit checks, interest, or fees, but you need recurring employment or government income to qualify.

The service is beneficial because on-time payments are categorized as loan repayments. The company notifies Equifax and TransUnion, which means that overdraft protection can improve your credit score.

In contrast, a buy-now-pay-later (BNPL) app like Klarna won’t improve your credit score because it doesn’t report to credit bureaus. For more information on Nyble’s pros and cons, please see our Nyble Review.

Tip #10: Try Borrowell

Borrowell is a free service that provides reports and credit score monitoring to over three million Canadians. The three advantages of Borrowell Canada include Monitor & Track, Understand & Improve, and Find the Right Product. The service allows you to track your success, flag errors, spot fraudulent activity, use its AI-powered credit coach, and view financial products that may fit your needs.

To learn more about whether it’s right for you, please see our Borrowell Credit Report Review.

How Soon Will My Credit Score Improve After Bankruptcy?

If you plan to file for bankruptcy, the hit to your credit score is long-lasting. The information stays on your credit report for six years and will be viewed unfavourably by potential lenders. As a result, you should practice patience when it comes to improving your credit score.

In contrast, a consumer proposal is similar to a bankruptcy, but the impact on your credit score lasts three years instead of six. Moreover, consumer proposals help protect your assets and ensure fixed monthly payments, while you often surrender assets during a bankruptcy and your monthly payments can vary with your income.

For more information on the differences between the two, please see our Consumer Proposal Guide.

Conclusion

Improving your credit score is possible by following the steps outlined above. Your score won’t improve overnight, but your hard work shouldn’t go unnoticed. Over time, lenders and credit bureaus will recognize your efforts, and cheaper financing and better terms will help put you on a path to a better financial future.