Every business owner understands the importance of cash flow. And when you have more cash going out than coming in, you need a short-term solution to mitigate the imbalance.

Enter Keep.

From delayed receivables to unexpected expenses, a Keep business credit card is designed to help your company run smoothly when payment problems arise.

But, is it the right solution for your business, or are there better options elsewhere?

☝IMPORTANT 2025 TIPS:

➔ Heavy debt stressing you out? Reach out to Consolidated Credit Canada to see if you qualify for debt relief of up to 50%.

➔ Do you require financing and have been turned away by traditional lenders? Consider using Swoop to get matched with an alternative lender. (Note: costs/interest rates may be higher)

About the Company

- URL: https://www.trykeep.com/

- Phone: 1-866-460-5337

- Email: support@trykeep.com

- Company HQ: Toronto, ON

- Trustpilot Reviews: 3.7/5 stars (63 reviews)

Keep Pros and Cons:

Before consulting with Keep Canada, please see our pros and cons list for a quick rundown of what to expect.

Pros:

- You can obtain a business credit card limit of $400,000+

- There is no interest fee, annual fee, or foreign transaction costs

- You can earn up to 4x the cash back of a typical business credit card

- There is 24/7 fraud monitoring, ID theft protection, and purchase protection

- Additional perks include Quickbooks integration, automated expensing, spend controls and insights, and dedicated relationship managers

Cons:

- Mixed reviews from applicants

- You may not qualify for your desired limit. If you need additional financing, you can use Swoop for a connection to an alternative lender.

What Is Keep Canada?

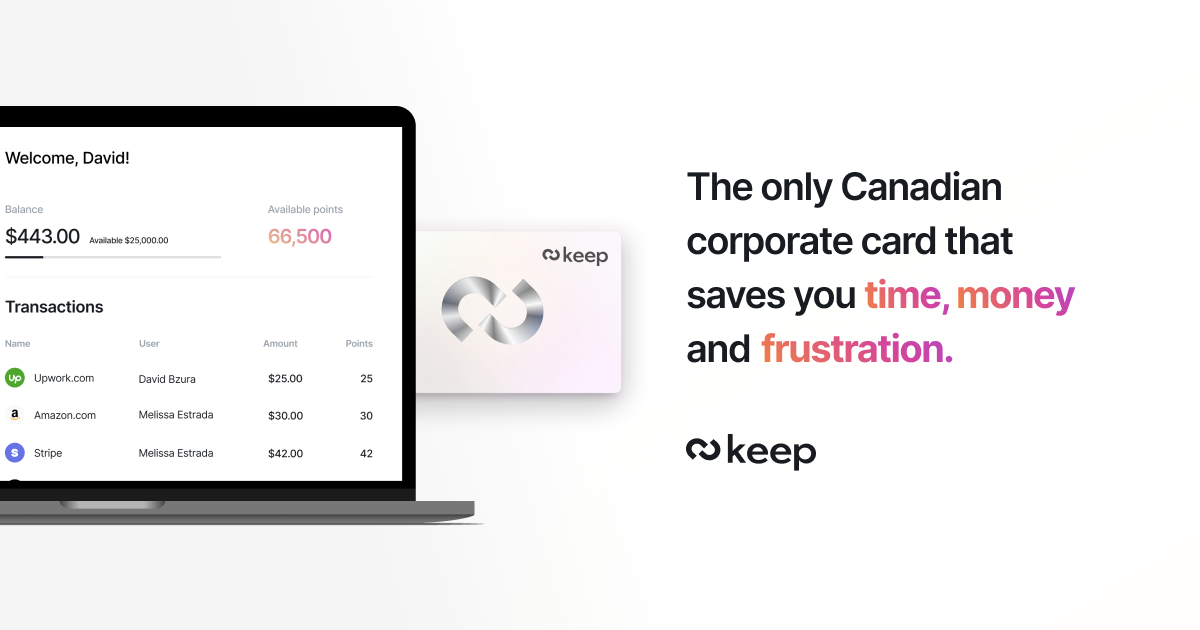

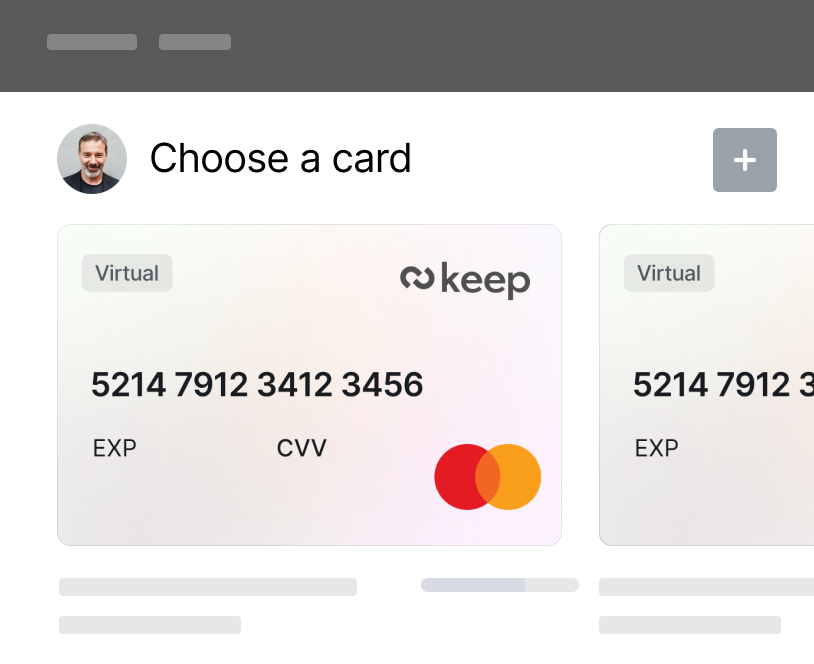

Dubbed an elite corporate Mastercard with “higher credit limits, meaningful rewards, and no fees,” Keep Canada can help you borrow 10x to 20x more than traditional lenders. Moreover, you earn rewards on every purchase, and unlimited virtual cards are available to ensure your team always has access to debt capital.

On top of that, Keep Canada protects cardholders with 24/7 fraud monitoring, ID theft protection, and purchase protection. You can also apply by phone, video call, or email, and inquiring won’t impact your credit score. However, please note that accepting an offer may result in a hard inquiry that does affect your credit score.

Why Choose a Keep Business Credit Card?

You can borrow up to $400,000, and there is no interest fee, annual fee, or foreign transaction costs. Instead of charging you directly, Keep earns money by facilitating transactions on its platform. As such, the business model allows the company to offer better terms and do away with traditional fees. That said, if you require borrowing beyond the $400,000 cap, you will need to consider additional financing through a platform such as Swoop.

A Keep credit card also earns up to 4x the cash back of a typical business credit card. It’s powered by Mastercard’s network and functions with Apple and Google Pay. Additional benefits include:

- Quickbooks Integration

- Automated Expensing

- Spend Controls and Insights

- Dedicated Relationship Managers

Why Is Choosing the Right Business Credit Card So Important?

Small businesses are the lifeblood of the economy, and they play critical roles in ensuring healthy employment and increasing Canadians’ standards of living. Entrepreneurship is so important that in May 2023, the Government of Canada announced measures to protect small firms from high credit card fees. The release stated:

“These new agreements will help more than 90 per cent of credit card-accepting businesses in Canada qualify for lower rates and see their interchange fees reduced by up to 27 per cent from the existing weighted average rate. These reductions are expected to save eligible Canadian small businesses about $1 billion over five years.”

To that point, “small businesses with annual Visa sales volume below $300,000 will qualify for the lower interchange fees from Visa, and those with annual Mastercard sales volume below $175,000 will qualify for the lower fees from Mastercard.”

Thus, if Keep Canada can save your business money through better terms and lower fees, you’ll have more leftover to invest and facilitate long-term growth. If your business has extensive debt and is struggling to make payments, it is best to avoid getting any new credit. Instead, consider debt relief by working with an organization like Consolidated Credit Canada.

Does Keep Canada Offer Consumer Credit Cards?

Unfortunately, Keep is a business-centric company that caters to small and mid-sized enterprises. As a result, it doesn’t offer consumer credit cards.

However, if you spend a lot of your disposable income at bars, restaurants, and value streaming services, please see our Neo Credit Card Review. The fintech offers an unsecured credit card with no fees and the following cash-back rates:

- Up to 5% cash back at restaurants and bars

- Up to 5% cash back at apps like Netflix, Disney+, Crave, Apple, Uber, Lyft, SkipTheDishes, DoorDash, UberEats

- 1% cash back on gas and groceries

There is also a premium card with higher cash-back rates and additional perks priced at $10.42 per month. Other benefits include:

- Credit Score Monitoring

- Purchase Protection

- 24/7 Legal Assistance

- $2,500 Group Life Insurance

- Personalized Insights

- Priority Customer Support

Similarly, if you’re in the market for a secured credit card, you may find our KOHO Credit Cards Review helpful. The product was named one of the “3 Best Prepaid Credit Cards in Canada for 2024” by Nerdwallet, and it’s primarily for Canadians looking to rebuild their credit scores.

Are Cardholders Happy With Keep Canada?

Keep doesn’t have many customer reviews, but it’s rated 3.7 out of 5 at Trustpilot. Unsatisfied applicants cited confusion over false approval and credit limits that didn’t meet their expectations. In contrast, satisfied clients cited excellent customer service and reliable credit policies.

Some of the positive reviews read:

- I’ve been working with Keep for the better half of the last year and they’ve been great. Very customer-focused and continuously rolling out new and better features. Highly recommend them for all of your corporate credit card needs.

- The approval process was quick and customer service has been outstanding.

Some of the negative reviews read:

- They collected my info, approved my application, and then scheduled a Zoom meeting for me to set me up. The meeting never happened and after a week they told me the approval email was sent by error.

- Applied and got approved, and then they set up an onboarding call. They asked how much cc limit I wanted; the max I said. The young rep said $2k limit.

Thus, Keep is the perfect example of a financial product where your experience may vary. Some cardholders are extremely happy with the terms and service, while others feel the fintech didn’t deliver on its promises. As a result, you should speak with a Keep Canada agent to determine if its business credit card fits your needs.

If you have outsized business debt, consult with Consolidated Credit Canada for additional guidance on debt relief.

What Do We Think About Keep Canada?

In our view, a Keep business credit card is worth inquiring about. The terms are exceptional, and the fintech eliminates a lot of the fees associated with other business credit cards. Moreover, the security protocols and the ability to integrate the card with your accounting and analytics software make it useful for identifying trends and staying competitive.

Consequently, our advice is to consult with a Keep specialist and figure out what the company can offer you. The majority of reviewers’ complaints stem from unmet expectations. Therefore, by hammering out the details with a representative, you’ll know exactly what you’re getting and can determine if the product is beneficial.

If you want to sign up or learn more, visit: https://www.trykeep.com/

☝IMPORTANT 2025 TIPS:

➔ Have the burdened of existing debt? Reach out to Consolidated Credit Canada for debt relief of up to 50%.

➔ Do you require financing and have been turned away by traditional lenders? Consider using Swoop to get matched with an alternative lender. (Note: costs/interest rates may be higher)