Debit cards are a dime a dozen, and boring is often beautiful when you want reliable ways to pay for everyday transactions. And while Neo Financial meets this criteria, additional perks are worthy of your attention. From cash back to high interest on your savings, the fintech’s digital-first model helps you obtain better products and terms.

But, is a Neo Money Card all it’s cracked up to be, or are there better options elsewhere?

About the Company

- URL: https://www.neofinancial.com/

- Phone: 1-855-636-2265

- Email: support@neofinancial.com

- Company HQ: Calgary, AB.

- Google Play Reviews: 4.2/5 stars (7,775 reviews)

- Trustpilot Reviews: 1.6/5 stars (89 reviews)

- Apple Store Reviews: 4.8/5 stars (31,466 reviews)

- BBB Reviews: 1.3/5 stars (99 reviews)

Neo Financial Pros and Cons:

For a quick rundown of Neo Financial’s pros and cons, please see our list below:

Pros:

- Free and premium Money accounts are available

- High cash-back rates, especially for bars, restaurants, streaming, food delivery, and ridesharing

- Earn 4% interest on your savings with no fees or deposit minimums.

- Accounts are CDIC-insured

Cons:

- Low customer service scores

- Must pay a $4.99 per month to get the best cash-back rates

Why Bank At Neo Financial?

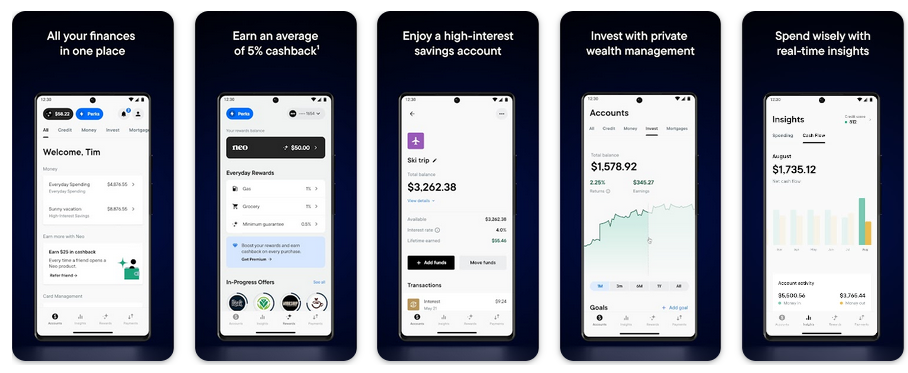

Neo Financial offers financial services to millions of Canadians, including mobile and online banking, checking, savings, mortgages, and credit card accounts. For a detailed breakdown of the latter, please see our Neo Credit Card Review.

The firm also provides a plethora of investment services, helping you build portfolios that align with your values, timelines, and risk tolerance. You can diversify your holdings across alternative investments and select active accounts through Neo OneVest, which provides portfolio management services.

Thus, Neo Financial Canada is a one-stop shop for all your banking, borrowing, and investment needs.

Is It Wise to Bank Online?

Statistics Canada reported in March 2024 that “most Internet users aged 25 to 34 (90%), 35 to 44 (89%), and 45 to 54 (88%) managed a chequing or savings account online.”

Moreover, “the proportion of older adults using online banking increased from 62% in 2018 to 70% in 2022.”

As a result, digital adoption has grown in popularity, and the regulatory and security measures implemented by fintechs and the Government of Canada have made financial apps safe places to bank.

To that point, the Bank of Canada recently developed the Retail Payment Activities Act (RPAA), allowing the BoC to supervise payment service providers (PSPs). The goal is to “build confidence in the safety and reliability of their services while protecting end users from specific risks.”

Consequently, fintech firms have to pass several tests to comply with Canadian laws.

What Is a Neo Financial Money Card?

Designed to optimize your spending and savings activity, a Neo Financial Money Card helps you manage, move, and grow your money. The debit product is a prepaid Mastercard (no preloading required), with no monthly fees, free everyday transactions, and you can earn cash back at thousands of Neo partners. There is a $5 charge for printed and mailed account statements, but you can access them electronically for free.

Neo Money offers free and premium options, and the latter costs $4.99 per month and includes higher cash-back tiers. For example, the free account earns:

- Up to 5% cash back at restaurants and bars

- Up to 4% cash back at apps like Netflix, Disney+, Crave, Apple, Uber, Lyft, SkipTheDishes, DoorDash, UberEats

- 1% cash back on gas and groceries

The premium account earns:

- Up to 6% cash back at restaurants and bars

- Up to 4% cash back at apps like Netflix, Disney+, Crave, Apple, Uber, Lyft, SkipTheDishes, DoorDash, UberEats

- 3% cash back on gas and groceries

- 0.5% cash back on all other purchases

As you can see, the premium plan includes more cash back for gas, groceries, and a higher maximum for restaurants and bars.

So, if you dine out, or are a big fan of streaming services, food delivery, and ridesharing apps, the premium plan could be right for you. Plus, if you drive a lot for work or enjoy road trips, the 3% cash back on gas and groceries could more than pay for the ~$60 annual fee.

How Does a Neo Savings Account Stack Up?

To help achieve your goals and develop solid savings habits, Neo Financial lets you open up to 10 savings accounts designed for different purposes. For example, you can set up a savings account for a new car, a vacation, school tuition, etc. The purpose is to compartmentalize your goals and help you stay on track.

There is also no minimum deposit, no fees, and you can withdraw your money at any time. More importantly, your Neo Money and Savings accounts are held at Concentra Bank, a CDIC member institution, that has deposit insurance up to $100,000 per category, per depositor. In other words, your funds are backed by the federal government, so you don’t have to worry about missing money.

The only downside is that Neo Financial Canada offers a 4% interest rate on savings balances. And while it’s a sold return, our KOHO Credit Cards Review explained how you can earn 5% on your savings balance with a $4 per month KOHO Essential count. Moreover, the fee is waived if you set up direct deposits or load $1,000 into your account each month, so KOHO is cheaper and pays a higher return than Neo if you can meet the zero-fee requirements.

Essentially, we recommend KOHO over Neo for those who can bypass the fee and/or have savings balances high enough that the extra 1% interest is worth incurring the $4 per month charge.

Are Users Happy With Neo Financial?

Neo Financial is rated highly at the Apple App Store and Google Play, with scores of 4.8 and 4.2 out of 5. Conversely, Trustpilot and the Better Business Bureau (BBB) have ratings of 1.6 and 1.3. The positive reviews stated:

- It’s so far better than any other bank I’ve banked with or looked into banking with. Neo is the best. I love everything about it. The 1 and only downside for now is not being able to do mobile deposits, which they are working on. #1 bank, in my opinion, so far.

- Literally the best bank. 4% intrest on savings, 2.25% on checking, tons of cash back and now credit score monitoring with an AI financial consultant? My guys, thanks, nevermind free etransfers Update: I personally absolutely love the new app layout. It makes a lot more sense to me.

The negative reviews stated:

- It’s not really a bad bank persay. They have lots of perks and stuff that make them appealing. However, they seem to be rather incompetent in regards to refunds and their customer service is an online chat only.

- Like the card, good rewards, app is pretty user-friendly. however, it’s difficult to get a hold of them if there is any issues with your credit card. phones are always down.

Thus, Neo Financial Canada seems to confront the same issues we see with other fintechs. The products are excellent and they include great terms, rates, and rewards. However, their digital-only footprints come at the expense of customer service, since they rely mostly on chat versus human connection. Consequently, Neo Financial is best suited for Canadians comfortable with online and mobile banking and who have the patience to troubleshoot issues via chat support.

The Neo Financial Verdict

Neo Financial Canada offers excellent Money and Savings accounts that are useful under the right circumstances. If you’re bundling streaming services like Netflix, Crave, and Disney+, why not earn up to 4% cash back in the process? Similarly, if you’re a nightlife enthusiast and spend your weekends at bars and restaurants, the 6% cash back can save you money.

So, while Neo Financial is not for everyone, its accounts are secure, offer CDIC insurance, and have higher cash back and savings rates compared to many of its competitors. Therefore, if you don’t mind the hit-and-miss customer service, Neo Financial could be right for you.

If you want to sign up or learn more, visit: www.neofinancial.com