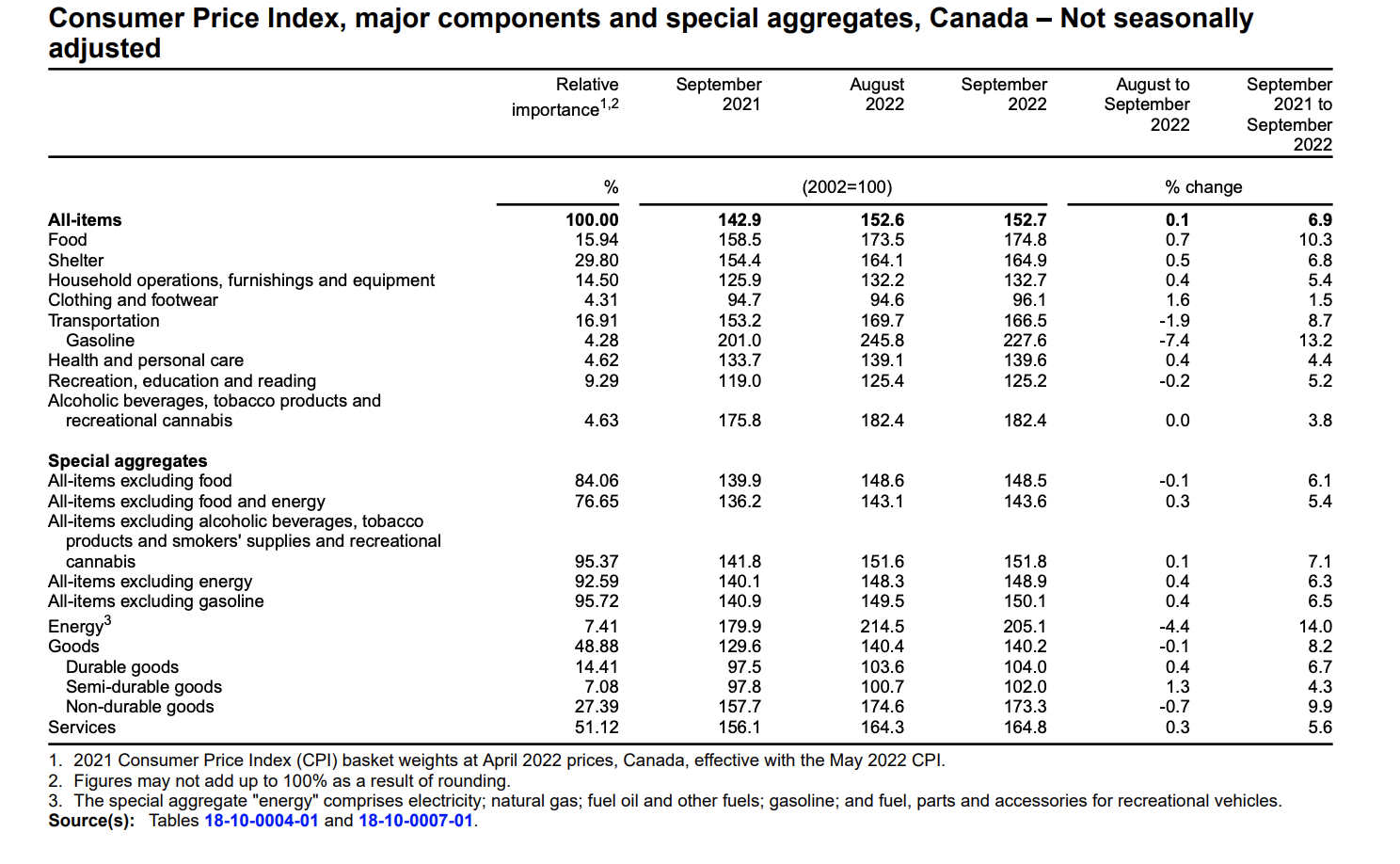

The Consumer Price Index (CPI) increased 0.1% on a monthly basis in September, reported Statistics Canada. On a year-over-year basis, the CPI grew by 6.9%. This marks a decline from the 7% increase seen the previous month. The agency noted that this is the third consecutive monthly deceleration in headline inflation.

The primary component for the slowdown in inflation seen in September was a decline in the price of gasoline. However, conversely, Canadian consumers paid more for foodstuffs at grocery stores.

Regarding the average wage in Canada, in September based on the data provided by Statistics Canada, the average hourly wage of Canadian workers increased by 5.2% over the last 12-month period. Consumer inflation continued to surpass the average hourly wage,

“The gap in September was larger compared with August,” explained Stats Can in its monthly report.

Despite the fact that inflation slowed somewhat in September, the Bank of Canada has indicated that the deceleration is still not sufficient, and thus anticipates further increases in interest rates.

(Source: Statistics Canada)

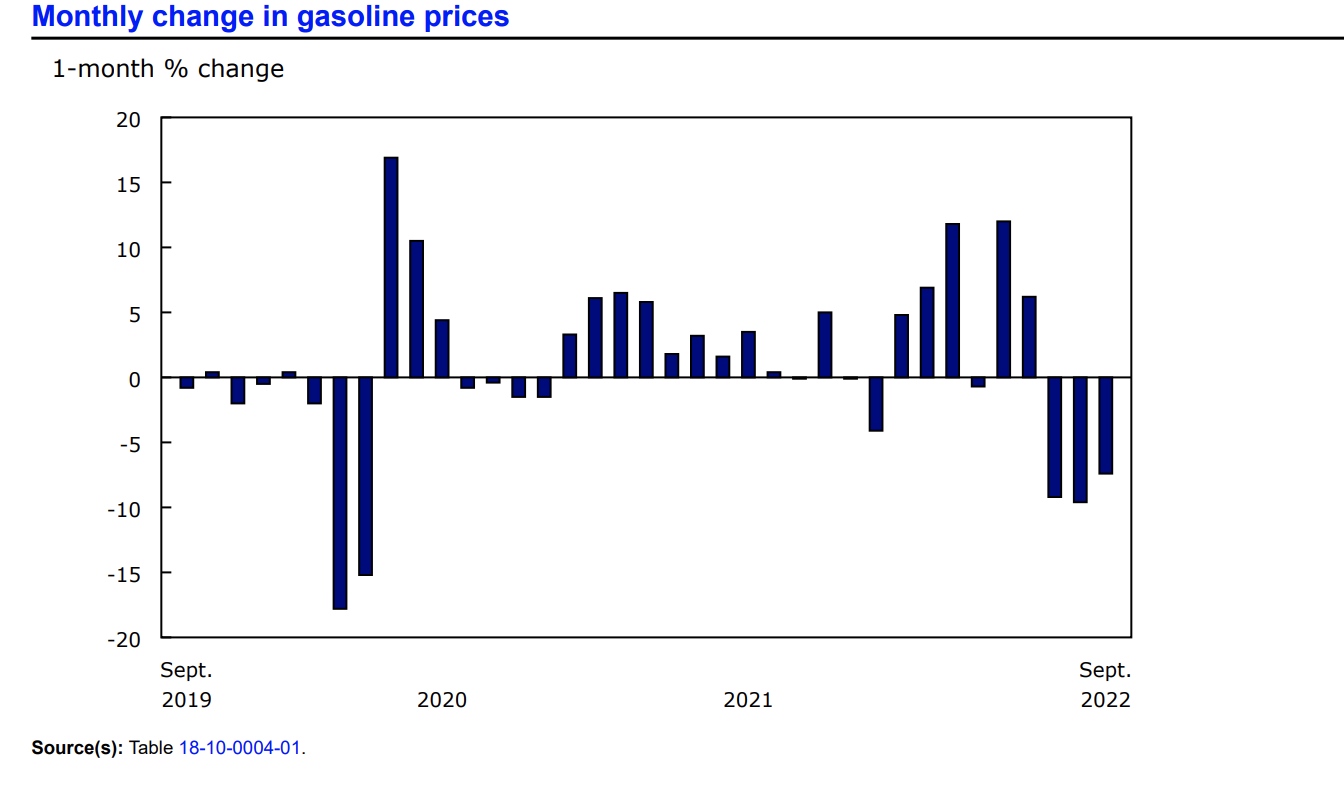

The Price of Gasoline

In September, the price of gasoline decreased by 7.4%. For Canadian consumers, this marks the third consecutive monthly drop in prices at gas pumps. The drop in gasoline prices was primarily because of the global rise in the supply of crude oil.

Over the last 12-month span, the price of gasoline increased 13.2% – a decrease from 22.1% seen year-over-year in August.

(Source: Statistics Canada)

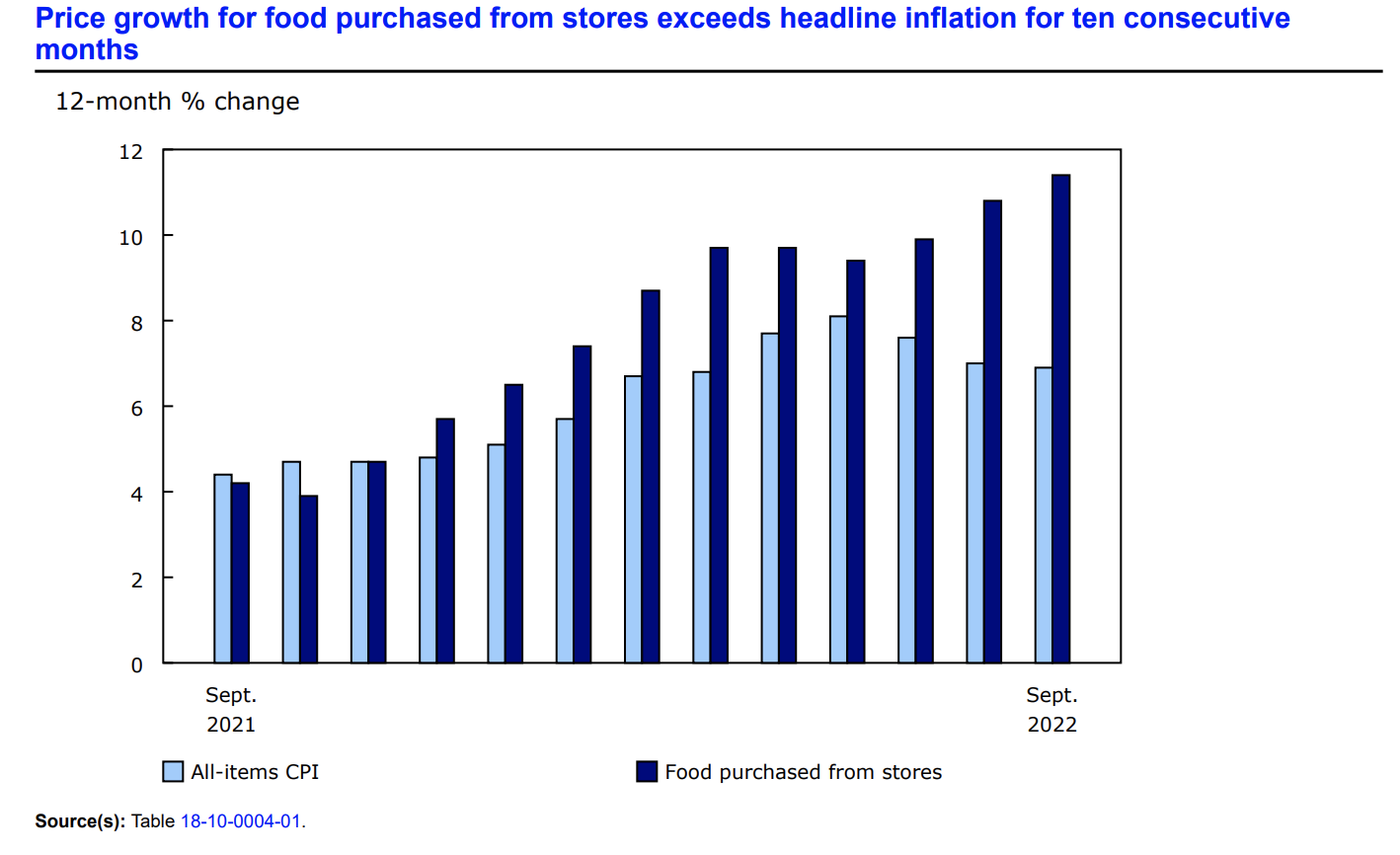

Food

In September, Canadian consumers paid more for food items purchased from the grocery store. This is the fastest price increase year-over-year in 41 years, specifically in August 1981.

Since this time last year, foodstuffs with the highest price increases included bakery products (+14.8%), fresh vegetables (+11.8%), dairy products (+9.7%), and meat (+7.6%).

In general, the increase in global food prices has been affected by several variables including recent extreme weather, the rise in the price of fertilizer, and the geopolitical situation in Ukraine.

(Source: Statistics Canada)

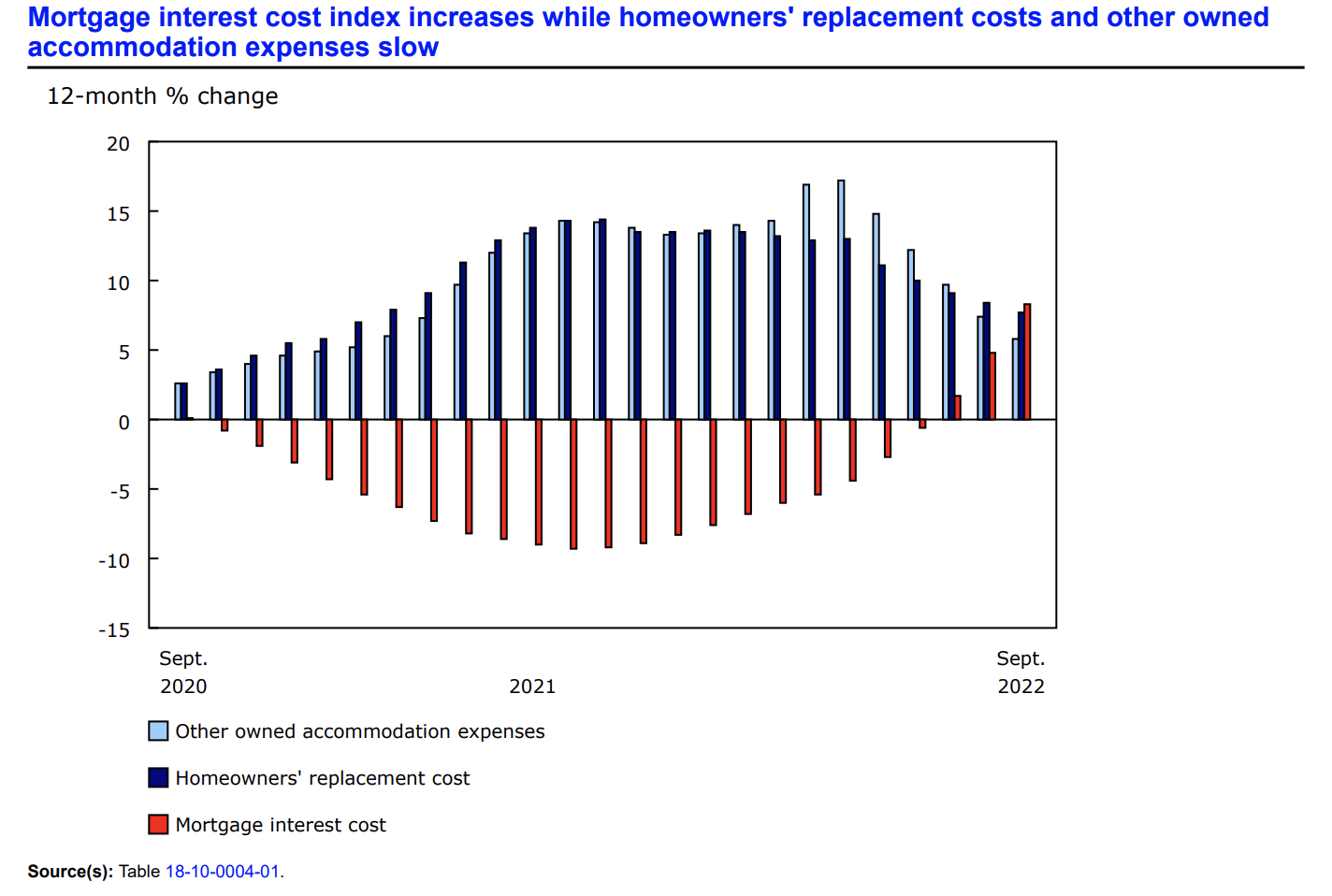

Shelter

In September, the cost of shelter in Canada increased at a slower pace on a year-over-year basis. Demonstrative of the continued cooling of Canada’s real estate market, prices for other owned accommodation expenses rose 5.8% – a slower pace than in the previous month.

Composite shelter indexes that slowed on a year-over-year basis included the homeowners’ replacement cost index by 7.7% in September, compared to the 8.4% rise seen in August.

Conversely, the index for mortgage index cost rose 8.3%, in correlation to the recent interest rate hikes.

(Source: Statistics Canada)

Want to learn more about how inflation is impacting the economy? Have a look at our table highlighting information regarding the Consumer Price Index (CPI) and inflation rates in Canada for 2022, try our inflation calculator, and subscribe to our newsletter.

Source Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/221019/dq221019a-eng.htm