If you’re an up-and-coming manufacturer, or a business in need capital to build out your assembly line, equipment loans are practical pathways to increasing your company’s infrastructure. Whether you’re looking for heavy equipment loans for your farm, or perhaps loans for logging equipment for a forestry venture, you’re at the right place. We’ll cover different financing options for general equipment loans, whether you have a good, bad or average credit score…

| ☝IMPORTANT 2025 TIPS: ➔ Crumbling under debt? Avoid getting more loans. Check if you qualify for up to 50% debt relief with Consolidated Credit Canada. ➔ Rejected by banks for your equipment loan and absolutely need it? Swoop Funding and other alternative lenders listed below can help. (Expect Higher Rates!) |

Best Places for Equipment Loans?

#1 – Top Five Banks (RBC, BMO, TD, ScotiaBank, CIBC). Why? Banks and credit unions generally offer the best rates, but they only approve good credit scores. They are also a bit slower to approve. Keep reading for more details on the best financial institutions that offer equipment loans…

#2 – Swoop Funding – this company specializes in equipment and machinery loans for companies of all sizes, and they work with various banks as well. They accept almost any credit score and are more flexible than banks.

#3 – Sonoma Capital. Most likely your 2nd best option in Canada for equipment loans and asset-backed lending, even if you have an average or bad credit score.

#3 – Merchant Growth or Driven.ca: Another decently-reviewed Canadian business lender that approves bad credit scores, as low as 550. Pretty competitive with Merchant Growth in terms of approval time and rates too.

IMPORTANT TIP: shop around and compare rates! Ask at least 2-3 institutions to give you a quote before you decide who to go with for your equipment financing.

What Are Equipment Loans?

Like a mortgage, equipment loans are a secured form of financing, where the lender uses the asset as collateral. These types of business loans, such as those offered by Swoop, are needed by any entrepreneur or business owner who rely on equipment. For example: gym owners and dump trucks are two types of businesses that rely on equipment loans, as they can be relatively capital intensive to start. Keep in mind that if you default on the loan, the lender can repossess the equipment and sell it to recoup the proceeds.

Equipment loans can be structured as renting, or conventional asset-based loans or leases:

- Lease-to-own means you obtain the title after the debt is repaid.

- Traditional loans include immediate ownership, and the title is yours from the start.

- Renting the equipment requires you to make periodic payments and return the asset after the term ends.

How Important Is My Credit Score?

Your credit score is a critical variable in obtaining affordable equipment financing. Lenders view borrowers with weak credit histories as riskier, which results in higher interest rate premiums.

To mitigate the problem, please see our guide on How to Improve Your Canadian Credit Score. We cover 10 proven strategies to uplift the metric. The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report,” so it’s possible to build momentum quickly. However, for larger jumps, please understand it’s a long-term journey.

To supplement your progress, Canadian fintechs are great resources. Our Borrowell Credit Report Review highlights its three main benefits:

- Monitor & Track

- Understand & improve

- Find the Right Product

By tracking your success, flagging errors, and spotting fraudulent activity, Borrowell helps clean up mistakes. Moreover, its AI-powered Credit Coach, Molly, provides personalized tips, articles, and tools to help increase your credit knowledge. Last, Borrowell Canada curates a list of financial products that may fit your needs. Best of all, Borrowell Canada is free, meaning you can improve your credit score at no cost.

As a third option, our KOHO Credit Building Review notes how opening a $30 to $500 secured line of credit and borrowing from the balance can boost your credit score. KOHO reports your repayment activity to Equifax and TransUnion, which can move the needle in the right direction. But, there is a cost to using KOHO, so please read the full review to determine if it’s the right product for you.

Finally, a KOHO secured credit card is free if you set up direct deposits or load $1,000 into your account every month. It was rated one of the “3 Best Prepaid Credit Cards in Canada for 2024” by Nerdwallet, there is no credit check, and approval is guaranteed. You also get cash back on purchases, and on-time repayments can strengthen your credit score. For more information on the pros and cons, please see our KOHO Credit Cards Review.

9 Equipment Loans For Startup Businesses in Canada

While equipment loans are excellent for start-up companies lacking financial resources, it’s wise to look at other options for debt relief before diving in. Consider, for example, partnering with organizations such as Consolidated Credit Canada.

With guides to assist you with all forms of business financing, please consult the list below to see what solutions are available in your area:

- Asset-Based Financing Guide, and provincial resources for Ontario, Alberta, and BC.

- 10 Places to Get Business Loans in Alberta

- 10 Places to Get Business Loans in Ontario

- 16 Things to Know About RBC Business Loans

- Keep Business Credit Card Review

- Zensurance Business Insurance Review

1. Swoop Funding

URL: www.swoopfunding.co

2. Sonoma Capital

3. First Financial

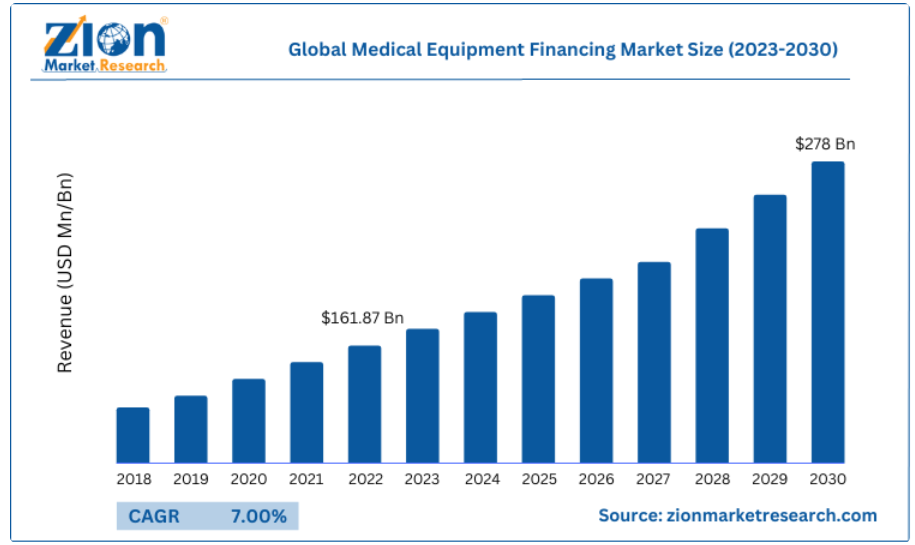

As a leading equipment financier, First Financial aids the manufacturing process by providing secured lease solutions. It issues loans to companies operating in sectors like construction and heavy equipment, healthcare, IT solutions and services, materials handling and automation, and renewable energy plus solar.

Typically, the purchased equipment acts as collateral, and you own the asset once the debt is repaid in full. First Financial is also a member of the Canadian Lenders Association (CLA), which advocates for ethical credit practices.

4. Armada Credit Group

By building relationships with banks, independent finance companies, and non-traditional lenders, Armada Credit Group is a broker that can help you obtain affordable equipment financing. Although the firm sometimes provides funds directly, it mostly facilitates deals across virtually all sectors. Therefore, it’s a great equipment financing solution for start-ups and small and mid-sized companies. Some benefits include:

- Loan-to-value (LTV) ratios can reach upwards of 100%

- Deferred payments and seasonal policies for certain assets

- Owning the asset now and paying with future dollars can be a hedge against inflation

- The firm often matches loan repayments with the cash flows generated by the equipment for smoother functionality

5. Prime Capital

Although Prime Capital describes its product as a “lease,” the end result is similar to traditional equipment financing. For example, ownership of the asset stays with Prime Capital until you repay the debt. Then, the firm transfers the title to your company and you become the new owner. This is a form of lease-to-own financing.

The great thing about Prime Capital is it works with “all types of businesses, from mom-and-pop shops to multinational organizations.” As a result, there should be solutions for start-up companies.

Examples of leasable equipment include, but are not limited to:

- Construction Equipment

- Medical Equipment

- Manufacturing Equipment

- Transportation Equipment

6. Meridian Credit Union

Meridian Credit Union partners with Accord Financial to provide equipment financing. The firm employs customized equipment strategies and payment plans to help build out your company’s long-term vision. Moreover, its team of advisors can help you seize opportunities and grow.

Meridian Credit Union provides equipment loans (including heavy equipment) with the following benefits:

- Enhanced cash flow with LTV ratios up to 100%

- Match the loan terms to your company’s budget and seasonal revenues

- Receive competitive rates, flexible terms, and fixed payments

Furthermore, Meridian Credit Union is a CFLA member and supports ethical lending practices.

7. QuickFi

As your go-to source for digital equipment financing, QuickFi aims to ease the strain on small and medium-sized businesses. Promoting a faster and dramatically preferred borrower experience, you can obtain heavy equipment loans in as little as three minutes.

By working with proponent equipment manufacturers (OEMs) and banks, QuickFi can offer special terms and rates that are usually unavailable through other platforms.

The company also promotes “bank level security,” and is a CLA member.

8. Vendor Lender

If you need heavy equipment to bolster your start-up’s production potential, Vendor Lender may be the right platform for you. As a business-to-business (B2B) broker, the firm helps connect you with dealers and facilitates transactions. Boasting proprietary technology and industry-leading rates, you have three financing options to choose from:

- Lease to Own ($1,000 to $2,000,000+)

- Traditional Loan (Up to $300,000)

- Rent

Please note that a traditional loan can be secured equipment financing or unsecured working capital. The only catch is your business must be up and running for at least three months before you can apply.

9. Fincap Financial Group

Similar to Vendor Lender, Fincap Financial Group is an online broker with over 30 Canadian representatives and 25 financing partners. The firm specializes in heavy machinery loans and has several eligible equipment options to choose from, but are not limited to:

- Forest Trucks

- Tractor-Trailers

- Cranes

- Compactors

- Excavators

- Backhoes

- Bailers

- Forklifts

| ☝IMPORTANT 2025 TIPS: ➔ Crumbling under debt? Avoid getting more loans. Check if you qualify for up to 50% debt relief with Consolidated Credit Canada. ➔ Rejected by banks for your equipment loan and absolutely need it? Swoop Funding and other alternative lenders listed below can help. (Expect Higher Rates!) |

Here’s a simplified comparison table that will help you understand each available lender:

| Lender | Key Features |

|---|---|

| Swoop Funding | Specialied in equipment loans for small businesses in Ontario, BC, Alberta, Manitoba, Saskwatchewan and other provinces. Loan type: Alternative Loans |

| Merchant Growth | Fast approval, lower credit score standards, good customer reviews Loan type: Alternative Loans |

| Driven.ca | Fast approval, lower credit score standards, good customer reviews Loan type: Alternative Loans |

| First Financial | Equipment as collateral, ownership after repayment Loan type: Secured Lease |

| Armada Credit Group | Matches borrowers with lenders, seasonal payment options Loan type: Broker (Loans/Leases) |

| Prime Capital | Flexible, ownership transferred after repayment Loan type: Lease-to-Own |

| Meridian Credit Union | Customized plans, competitive rates, up to 100% LTV Loan type: Equipment Loans |

| QuickFi | Fast (3-minute) approval, bank-level security Loan type: Digital Financing |

| Vendor Lender | Lease-to-own, traditional loans, rent options Loan type: Broker (Loans/Leases) |

| Fincap Financial Group | Specialized in heavy equipment loans, multiple financing partners Loan type: Broker (Heavy Machinery) |

Conclusion – Where to Start?

You want to start with your local bank or credit union. If you get rejected, you might want to improve your credit score by working with Consolidated Credit Canada. Then, you can try to apply through the financial institution again.

Alternatively, you can look into alternative lenders like the ones we mentioned above and see what rates and terms you can qualify for. You can sometimes get pretty competitive rates from lenders like Swoop, especially if your business has been around for a while and is in a good or steady financial spot.

If your startup business operates in industries like construction, mining, or resources, equipment financing could be an integral part of your growth strategy.

Luckily, affordable options are available, and because many of the lenders on our list are CLA-certified, they work with an agency that promotes responsible credit issuance.