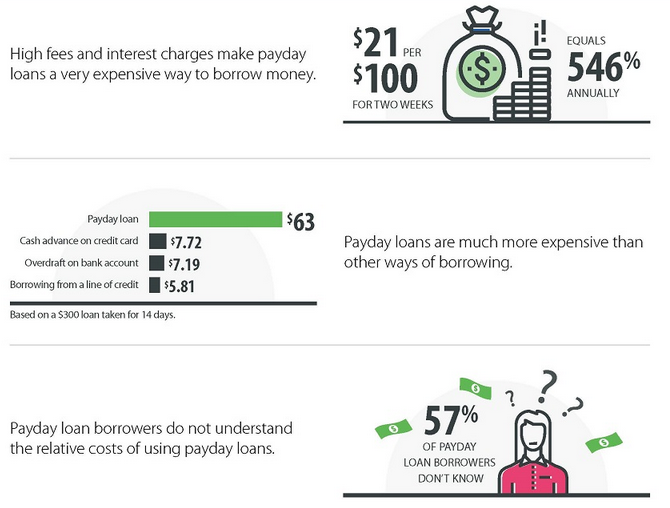

If aggressive creditors caused you to seek insolvency assistance, you may be wondering if a payday loan is a wise decision. Unfortunately, while payday loans are marketed as solutions for short-term cash problems, they often do more harm than good. Annual percentage rates (APRs) can exceed 400%, and if you miss payments, the late fees can double or triple the out-of-pocket costs.

As a result, if you want to help and not hurt your finances, consider other alternatives before you opt for a payday loan.

Where Should You Begin Your Loan Search?

Banks and credit unions are often the best resources for finding reliable and affordable loans. Establishing relationships with local branches and loan officers help ensure a smooth application process. In addition, consulting with a loan broker can help you obtain better terms, as they’re able to shop the application to multiple institutions and let them compete for your business.

However, if you’re currently dealing with a consumer proposal, these options may be out of reach. Our Consumer Proposal Guide covers the ins and outs of the strategy for those who are unfamiliar. In a nutshell: the negative impact on your credit score may prevent you from obtaining a traditional loan.

How Can You Improve Your Credit Score?

If you can’t access traditional loans due to a poor credit score, there are ways to boost the metric. Remember, your credit score heavily influences your ability to obtain a mortgage, auto loan, and credit card, so rebuilding your reputation will benefit you down the road. The five components of your credit score include:

- Payment History (35% Weight)

- Credit Utilization (30% Weight)

- Credit History (15% Weight)

- Credit Mix (10% Weight)

- Credit Inquiries (10% Weight)

Consequently, repaying your debts on time and limiting your credit utilization account for 65% of your credit score calculation. Thus, keeping your credit usage at 30% or below your limit can boost your credit score. As an example, if you have a $500 credit card limit, you should keep the monthly charges at $150 or less.

To build momentum, please see our Borrowell Credit Report Review. The fintech provides weekly credit score updates to over three million Canadians and the service is free to use. The main benefits of Borrowell Canada include:

- Monitor & Track

- Understand & improve

- Find the Right Product

Borrowell helps track your success, flag errors, and spot fraudulent activity. You can also access its AI-powered Credit Coach, Molly, who provides personalized tips, articles, and tools to increase your financial knowledge. Lastly, Borrowell markets products from 75+ partners, and it generates revenue through referral fees. However, you don’t have to purchase anything, and the free services can be used on their own.

As another product worthy of your attention, Nerdwallet rated KOHO’s Mastercard as one of its “3 Best Prepaid Credit Cards in Canada for 2024.” Rather than borrowing from KOHO or a third-party bank, you ‘prepay’ by depositing funds and using the money to make everyday purchases. The behavior rivals swiping a traditional credit card, and when you repay the funds on time, your credit score benefits.

Furthermore, there is no credit check, and approval is guaranteed, which makes a KOHO credit card great for Canadians unable to obtain unsecured credit. To learn more about KOHO’s services, please see our KOHO Credit Cards Review and our KOHO Credit Building Review.

Why Should You Avoid Payday Loans?

Payday lenders typically extend up to $1,500 in short-term credit, and they differ from traditional loans for the following reasons:

- The repayment term is usually weeks versus years for a traditional loan

- You can obtain a payday loan without a credit check

- There is a flat fee when you pay on time instead of interest

- You typically repay the funds with your next paycheck

Yet, the Government of Canada provides a nice breakdown of why payday loans are poor choices. The text stated:

- A payday loan costs $17 per $100 that you borrow, which is the same as an annual interest rate of 442%

- A line of credit includes a $5 administration fee plus 8% annual interest on the amount you borrow

- Overdraft protection on a chequing account includes a $5 fee plus 21% annual interest on the amount you borrow

- A cash advance on a credit card includes a $5 fee plus 23% annual interest on the amount you borrow

As you can see, a payday loan is the worst option Canadians can choose. And with cheaper resources available, there is no need to settle for an underperforming product.

What Are the Best Online Payday Loan Alternatives?

To save yourself potentially hundreds of dollars, consider a Bree cash advance. We cover all of the details in our Bree Loans Review, and you should read it to determine if the product is right for you. But, as a quick explanation, Bree provides the following benefits:

- A cash advance of up to $250

- Zero-interest

- No credit check

- Fast approval

- Highly rated

Specifically, Bree provides overdraft protection, which rivals a cash advance. If you need cash quickly, Bree provides the funds in 0-3 business days and you repay the debt with your next paycheck. You can pay a fee for instant delivery, but there are no fees for standard delivery. Thus, if you can wait 0-3 days, Bree is a much better option than a payday loan. The only pitfalls are Bree charges a $2.99 per month platform fee and new users typically don’t qualify for the full $250.

As another great option, Nyble Canada lets you access an interest-free line of credit of $30 to $150. There are no platform fees, and free members receive the funds in 0-3 business days. The only charge is a $0.99 per month expense to link your Nyble account to your bank account. You can think of it like a subscription fee, but it’s a relatively small outlay.

When the funds are due, Nyble deducts the balance from your bank account and reports the repayment to credit bureaus. Consequently, making on-time repayments can boost your credit score.

Like Bree, the main downside is that you usually don’t qualify for the full amount right away, as users often receive higher limits over time. For a complete breakdown of everything Nyble Canada has to offer, please see our Nyble Review.

What Should You Do When Debt Becomes Unmanageable?

Canadians experienced with consumer proposals understand the value of a licensed insolvency trustee (LIT). Working with a professional can help you uncover debt-relief strategies you wouldn’t have thought of on your own.

LITs are federally regulated and go through a rigorous certification process. Therefore, they are useful allies when you’re drowning in debt. For a complete breakdown of how LITs can help you, please see our Licensed Insolvency Trustee Guide.

Conclusion

While online payday loans may seem useful, we believe you should avoid them, especially if you’re dealing with a consumer proposal. The APRs are outlandish, and we don’t see the point in paying 400%+ when more affordable options are available. Whether it’s Bree or Nyble, you can find cheap cash advances without falling victim to predatory practices. As a result, please do your homework before applying for a payday loan.