Carma Auto Finance 2025 Review – We Review This Auto Loan Provider.

Carma Auto Finance is a Canadian auto loan provider certified by the Canadian Lenders Association (CLA), making it a trusted name in the automotive financing industry. With a focus on offering accessible auto loans for customers of all credit backgrounds,...

Read More

Econommi Review – Is This Auto Loan Company Worth It? (2025 Review)

Econommi is a financial technology company that provides consumers with innovative automotive finance solutions. As a CLA-certified lender, Econommi promises to maintain a high level of ethics when it comes to its lending practices. A major selling point is its...

Read More

Farber Debt Solutions – We Review This Canadian Licensed Insolvency Trustee (2025 Update)

Credit: Farber Debt Solutions Dealing with debts can be overwhelming, and many Canadians struggle to find a solution that helps them regain financial stability. One of the most trusted names in debt relief is Farber Debt Solutions. The firm is...

Read More

Credit Counselling Society – Is This a Good Debt Counsellor in Canada for 2025? Let’s Review…

The Credit Counselling Society (CCS) is one of the leading non-profit credit counselling agencies in Canada, which helps people facing debt problems. CCS was founded in 1996 and offers debt counselling, DMPs, and other financial education services. In this article...

Read More

Heavy Equipment & Construction Financing: 6 Loans for Bobcats, Excavators & Machinery in 2025

Heavy equipment and construction financing helps businesses in the construction and related industries. These companies need expensive machinery, like Bobcats, excavators, and other heavy-duty equipment, to perform daily operations effectively. However, buying this equipment outright can drain their finances –...

Read More

Best 8 Bad Credit (Or No Credit) Business Loans in 2025

Trying to find a loan for a business with no credit history? What about bad credit? If so, you are probably well aware of how challenging it can be. It's not impossible, though – there are financial products designed for...

Read More

How to Qualify for a Small Business Loan in Canada in 2025?

If, like many entrepreneurs and startup business owners, you're looking to qualify for a small business loan in Canada at the best rates and conditions, here are the key factors to keep in mind: IMPORTANT 2025 TIPS:➔ Stressed about your debt...

Read More

Restaurant Equipment Loans in Canada: 6 Places to Go In 2025

Are you opening a new restaurant or perhaps you want to expand operations with your existing one? If so, you know it is a time filled with many emotions ranging from excitement to overwhelm. And there are plenty of decisions...

Read More

Car Title Loans – How & Where To Get Them In Canada? (2025 Update)

Car title loans are a quick-access financial option where you use your vehicle as collateral. They can be useful if you're in a pinch and need cash fast, but it's important to be aware of the high interest rates and...

Read More

9 Equipment Loans For Startup Businesses in Canada (2025)

If you're an up-and-coming manufacturer, or a business in need capital to build out your assembly line, equipment loans are practical pathways to increasing your company's infrastructure. Whether you're looking for heavy equipment loans for your farm, or perhaps loans...

Read More

Gym Equipment Financing: 7 Ways to Get a Loan Without Breaking the Bank (2025)

Do you have a business in the fitness industry? Is the company new or undergoing expansion? If so, purchasing gym equipment can require a sizable investment. While it is not the only way, financing treadmills, weights, and stationary bikes makes...

Read More

Dump Truck Financing in Canada: 5 Loans You Can Apply For.

If you’re looking to finance a dump truck in Canada, there are a variety of loans tailored to fit your needs, whether you're an established business or just getting started. Let’s dive into the key financing options. ☝IMPORTANT 2025 TIPS:...

Read More

Quantifi Lending Inc. – Should You Choose This Auto Loan Provider? (2024 Review)

When searching for auto financing options in Canada, the vast range of lenders can make the process feel overwhelming. Each auto loan provider promises several benefits, but how do you decide the one right for your own unique needs? Quantifi...

Read More

10 Best Business Loans in Alberta (2024)

Operating a business in Calgary, Edmonton or anywhere else in Alberta can be both rewarding and challenging. Whether you’re just starting out or looking to expand your current operations, a business loan can be a crucial tool to help you...

Read More

Payday Loans in Canada: Are They Worth It? Any Better Alternatives?

Payday loans in Canada can (sometimes) be a lifesaver when you're in a financial pinch and have an emergency expense coming up. They're generally quick to get, easy to apply for (can be 100% online), and don't usually require a...

Read More

Alterfina – Good or Bad Canadian Lender? (2024 Review)

Alterfina is a Canadian online lending platform based in Quebec. They specialize in short-term loans and cash advances, especially to individuals with bad or no credit that have been denied by banks. IMPORTANT 2025 TIP:➔ Crumbling under debt? Contact Consolidated...

Read More

Debt Consolidation or Consumer Proposal: What Should You Choose to Alleviate Debt?

Handling high amounts of debt is never a fun thing, especially when one has to work hard to pay many loans, credit cards or even overdue bills. If you find yourself at a point where you cannot pay your debts...

Read More

Credit Canada – Legit Debt Relief Solution? Read Our Review…

Credit Canada is one of the most well-established non-profit debt relief organizations in Canada. The firm is known for helping Canadians with debt management and financial literacy. In this review, we’ll explore Credit Canada’s background, services, customer reviews, and whether...

Read More

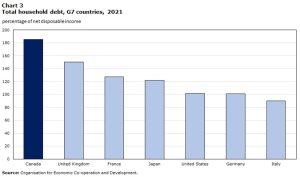

Debt Consolidation vs Consumer Proposal in Canada: What’s Best?

Debt is a reality many Canadians live with. The household debt-to-income ratios have continued to soar. The household debt-to-income ratio reached 184.5% in early 2023, meaning Canadians owed $1.85 for every dollar of disposable income. If you are feeling buried under financial...

Read More

9 Equipment Loans For Startup Businesses in Canada

If you're an up-and-coming manufacturer, or a business in need capital to build out your assembly line, equipment loans are practical pathways to increasing your company's infrastructure. But, where can you find the best equipment loans in Canada, whether you...

Read More