If you’ve been denied business loans and don’t know where to turn, asset-based financing may be right for you. Utilizing your property, equipment, or accounts receivables as collateral can encourage lenders to extend credit. However, since there are two sides to every story, who should consider asset-based financing in Ontario? Here’s a quick comparison table first:

Top 3 Places to Start in Ontario:

#1 – Top Five Banks (RBC, BMO, TD, ScotiaBank, CIBC) and Ontario credit unions. Why? They generally have the best rates and terms, but you need a good credit score. Stricter application process and longer time to get funding, but overall this is your best choice.

#2 – Swoop Funding – this Ontario-based lender provides all types of loans for businesses, including equipment, machinery and asset-backed loans. They accept lower credit scores, and they work with various banks as well in their roster to get you the best rates. They are also faster and more flexible than banks.

#3 – Journey Capital – Another well-reviewed Ontario lender that may provide asset-based loans in the province. They approve lower credit scores as well (550+). They are pretty competitive with another lender, Merchant Growth in terms of approval time and rates too.

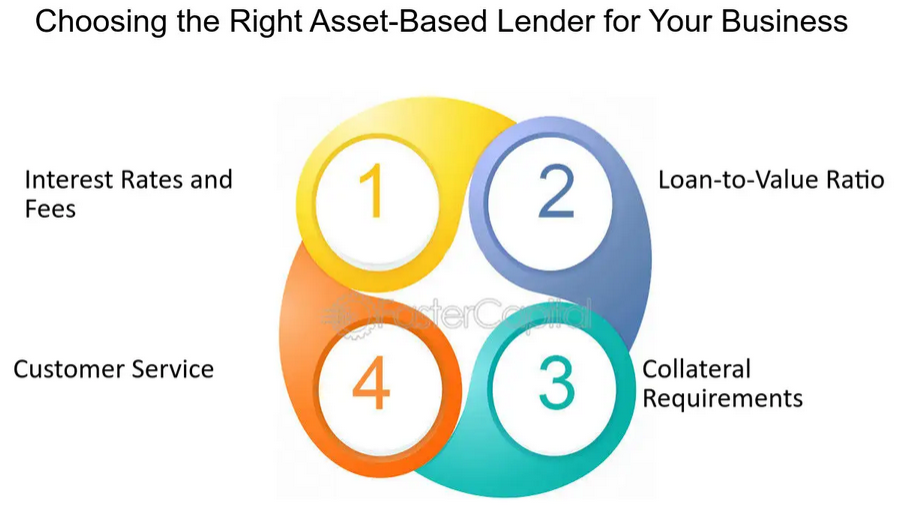

IMPORTANT TIP: shop around! Ask at least 2-3 lenders to give you a quote before you decide who to go with for financing.

Making Sense of Asset-Based Financing

To understand the ins and outs of asset-based financing in Ontario, you must appreciate the difference between secured and unsecured loans. A typical credit card is an example of an unsecured loan, as lenders can’t seize your personal assets if you default. In contrast, a mortgage is an example of a secured loan, as the creditor can foreclose on your home if you fail to make the payments.

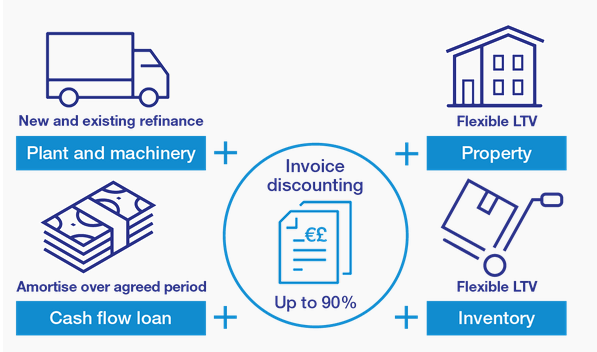

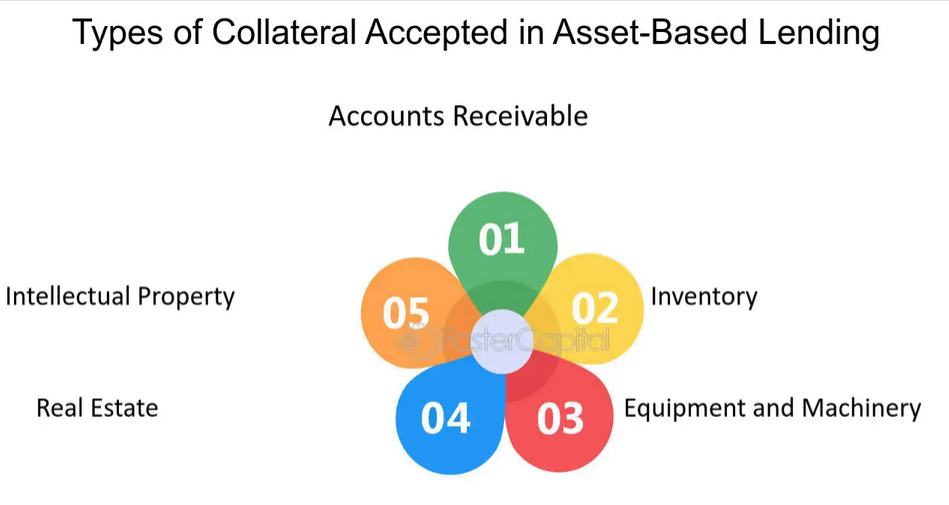

Asset-based lending is similar. Businesses use property, equipment, and other balance sheet assets as collateral, and agree to forfeit those assets if they default. The terms provide lenders with additional protections and reduce their risk.

Asset-based loans in Ontario are issued at a percentage of the collateral’s market value. For example, if the collateral is worth $100,000, the lender may offer a $60,000 loan, which equates to a 60% loan-to-value (LTV) ratio. The obvious downside is that defaulting is like selling a $100,000 asset for $60,000.

On top of that, borrowers with weak credit scores often confront unfovourable terms and high interest rates. Even though it’s a business loan and not a personal loan, creditors typically scrutinize your credit history to determine the appropriate interest rate. As a result, since paying a higher interest rate could pose more cash flow challenges for your business, it’s wise to work on your credit score before considering an asset-based loan in Ontario.

Why Does My Personal Credit Score Matter?

To put yourself on a path toward better loan terms and financing rates, please remember that your personal credit score can impede your business aspirations. Not only could higher interest rates create cash concerns, but loan covenants may restrict operational efficiency.

For example, lenders may require minimum financial ratios and restrict certain uses of business capital. And if your company is already struggling, these rules can worsen the problem.

Therefore, by improving your credit score and practicing responsible habits, lenders should view the progress positively and be more lenient with their loan terms. Furthermore, you may even qualify for unsecured business loans, which protect your collateral from potential collections.

To begin the process, please consult our guide on How to Improve Your Canadian Credit Score. It includes 10 reliable strategies to increase your credit score with little or no out-of-pocket costs. The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report,” so it doesn’t take long to move the needle.

For larger increases in your credit score, it can take longer, but the long-term commitment is worth it.

What Are Some Small Steps to Improve My Credit Score?

With fintech companies providing pathways for Canadians to rebuild their credit, several resources should be on your radar. Our Borrowell Credit Report Review highlights the three main advantages of the service:

- Monitor & Track

- Understand & improve

- Find the Right Product

The first lets you track your success, flag errors, and spot fraudulent activity. The second provides access to Molly, Borrowell’s AI-powered Credit Coach, who provides personalized tips, articles, and tools to become more credit savvy. Last, Borrowell Canada curates a list of financial products that you may find useful.

Best of all, Borrowell Canada is free to use, and you can build responsible credit habits at no charge.

Our KOHO Credit Building Review explains how its secured line of credit lets you deposit $30 to $500 and borrow against the balance. Your payments are categorized as loan repayments, and KOHO reports the activity to Equifax and TransUnion, which can boost your credit score. In contrast to Borrowell, KOHO is not free, so please read the full review to determine if it’s right for you.

Finally, KOHO’s secured credit card was rated one of the “3 Best Prepaid Credit Cards in Canada for 2024” by Nerdwallet. Approval is guaranteed, there is no credit check, and there are no fees if you set up direct deposits or load $1,000 into your account per month. You also earn cash back on your purchases and making on-time repayments can strengthen your credit score. To learn more, please see our KOHO Credit Cards Review.

Where Can I Find Asset-Based Loans In Ontario?

If you have a good to excellent credit score, traditional banks are where you want to search for an asset-based loan in Ontario. The Big 5 — RBC, TD, BMO, CIBC, and Scotiabank — operate nationwide and are especially viable if you’re a medium to large-sized company.

For companies operating on smaller scales, alternative lenders are often the best choices for small businesses seeking asset-based financing in Ontario. Since the Big 5 focuses more on larger companies, alternative lenders may be the best option.

For bad credit applicants, please improve your credit score before applying for asset-based financing in Ontario. Securing the lowest rate and best terms should be your primary objective, and a solid credit score can help achieve that goal.

Below, we curated a list of institutions where you can find asset-based loans in Ontario. For information on where to search in other provinces, please see our guides for asset-based lending Options in Alberta and Options in BC.

1. Royal Bank of Canada

As the country’s leading financial institution, the Royal Bank of Canada (RBC) has engaged in asset-backed lending since 1999. Moreover, RBC works with companies of all sizes, so options should be available for startups and firms with lower revenues.

When considering an asset-backed loan, the following features are available:

- Up to 90% LTV ratios for accounts receivable and appraised inventory

- Fixed assets’ appraised values can be used to determine term loan collateral

- 100% of the face value for customer invoice purchases

- Financing is available in several currencies, including CAD, USD, and more

2. Canadian Imperial Bank of Commerce

As another reliable option, the Canadian Imperial Bank of Commerce (CIBC) is an Ontario asset-backed loan provider, and you can use your company’s accounts receivable, inventory, property, machinery, and other assets as collateral. Furthermore, there are limited or no financial covenants, which increases your firm’s financial flexibility.

However, please note that CIBC mainly works with medium and large businesses, so smaller firms may not meet the bank’s size minimum.

3. Liquid Capital

Known across Canada and the U.S., Liquid Capital is an alternative lender that offers asset-based financing in Ontario. Acceptable collateral includes real estate, equipment, and other assets, and you repay the secured line of credit with monthly installments.

You can borrow up to $10 million, and Liquid Capital provides strategic guidance to help you overcome operational difficulties. The firm’s large network of alternative funding professionals operates across North America and has expertise in local markets.

The only pitfall is Liquid Capital requires a strong or higher credit score to qualify. As such, the policy highlights the importance of maintaining a healthy credit reputation.

4. Meridian Credit Union

Home to 80 years of innovation in Ontario, Meridian Credit Union partners with Accord Financial to provide asset-based loans. You can use accounts receivable, inventory, machinery, equipment, and often real estate as collateral, and Meridian Credit Union has business advisors who can guide you through the process.

In addition, the processing time from application to funding is usually faster than a conventional loan, although the terms and fees depend on the specifics of your business and the collateral.

5. Wells Fargo

Although it’s a U.S. institution, Wells Fargo offers capital finance solutions in Ontario. By analyzing a business’s credit quality and collateral, Wells Fargo can tailor financing and allow for more flexibility in achieving your goals. Funds can be used for initiatives like:

- Working capital

- Seasonal cash flow fluctuations

- Growth and expansion

- Importing and exporting

- Mergers and acquisitions

- Turnaround situations

- Capital expenditures

- Restructuring

However, please note that Wells Fargo primarily works with middle-market and large corporations across Canada.

6. First Financial

Specializing in equipment financing, First Financial helps Ontario businesses streamline the manufacturing process through secured lease solutions. The firm has notable experience across industries like construction and heavy equipment, healthcare, IT solutions and services, materials handling and automation, and renewable energy plus solar.

Typically, the equipment is used as collateral for the loan, and the lien is removed after you repay the funds. The firm is also a member of the Canadian Lenders Association (CLA), a proponent of ethical credit practices across the country.

7. Armada Credit Group

Through its partnerships with banks, independent finance companies, and non-traditional lenders, Armada Credit Group helps businesses obtain affordable equipment financing. Acting as a broker, and sometimes a direct lender, the firm helps facilitate large and small deals across virtually all industries. Thus, it’s a great resource for start-ups and small and mid-sized enterprises. Some benefits include:

- Potential for 100% LTV ratios

- Deferred payments and seasonal slips for qualifying assets

- Hedge inflation by owning the asset now and paying in future dollars

- Match your loan payments to the cash flows generated from the equipment

Moreover, Armada Credit Group has an office in Mississauga, Ontario, is a CLA member, and has a team of professionals to help guide you throughout the process.

Conclusion

With several options to choose from, Ontario asset-based loans are available to most businesses. To find the best product and terms, we recommend submitting several applications. That way, you can weigh the pros and cons before making a final decision.

Also, please take the time to work on your credit score. Doing so can potentially lead to cheaper rates and faster approval.