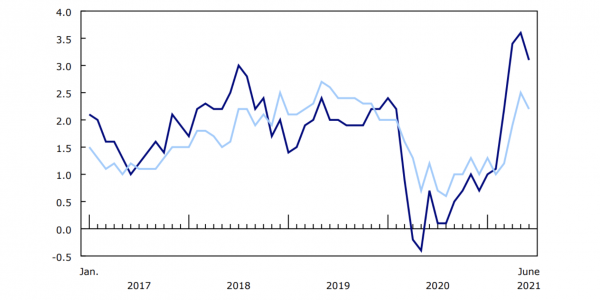

The Consumer Price Index increased 3.1 % in June, on a year-over-year basis reported Statistics Canada. This was a percentage decrease from the 3.6% rise … Read More

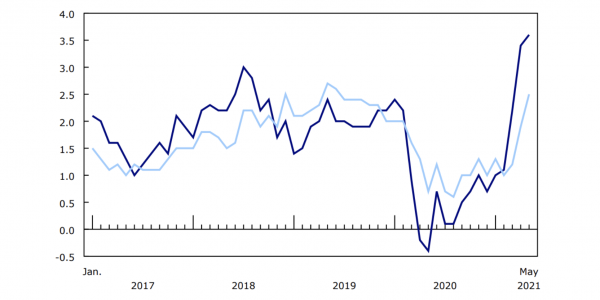

The Consumer Price Index (CPI) Rose 3.6% in May

The Consumer Price Index (CPI) increased 3.6% on a year-over-year basis in May, reported Statistics Canada. The agency stated that this marked the most substantial … Read More

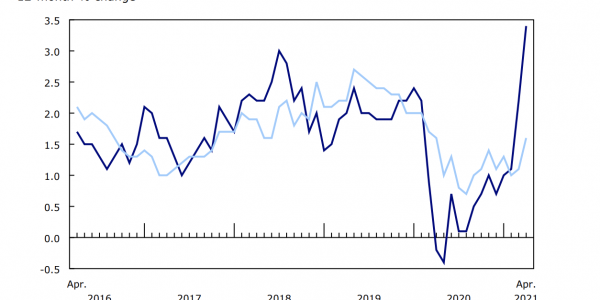

The Consumer Price Index Edged Up 3.4% in April

The Consumer Price Index edged up 3.4 % in April, on a year-over-year basis reported Statistics Canada. This was a percentage gain from the 2.2% … Read More

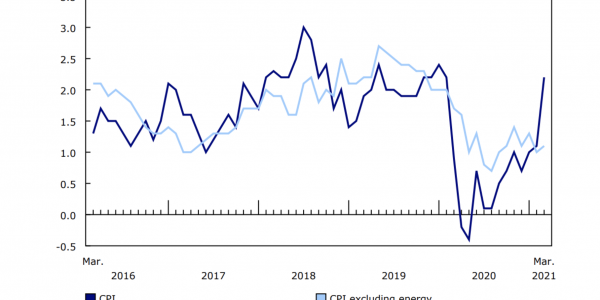

The Consumer Price Index (CPI) Increased 2.2% in March

The Consumer Price Index (CPI) increased 2.2% on a year-over-year basis in March, up from the 1.1% rise seen in February, reported Statistics Canada. “A … Read More

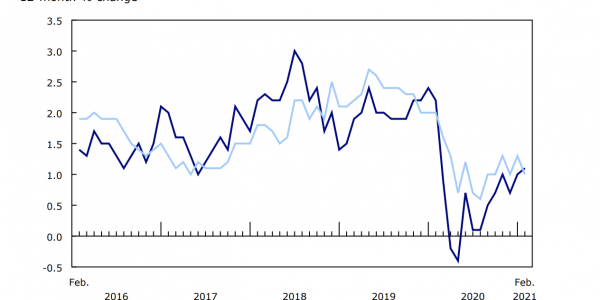

The Consumer Price Index (CPI) Rose 1.1% in February

The Consumer Price Index (CPI) increased 1.1% on a year-over-year basis in February, reported Statistics Canada. The agency stated that the rise from 1% in … Read More

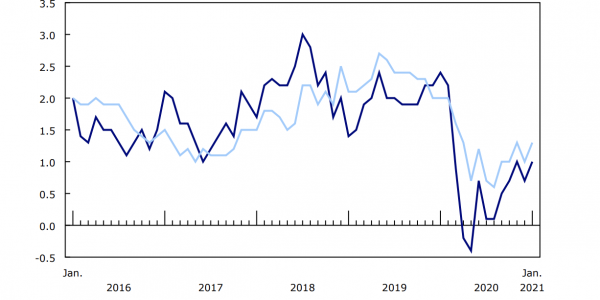

The Consumer Price Index (CPI) Increased 1% in January

The Consumer Price Index (CPI) edged up 1% on a year-over-year basis in January, reported Statistics Canada. The agency said that the rise from 0.7% … Read More

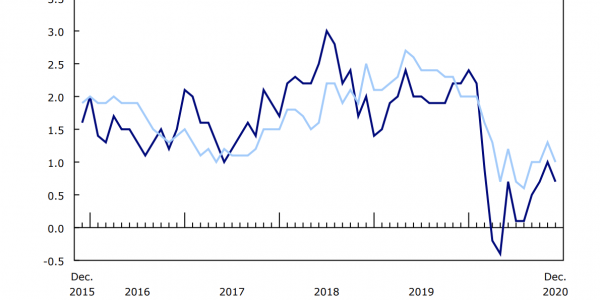

The Consumer Price Index (CPI) Rose 0.7% in December

The Consumer Price Index (CPI) edged up 0.7% on a year-over-year basis in December, reported Statistics Canada. Excluding the price of gasoline, the CPI increased … Read More

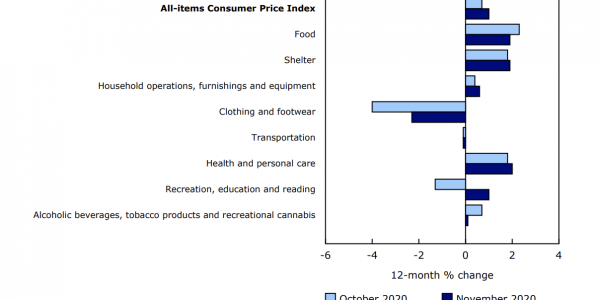

The Consumer Price Index Increased 1% in November

The Consumer Price Index (CPI) edged up 1% in November on a year-over-year basis, reported Statistics Canada. On a seasonally adjusted monthly basis, the CPI … Read More

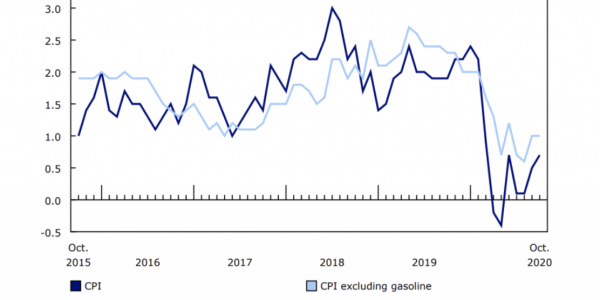

The Consumer Price Index (CPI) Edged Up 0.7% in October

The Consumer Price Index (CPI) edged up 0.7% on a year-over-year basis in October, reported Statistics Canada. The agency stated that the increase from 0.5% … Read More

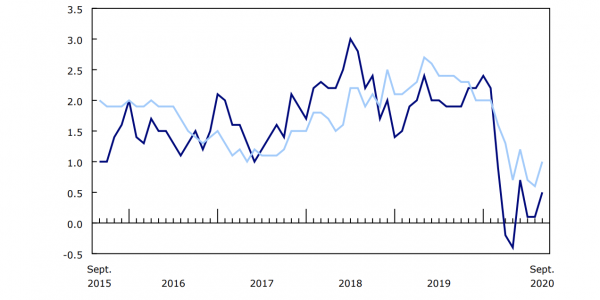

The Consumer Price Index Increased 0.5% In September

The Consumer Price Index (CPI) increased 0.5% in September on a year-over-year basis, reported Statistics Canada. It is up from a 0.1% rise in August. … Read More