Every business owner understands the importance of cash flow. And when you have more cash going out than coming in, you need a short-term solution … Read More

Farber Debt Solutions – We Review This Canadian Licensed Insolvency Trustee (2025 Update)

Dealing with debts can be overwhelming, and many Canadians struggle to find a solution that helps them regain financial stability. One of the most trusted … Read More

Credit Counselling Society – Is This a Good Debt Counsellor in Canada for 2025? Let’s Review…

The Credit Counselling Society (CCS) is one of the leading non-profit credit counselling agencies in Canada, which helps people facing debt problems. CCS was founded … Read More

Credit Verify – Is It Good for Credit Monitoring in 2025? Read Our Review.

Keeping an eye on your credit score is a smart move if you’re worried about your finances. One service that you can use to monitor … Read More

Heavy Equipment & Construction Financing: 6 Loans for Bobcats, Excavators & Machinery in 2025

Heavy equipment and construction financing helps businesses in the construction and related industries. These companies need expensive machinery, like Bobcats, excavators, and other heavy-duty equipment, … Read More

Best 8 Bad Credit (Or No Credit) Business Loans in 2025

Trying to find a loan for a business with no credit history? What about bad credit? If so, you are probably well aware of how … Read More

How to Qualify for a Small Business Loan in Canada in 2025?

If, like many entrepreneurs and startup business owners, you’re looking to qualify for a small business loan in Canada at the best rates and conditions, … Read More

Restaurant Equipment Loans in Canada: 6 Places to Go In 2025

Are you opening a new restaurant or perhaps you want to expand operations with your existing one? If so, you know it is a time … Read More

Car Title Loans – How & Where To Get Them In Canada? (2025 Update)

Car title loans are a quick-access financial option where you use your vehicle as collateral. They can be useful if you’re in a pinch and … Read More

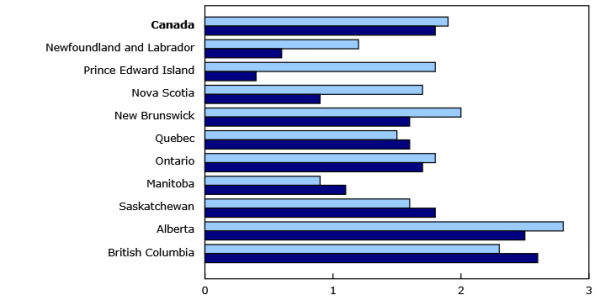

The Consumer Price Index Falls (-0.4%) in December 2024, Hits 1.8% Y-O-Y

Canada’s consumer price index (CPI) increased by 1.8% year over year (Y-o-Y) in December, slipping from 1.9% Y-o-Y in November. Statistics Canada (StatsCan) published the … Read More